Six Canadian professionals. Three questions about competitive intelligence. One humbling truth: most track competitors through coffee gossip, Reddit threads, and member screenshots. Not dashboards. Not battlecards. Just ad-hoc scanning between meetings.

I ran a Ditto study to understand how real B2B professionals (not just sales VPs and product marketers, but frontline workers who actually need competitive intel) approach tracking what competitors are doing. The gap between vendor promises and user reality is striking.

The Participants

Our panel included six Canadian professionals aged 34-53, from Ontario, Quebec, Alberta, and British Columbia. A product operations manager, credit union member services staff, a maintenance technician, a hospital porter, a freelance cat sitter, and an admin assistant. What united them: all need to understand their competitive landscape, and none have sophisticated tools to do it.

The Reality of Competitive Tracking

When we asked how they currently track what competitors are doing, the answer was remarkably consistent: ad-hoc, with a thin veneer of process.

No formal process. It's ad-hoc. We hear stuff on shift. Porter bay chatter. Union emails. Job postings. A couple Reddit threads.

Daniel, a hospital porter from Vaughan, described the reality in stark terms: information is scattered, often late, and filtered through rumour. Management spin differs from floor facts. Vendor swaps happen with zero notice.

The common tracking methods:

Skimming competitor websites for posted rates and promos

Member/customer screenshots of offers they received

Job postings and tender notices as leading indicators

Union bulletins and grapevine chatter

Walking past nearby branches to read window posters

Reddit and Facebook groups for industry scuttlebutt

Occasional trade shows with 'blunt questions'

Elena from Burnaby kept a 'messy Google Sheet' that she called 'duct-taping' her competitive tracking. Laura from Red Deer maintained a Notion hub with weekly sweeps. Both acknowledged these were fragile, personal systems that would collapse if they left or got busy.

