Here's something I've been wrestling with: mobile-only banks like Varo promise the world. No fees. High APY savings. Cash advances when you're short. But when I asked six American consumers what they actually think about moving their primary checking to a branchless bank, the response was almost unanimously sceptical. Not hostile. Not dismissive. Just... careful. And their reasons reveal something important about what 'convenience' really means to different people.

I ran a study with six US consumers across different income levels, ages (22-33), and locations, from rural Nevada to suburban Jacksonville. The goal was simple: understand how real people react to Varo's value proposition and what concerns would stop them from making the switch.

The Participants

This wasn't a homogeneous group. We had Nathan, a 22-year-old expectant father in Oklahoma exploring trade careers. Brandon, a 28-year-old DevOps engineer in Florida who's privacy-aware and pragmatic. Shelby, a 33-year-old single mum in rural Illinois living on public benefits. Elizabeth, a 29-year-old stay-at-home mother of three in rural Nevada. Tiffanie, a 23-year-old luxury retail sales manager in Illinois with disciplined finances. And Tayvon, a 27-year-old chef in Savannah with dreams of opening a food truck.

What unites them? They all manage money carefully, live in different circumstances, and have very real, practical concerns about where their money lives.

'No Hidden Fees, Up to 5% APY': Too Good to Be True?

When consumers see Varo's headline promises, their first instinct is scepticism. The phrase 'up to' was flagged by nearly everyone.

"Gut reaction? Side-eye. 'Up to 5% APY' screams teaser rate or tiny balance cap, and 'no hidden fees' usually hides in out-of-network ATMs, instant transfers, or some goofy hoop-jumping like 10 debit swipes a month."

That's Tayvon, the Savannah chef. His instinct mirrors what I heard across the board: marketing language has trained consumers to look for the catch. Tiffanie, our Springfield sales manager, put it bluntly: "It reads like a billboard that hopes you're too cold to read the fine print."

The pattern was clear. Everyone wanted to know:

What balance cap applies to that 5% APY?

What hoops (direct deposit requirements, minimum swipes) are hidden?

Is this a promo rate that drops after 3 months?

What fees exist that aren't called 'fees'?

