Most buyer personas are fiction. Well-intentioned fiction, granted, with plausible job titles and stock photography and carefully worded pain points. But fiction nonetheless. They are constructed from a combination of founder intuition, sales anecdote, and the output of a workshop where twelve people argued about whether the target buyer was a "VP of Marketing" or a "Director of Demand Gen" until someone suggested lunch. The resulting persona document gets printed, pinned to a wall, referenced in approximately two meetings, and then quietly ignored for the next eighteen months.

This is not a controversial observation. Ask any experienced product marketer and they will tell you that persona quality is the single biggest determinant of whether the rest of the PMM function works or doesn't. April Dunford's positioning framework hinges on identifying the target customers who care most about your differentiated value. The Product Marketing Alliance's State of Product Marketing report consistently finds that defining and refining buyer personas is a core responsibility for ninety-one percent of PMMs. Tamara Grominsky, who created PMA's Segmentation Certified programme, argues that segmentation is the foundation on which every other strategic decision rests. If you segment wrong, you position wrong. If you position wrong, you message wrong. If you message wrong, you sell wrong. The errors cascade.

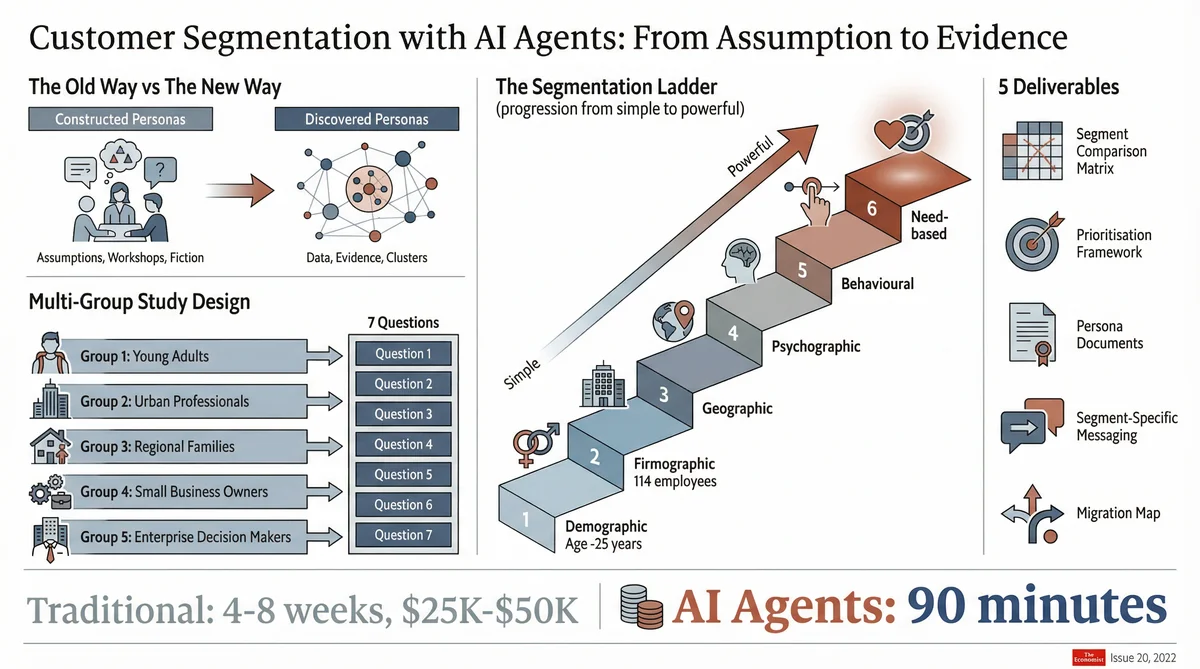

And yet. The tools available for building and validating personas have remained stubbornly manual for decades. Customer interviews take weeks to schedule. Surveys produce quantitative data but miss the qualitative depth that makes a persona feel real. CRM data tells you who bought, but not why. The result is that most companies segment their market based on firmographic convenience (company size, industry, geography) rather than behavioural reality (how people actually make decisions, what they care about, why they switch).