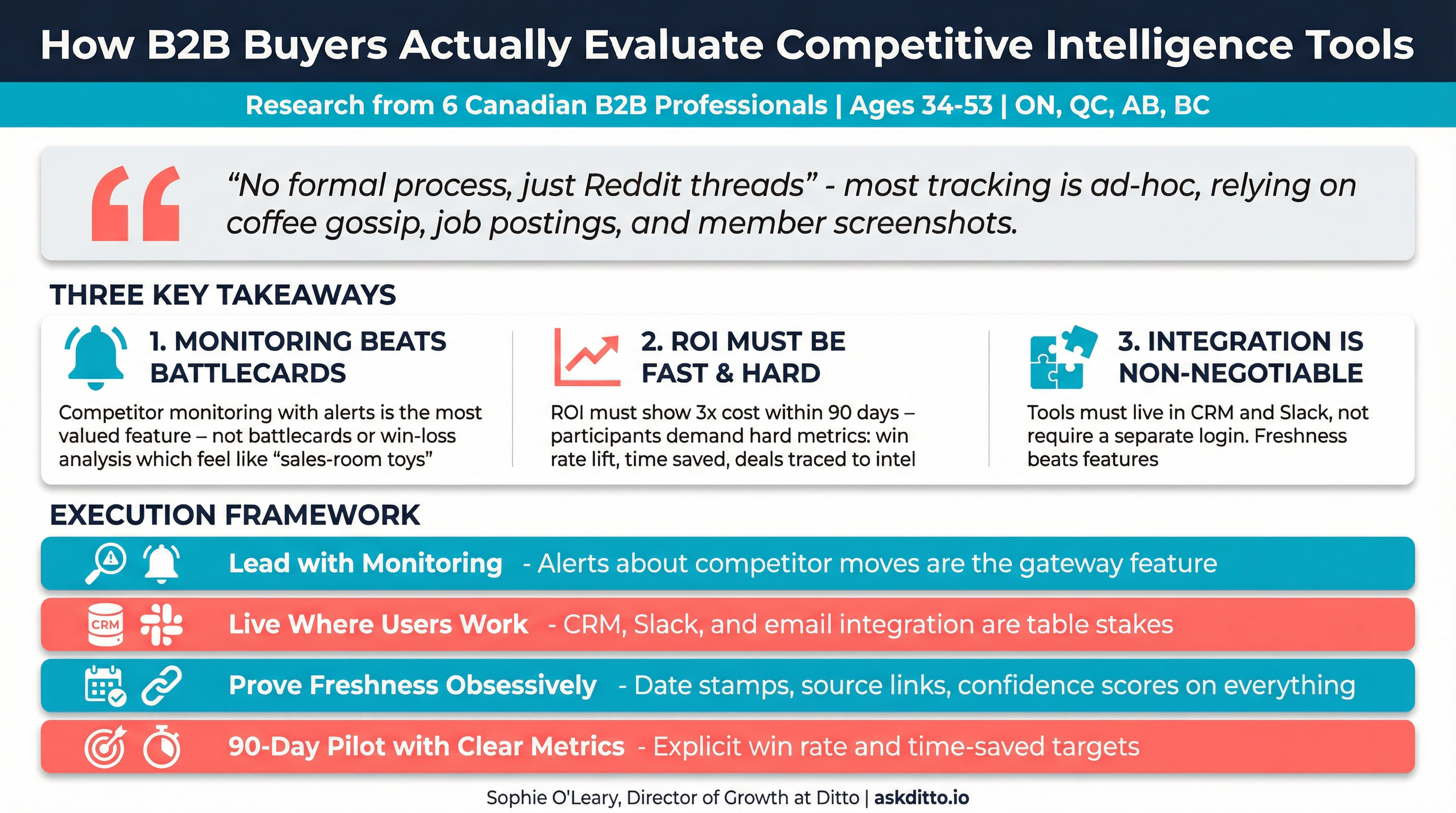

Key insight: Competitive intelligence is happening - just informally and inconsistently. The opportunity for tools is not creating new behaviour but systematizing existing ad-hoc practices.

What CI Features Actually Matter

We asked which competitive intelligence features would be most valuable: automated battlecards, win-loss analysis, or competitor monitoring. The answer surprised us.

Battlecards sound like sales fluff. Not my world. We move patients. We swap carts. No pitch deck.

Daniel the hospital porter was blunt: battlecards are irrelevant for his work. What would help? Simple alerts about pay changes, job postings, vendor swaps, and shift rules at competing hospitals.

The ranking across participants was clear:

Most valuable: Competitor monitoring with real alerts - not newsletters, but actual pings when something changes

Somewhat valuable: Battlecards IF they are short, dated, sourced, and in French (for Quebec users)

Least valuable: Win-loss analysis - 'We are not closing deals, total waste' for non-sales roles

Ryan, a maintenance technician from Thunder Bay, put it perfectly: 'Battlecards and win-loss stuff feel like sales-room toys. Give me proof, cold performance, parts, and lead times. Keep it simple and we'll actually use it.'

What is missing from current tools:

French-first content: Quebec wording, not half-translated terms

Branch-level tracking: Real fees, rate specials, hours, not generic national blur

One-page printables: PDF battlecards with date stamps for the desk binder

Regional filters: By city and radius, not wading through noise from elsewhere

Evidence links: Date-stamped screenshots and URLs to back up claims

Expiry countdowns: Stop quoting promos that died yesterday

Key insight: CI tools are built for sales and product marketing, but frontline workers have different needs. Simple, timely, local information beats sophisticated analysis features.

The ROI Conversation

We asked what would convince them a CI platform is worth the investment and how they would measure ROI. The answers were refreshingly practical.

If it can't pay for itself in 90 days, I wouldn't buy it. Pretty dashboards do not move me. Hard numbers do.

Heather from Ottawa set the bar: a CI tool starts at zero value and must earn its keep. She wants proof of impact within a quarter, not promises about 'better insights.'