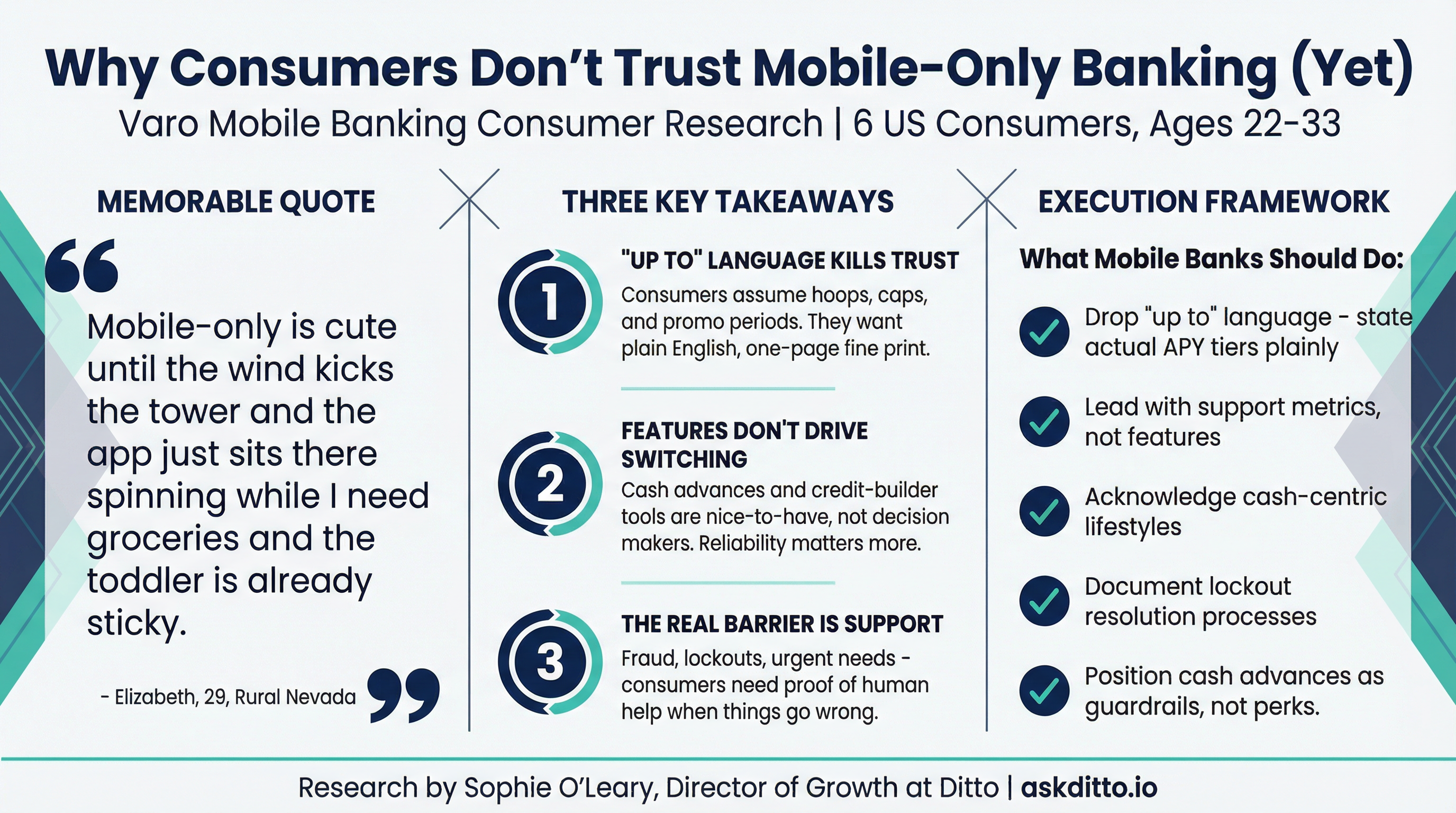

Key insight: The 'up to' language actively damages trust. Consumers have been burned before. They want the fine print on one page, in plain English, before they'll take the promise seriously.

Cash Advances and Credit Building: Nice, But Not the Reason to Switch

Varo positions its $250 cash advance and credit-builder card as differentiators. But for this group? These features landed somewhere between 'nice to have' and 'actively suspicious'.

"Cash advance up to $250 sounds nice in a pinch. Diapers hit, tire blows, whatever. But these things always have a catch. Fees, tips, direct deposit rules, weird limits. I hate that loop."

That's Nathan, the expectant father in Oklahoma. His concern echoes across the group: the cash advance feels like a gateway to dependency, not a safety net. Elizabeth in Nevada was more direct: "The $250 advance thing feels like payday-lite. Even if they dress it up cute, it still claws back your next check and you start living one step behind."

The credit-builder card fared slightly better, but only for those actively trying to build or rebuild credit. For participants with established scores, it was irrelevant. Brandon, our DevOps engineer, summed it up: "The credit-builder card is fine if you're starting from scratch, but if your score is solid it's basically noise."

Key insight: Cash advances and credit building tools are secondary features, not switching drivers. Consumers choose banks for reliability and friction reduction, not for emergency loans they hope never to use.

The Mobile-Only Problem: More Concerns Than Expected

Here's where it gets genuinely interesting. I asked what concerns would stop them from making a mobile-only bank their primary checking account. The responses were extensive, detailed, and consistent.

The big concerns that emerged:

Cash deposits: Tips, yard sale earnings, family paybacks. Where does cash go without a branch?

Fraud and lockouts: Card gets flagged, app glitches, support is just a chatbot. Who fixes it NOW?

App outages: Phone dies, app needs update, service drops. Money trapped.

Human support: When something goes wrong with rent-level money, people want a desk and a person.

ATM access: If the free network is thin in your area, fees pile up fast.

Account freezes: KYC flags without a branch means emailing selfies while your money is frozen.

Cashier's checks and notary: Big purchases, title transfers, county paperwork. Branches handle these.

"Out here, mobile-only is cute until the wind kicks the tower and the app just sits there spinning while I need groceries and the toddler is already sticky."

Elizabeth's rural Nevada reality highlights a key tension: mobile banking assumes reliable connectivity and tech fluency. Rural consumers, parents with hands full, anyone with a budget phone on a throttled plan, they all experience friction that marketing doesn't acknowledge.

Key insight: Mobile-only banking has a trust gap, not a features gap. The concerns aren't about what Varo offers, they're about what happens when things go wrong and there's no branch to walk into.

What This Means for Mobile Banking Brands

If you're building or marketing a mobile-only bank, this research suggests some clear directions:

Drop the 'up to' language. State your actual APY tiers and requirements plainly. One page. Plain English.

Lead with support, not features. Show your fraud resolution time, your human support availability, your uptime stats.

Acknowledge cash-centric lifestyles. Many Americans still handle cash. Partner networks for deposits need to be fee-free and extensive.

Address the lockout nightmare. Document exactly what happens when accounts get flagged and how quickly it resolves.

Position cash advances carefully. They're emergency tools, not lifestyle features. Market them as guardrails, not perks.

The Bottom Line

Varo's value proposition resonates in theory. No fees, high yield savings, instant access. But the execution concerns run deep, especially for anyone who's ever been locked out of an account, needed a cashier's check urgently, or lived somewhere with spotty service.

The verdict from these six consumers? They'd try Varo as a secondary account. A place to park some savings, test the waters. But making it their primary? That requires trust that marketing alone can't build. It requires proving the support is there when things go sideways.

What the Research Revealed

We asked real consumers to share their thoughts. Here's what they told us:

When you see a mobile bank advertising 'no hidden fees, no minimum balance, and up to 5% APY on savings', what's your first reaction?