This article describes a different approach. Using Ditto, a synthetic market research platform with over 300,000 AI personas validated by EY Americas and in academic studies at Harvard, Cambridge, Stanford, and Oxford, and Claude Code, Anthropic's agentic development environment, you can build data-backed customer segments and validated buyer personas in under two hours. Not from assumptions. Not from a workshop. From structured research with synthetic respondents who behave like your actual target market.

The Segmentation Problem

Customer segmentation is the process of dividing a market into distinct groups of buyers who have different needs, characteristics, or behaviours. It determines who you target, how you prioritise, and where you invest. Bad segmentation leads to spray-and-pray marketing. Good segmentation focuses resources where they convert.

There are six established approaches to segmentation, and the best practice, as any marketing textbook will tell you, is to layer multiple types:

Demographic: Age, gender, income, education, occupation. The simplest cut. Useful but blunt.

Firmographic: Company size, industry, revenue, technology stack. The B2B equivalent of demographic segmentation.

Geographic: Country, region, urban versus rural. Matters more than most companies acknowledge, particularly for international expansion.

Psychographic: Values, attitudes, interests, lifestyle. The qualitative layer that transforms a demographic segment into something you can actually message to.

Behavioural: Purchase history, product usage, engagement patterns, switching behaviour. The most predictive but hardest to research before you have customers.

Need-based: Grouped by the problem they are trying to solve, regardless of demographics. Aligns directly with the Jobs-to-Be-Done framework.

The challenge is that layered segmentation requires layered research. Demographic and firmographic data is easy to obtain (LinkedIn, CRM, census data). Geographic data is trivial. But psychographic, behavioural, and need-based segmentation requires talking to people. Lots of people. Across multiple segments. And then comparing what they say.

Traditional segmentation research typically involves commissioning a market research firm to conduct twenty to fifty interviews across several prospective segments, supplemented by a survey of two hundred to five hundred respondents. The firm analyses the data, identifies clusters, and delivers a segmentation framework. The process takes four to eight weeks and costs $25,000 to $50,000. The output is excellent when it is done well. The problem is that it is done rarely, updated even more rarely, and by the time the insights reach the product marketing team, the market may have already shifted.

Constructed Personas Versus Discovered Personas

There is a fundamental distinction between personas that are constructed and personas that are discovered. Constructed personas start with assumptions and fill in details through imagination. "Let's call her Marketing Mary. She's 35, manages a team of four, reports to the CMO, and her biggest challenge is proving ROI." The team nods. Marketing Mary goes on a slide. Nobody asks whether Marketing Mary actually exists in sufficient numbers to constitute a viable segment.

Discovered personas start with data and let the segments emerge. You recruit a diverse group of respondents, ask them questions about their lives, their problems, their decision-making processes, and their priorities, and then you look for the natural clusters. The clusters may not map to job titles at all. You might discover that the meaningful divide is not between "VP of Marketing" and "Director of Demand Gen" but between "people who buy based on peer recommendations" and "people who buy based on analyst reports." That distinction changes your entire channel strategy, but you would never find it by constructing personas in a workshop.

This is where Ditto's architecture becomes particularly powerful. Ditto does not just recruit respondents who claim to match a demographic filter. Each of the 300,000+ personas has a defined demographic profile, psychographic traits, media consumption habits, and behavioural patterns grounded in census data and behavioural research. When you recruit ten personas matching a filter, you get ten distinct individuals with internally consistent worldviews, not ten copies of the same archetype. The diversity is built in. The study reveals the segments.

The Multi-Group Segmentation Study

The core methodology is beautifully simple. You run the same study across multiple Ditto groups with different demographic filters, then compare the responses to identify meaningful differences. Claude Code orchestrates the entire process: recruiting groups, asking questions, polling for responses, completing studies, and producing the comparative analysis.

Here is a typical five-group study design for a B2B SaaS product:

Group A: USA, age 25 to 35, employed. Early-career professionals, digital natives, comfortable with self-serve.