The ROI metrics that would convince them:

Win rate lift: +5-10 points vs named competitors within 2 quarters

Time reclaimed: Fewer 'what do we say vs X?' pings, measured in hours per week

Faster ramp: New hires hitting productivity sooner, quantified in days

Churn saves: At-risk renewals kept because of crisp counter-messaging

Adoption proof: At least 70% of reps using battlecards weekly, not shelfware

Laura from Red Deer laid out the math: '(Incremental gross margin from win rate + time saved value) minus (subscription + onboarding + any headcount). If it's not 3x cost or better, I'm out.'

Deal breakers that would kill adoption:

Needs a full-time babysitter to be useful

Brags about pageviews, not closed-won deals

Per-seat pricing that explodes for frontline teams

Requires a separate login instead of living in CRM/Slack

Case studies that look nothing like their world

Paywalls on basics like integrations or alerts

Key insight: CI tool buyers want a 90-day pilot with explicit targets, not a multi-year contract with vague ROI promises. Show win rate lift and time savings or get cancelled.

What This Means for CI Platforms

If you are building or selling a competitive intelligence platform, this research points to clear requirements:

Lead with monitoring, not battlecards. Alerts about competitor moves are the gateway feature. Fancy analysis comes later.

Live where users work. If it requires a separate login, adoption will fail. CRM, Slack, and email integration are table stakes.

Prove freshness obsessively. Stale intel destroys trust faster than no intel. Date stamps, source links, and confidence scores on everything.

Price transparently. Per-seat games and paywalled features alienate buyers. Include viewer access for broader teams.

Offer short pilots with clear metrics. 90-day trials with explicit win rate and time-saved targets. Easy cancellation if targets are missed.

Support non-sales use cases. Frontline workers, member services, and operations teams need CI too - just in different formats.

Localise properly. French-first for Quebec, Canadian pricing and compliance, regional filtering by city and province.

The Bottom Line

Competitive intelligence tools have an adoption problem rooted in workflow friction and ROI skepticism. Users are not asking for more sophisticated features. They are asking for simple, timely, integrated information that proves its value within a quarter.

The platforms that win will be the ones that respect the reality of ad-hoc competitive tracking and make it easier - not the ones that try to replace coffee gossip with dashboards nobody visits.

Want to test how your CI platform positioning lands with real B2B buyers? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real professionals to share their thoughts. Here's what they told us:

How do you currently track what your competitors are doing?

Daniel Patel, 38, Hospital Porter, Vaughan, ON:

Short answer. No formal process. It is ad-hoc. We hear stuff on shift. Porter bay chatter. Union emails. Job postings. A couple Reddit threads. That is it. Takes me ten minutes max.

Elena Morales, 34, Credit Union Member Services, Burnaby, BC:

Short answer: ad-hoc, with a thin veneer of process. Day to day, I'm skimming competitor sites for posted rates and promos, watching internal notes from Marketing, and I confess I pick up a lot from members who walk in waving screenshots.

Ryan MacDonald, 39, Maintenance Technician, Thunder Bay, ON:

Short answer - ad-hoc. I'm a maintenance tech, not strategy. I still keep an eye out. Regulator filings and outage boards. Supplier reps and OEM bulletins. Job postings and tenders. What I see on the road.

Heather Reid, 43, Freelancer, Ottawa, ON:

Short answer: ad-hoc. I straddle a few hustles - cat sitting, light cleaning, small admin gigs - so 'industry' feels funny, but I keep tabs by stalking Kijiji and Facebook groups, walking the bulletin boards, and a couple Google Alerts.

Laura Rosenberg, 47, Product Operations Manager, Red Deer, AB:

Short answer: it's mostly ad-hoc wrapped in a thin layer of process so leadership doesn't kvetch. I keep a Notion 'comp hub' with battlecards, pricing snapshots, and an integrations map. Friday mornings I do a 30-minute sweep.

