Every Man Jack positions itself as "naturally derived grooming for men" - a proposition that straddles the line between mainstream accessibility and premium natural positioning. But how do US consumers actually perceive this middle-ground approach?

We surveyed 6 US consumers interested in natural personal care products. Their responses reveal important insights about the natural grooming category and Every Man Jack's competitive position.

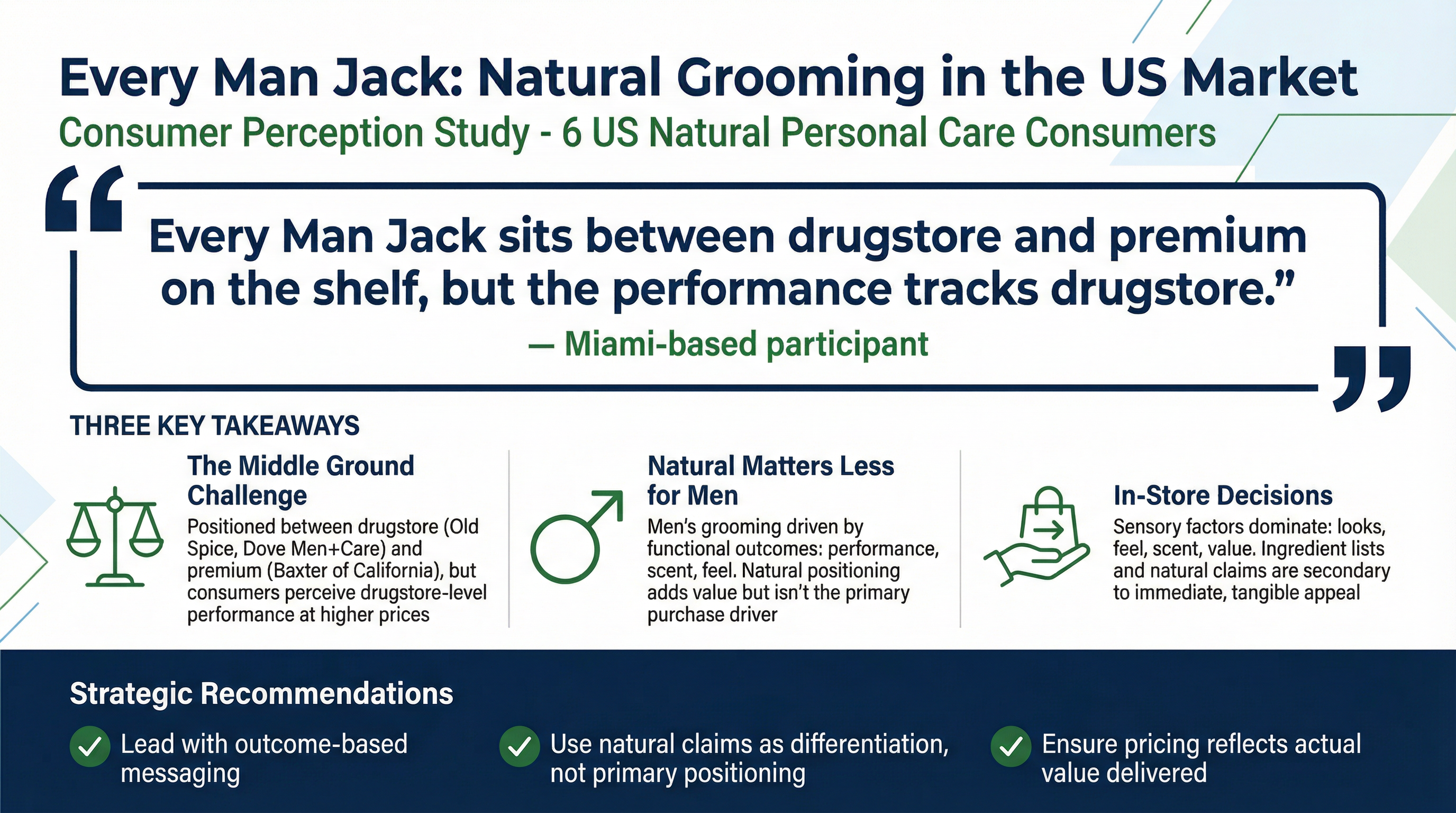

The Middle Ground Challenge

Respondents consistently placed Every Man Jack between drugstore brands like Old Spice and Dove Men+Care and premium options like Baxter of California. But this positioning creates a challenge: consumers see drugstore-level performance at higher-than-drugstore prices.

As one Miami-based participant noted: "Every Man Jack sits between drugstore and premium on the shelf, but the performance tracks drugstore." This perception gap between positioning and expected performance is a significant challenge for the brand.

Natural Matters Less for Men

An interesting finding emerged around the relevance of "natural" claims in men's grooming. Respondents suggested that natural ingredients matter more in women's products than men's - not because men don't care about ingredients, but because the category associations are different.

Men's grooming is still largely driven by functional outcomes: does it work, does it smell good, does it feel right? Natural positioning adds value for a subset of consumers but isn't the primary purchase driver for most.

In-Store Decision Making

When asked what would make them pick up Every Man Jack from a shelf, respondents focused on sensory factors: "looks like it'll feel good, smell quiet, and not waste my money." Ingredient lists and natural claims are secondary to immediate, tangible appeal.

This insight suggests that Every Man Jack's marketing should emphasize experience and outcome rather than ingredient purity. Natural positioning works as a supporting message, not a headline.

Strategic Recommendations

For Every Man Jack to strengthen its market position, it needs to close the gap between positioning and perceived performance. Lead with outcome-based messaging, use natural claims as differentiation rather than primary positioning, and ensure pricing reflects the actual value delivered.