Elizabeth Mcshane, 29, Stay-at-Home Parent, Rural, NV, USA:

Gut reaction? Side-eye. "No hidden fees" always has an asterisk, and "up to 5% APY" reads like promo-with-hoops - tiny cap, direct deposit, 10 swipes a month, whatever game they play. Mobile-only makes me twitchy out here. If the app glitches or the Wi-Fi burps, then what, I just stare at my own money.

Nathan Islas, 22, Youth Apprentice, Norman, OK, USA:

First reaction: what's the catch. Up to 5% screams hoops and tiny caps. No hidden fees sounds cute until some random "service" fee shows up. I got burned on that before and I'm still mad about it.

Tayvon Curet, 27, Chef, Savannah city, GA, USA:

Gut reaction? Side-eye. "Up to" 5% screams teaser rate or tiny balance cap, and "no hidden fees" usually hides in out-of-network ATMs, instant transfers, or some goofy hoop-jumping like 10 debit swipes a month.

Tiffanie Turpin, 23, Sales Manager, Springfield city, IL, USA:

Gut reaction? Eye roll. It reads like a billboard that hopes you're too cold to read the fine print. "Up to 5% APY" screams promo hoops and balance caps to me, not a steady rate you can actually live with.

Brandon Camacho, 28, DevOps Engineer, Jacksonville, FL, USA:

Gut reaction: skeptical. The phrase "up to 5% APY" is a tell. Up to usually means hoops or a tiny balance cap, and "no hidden fees" tends to hide in the edges like ATM networks or transfer limits.

Shelby Mitchell, 33, Stay-at-Home Parent, Rural, IL, USA:

Gut reaction? What's the catch. Anytime I see "no hidden fees" and "up to 5% APY," my eyebrow goes up. It could be fine, but that phrasing usually means hoops and tiny caps.

Varo offers cash advances up to $250 and a credit-building card. How important are these features?

Brandon Camacho, 28, DevOps Engineer, Jacksonville, FL, USA:

Short answer: not important for me. A $250 cash advance feels like a band-aid, not a feature. The credit-builder card is fine if you're starting from scratch, but if your score is solid it's basically noise.

Tiffanie Turpin, 23, Sales Manager, Springfield city, IL, USA:

Short answer: not important to me, and no, I wouldn't switch for those. $250 cash advance is fine for paycheck timing hiccups, but I have an 8-month emergency fund.

Tayvon Curet, 27, Chef, Savannah city, GA, USA:

Short take: nice-to-have, not a reason to move my money. Cash advances and a credit-builder card are add-ons. I pick a bank for the boring stuff that actually keeps my weeks smooth.

Elizabeth Mcshane, 29, Stay-at-Home Parent, Rural, NV, USA:

Bottom line: not important to me, and no, I wouldn't switch just for that. The $250 advance thing feels like payday-lite. Even if they dress it up cute, it still claws back your next check.

Nathan Islas, 22, Youth Apprentice, Norman, OK, USA:

Short answer: not that important and I would not switch just for that. Cash advance up to $250 sounds nice in a pinch. But these things always have a catch.

Shelby Mitchell, 33, Stay-at-Home Parent, Rural, IL, USA:

Short version: nice-to-have, not a reason to switch on their own. Cash advance up to $250: Useful in a pinch if it's clear, cheap, and hoop-free.

What concerns would you have about moving your primary checking to a mobile-only bank?

Nathan Islas, 22, Youth Apprentice, Norman, OK, USA:

Short answer - yeah, I got concerns. I run tight. I need cash and a person sometimes. Phone-only sounds fine till stuff breaks. If fees were truly zero and ATMs were everywhere here, maybe I'd test it as a backup. Primary? With a baby and one paycheck - nah.

Brandon Camacho, 28, DevOps Engineer, Jacksonville, FL, USA:

Honestly, slick app or not, a mobile-only primary checking account gives me a few red flags right away. Uptime and access: if the app is down or my phone dies, I don't want my money trapped behind an update.

Shelby Mitchell, 33, Stay-at-Home Parent, Rural, IL, USA:

Short answer: I'd be pretty wary. Out here, no branch sounds like more hassle than help. Our signal drops and the internet caps out. If my phone dies or the app glitches during a cold snap, I don't want my money trapped.

Elizabeth Mcshane, 29, Stay-at-Home Parent, Rural, NV, USA:

Short answer: lots. Out here, mobile-only is cute until the wind kicks the tower and the app just sits there spinning while I need groceries and the toddler is already sticky.

Tiffanie Turpin, 23, Sales Manager, Springfield city, IL, USA:

Short answer: yes, I've got concerns. I like slick apps, but moving my primary checking to a mobile-only bank is a hard maybe at best. When stuff breaks, I want a desk and a person.

Tayvon Curet, 27, Chef, Savannah city, GA, USA:

Short answer: I'd be twitchy making that my primary. I like having a credit union I can bike to when something goes sideways.

Want to understand how your target customers really feel about your product? Ditto lets you run studies like this in hours, not weeks.