Claude Morin, 53, Credit Union Member Services, Trois-Rivieres, QC:

Short answer: ad-hoc with a few habits I keep tight. Head office fires us a monthly summary that looks nice but lands late and misses the little tricks in the fine print, so I keep my own notebook and a small spreadsheet.

Which CI features would be most valuable: battlecards, win-loss analysis, or competitor monitoring?

Ryan MacDonald, 39, Maintenance Technician, Thunder Bay, ON:

Short answer: not battlecards. I'm not pitching software. I'm keeping turbines alive in -18 and trying to get home for supper. Win-loss charts don't get a unit back online. Most valuable to my crew? Competitor monitoring with real alerts - recalls, spec changes, service bulletins, warranty tweaks.

Claude Morin, 53, Credit Union Member Services, Trois-Rivieres, QC:

Honestly, in my world at the caisse, competitor monitoring is the piece that actually helps at the counter. Automated battlecards only work if they're short, local, and printable in French - otherwise they just sit there and get stale.

Daniel Patel, 38, Hospital Porter, Vaughan, ON:

Battlecards sound like sales fluff. Not my world. We move patients. We swap carts. No pitch deck. Most useful: Competitor monitoring. Simple alerts. What changed today. Pay, premiums, parking, OT rules. GTA only.

Laura Rosenberg, 47, Product Operations Manager, Red Deer, AB:

Short answer: competitor monitoring that pipes clean signals into Slack and our CRM wins. If it cannot auto-diff pricing pages, packaging, docs, and roadmap crumbs, and then surface that in-context, it is just pretty wallpaper.

Heather Reid, 43, Freelancer, Ottawa, ON:

For a team of one, competitor monitoring with tight filters is the only thing that actually helps - give me a Friday digest and SMS pings when rates move. Battlecards are corporate fluff; I do not need a deck to tell me what my eyeballs already see.

Elena Morales, 34, Credit Union Member Services, Burnaby, BC:

Short answer: auto-updated battlecards with real dates and fine print are gold, then quiet monitoring with alerts, and win-loss way behind unless it is actually usable by frontline. I need a clean one-pager that does not lie to me and saves me 5 minutes when a member is staring at me.

What would convince you a CI platform is worth the investment? How would you measure ROI?

Ryan MacDonald, 39, Maintenance Technician, Thunder Bay, ON:

If in 90 days I can't point to better win rates, faster cycles, and real time savings, I'd cut it. If it hits those, fine, write the cheque and keep it tight. Show me it works under load, then we're good.

Daniel Patel, 38, Hospital Porter, Vaughan, ON:

It's -22. I'm cranky. If it costs $300 a seat, it better save $400 of time. Every month. Or I'm out. Time saved x loaded hourly rate. Monthly roll-up. Compare 4 weeks before vs 4 weeks after.

Claude Morin, 53, Credit Union Member Services, Trois-Rivieres, QC:

I'd want proof that it saves time at my desk and wins us concrete business, not a pitch deck. Win rate vs named competitors on mortgages, personal loans, cards - show a lift, even 3-5 points, and I can defend the spend.

Laura Rosenberg, 47, Product Operations Manager, Red Deer, AB:

Short answer: if it doesn't move win rate and stop discounting sprawl, it's shelfware. Give me proof in one quarter, two tops, or I cancel. +5 to +10 points vs our top 3 named competitors within 2 quarters.

Heather Reid, 43, Freelancer, Ottawa, ON:

Short answer: if it cannot pay for itself in 90 days, I would not buy it. Pretty dashboards do not move me. Hard numbers do. (Incremental gross margin from extra wins + monetized time saved) minus (subscription cost).

Elena Morales, 34, Credit Union Member Services, Burnaby, BC:

If it turns into another pretty portal that nobody opens, I'll be grumpy about the invoice every month. If it makes my morning prep faster and helps me hold the line against the Big Five without panicking on price, then fine - I'm in.