Group B: USA, age 36 to 50, employed. Mid-career decision-makers, experienced buyers, more process-driven.

Group C: UK, age 25 to 50, employed. Same professional profile, different market context and cultural expectations.

Group D: Canada, age 25 to 50, employed. North American but with distinct regulatory and market dynamics.

Group E: USA, age 25 to 50, is_parent=true. Same demographics with an additional life context variable that may affect purchasing priorities and time constraints.

All five groups answer the same seven questions. The questions are designed to surface the dimensions along which segments meaningfully differ:

Question 1 (Day-in-the-Life): "What does your typical day look like? What takes up most of your time and attention?"

This is the contextual anchor. It reveals not just what people do, but what they care about. A persona whose day is dominated by meetings has different product needs from one whose day is dominated by deep-focus work. The variation across groups tells you whether your segments differ in context (a meaningful segmentation dimension) or only in demographics (a superficial one).

Question 2 (Problem-Solving Behaviour): "When you face [your problem space], what is the first thing you do? Who do you turn to? Where do you look for solutions?"

This surfaces the information architecture of decision-making. Some segments Google it. Some ask a colleague. Some post in a Slack community. Some call a consultant. These are not trivial differences. They determine your go-to-market channel strategy. If your highest-value segment discovers solutions through peer recommendation rather than Google, your SEO investment may be misallocated.

Question 3 (Goals and Barriers): "What are your biggest professional goals right now? What is standing in your way?"

This is the Value Proposition Canvas in a single question. The goals are the jobs-to-be-done. The barriers are the pains. The gap between the two is your opportunity. When Group A's barriers are fundamentally different from Group C's barriers, you have a segmentation insight that should change how you position the product for each market.

Question 4 (Channel Preferences): "How do you typically discover new tools or services? Recommendations? Social media? Google? Events? Industry publications?"

Direct channel intelligence. Dave Gerhardt has argued persuasively that distribution is the most undervalued skill in marketing. This question reveals where each segment actually spends attention, which is frequently not where marketing teams assume they do. The answers directly inform your media mix and content distribution strategy, and the cross-segment comparison reveals whether a single-channel strategy can work or whether you need segment-specific distribution.

Question 5 (Decision Criteria): "When making a purchase decision for work, what matters most: price, ease of use, features, brand reputation, or something else?"

This is the question that separates segments worth targeting from segments that happen to exist. A segment that buys on price is structurally different from one that buys on ease of use, and both are different from one that buys on brand reputation. Your messaging, your sales motion, your competitive positioning, and your pricing strategy all change depending on which criterion dominates. If Group A buys on ease of use and Group B buys on features, you either need two messaging tracks or you need to choose which segment to prioritise. This is the heart of segmentation as a strategic discipline.

Question 6 (Adoption Behaviour): "What is the last product or tool you adopted for work? What convinced you? What almost stopped you?"

Past behaviour is the best predictor of future behaviour. This question reveals the actual purchase journey: the trigger event, the evaluation criteria, the objections, and the tipping point. It is far more reliable than hypothetical questions about what they would do, because they are recalling what they actually did. The patterns across segments tell you which objections are universal (and must be addressed for everyone) and which are segment-specific (and can be addressed through targeted enablement).

Question 7 (Aspirational Jobs-to-Be-Done): "If you could have one superpower at work, what would it be? What would it let you do that you cannot do now?"

The deliberately playful framing is intentional. It bypasses the corporate filter and reveals what people actually want, stripped of the practical constraints they usually impose on their answers. The "superpower" question surfaces the emotional and aspirational jobs-to-be-done that rational questions miss. When a persona says "I wish I could know what my customers actually think, not just what they tell me in surveys," they have just described the Ditto value proposition in their own words. That language goes directly into your messaging.

What Claude Code Produces

Fifty personas. Seven questions each. Three hundred and fifty qualitative responses. Claude Code analyses this corpus and produces five deliverables:

Segment Comparison Matrix. A structured comparison of how each group responded to each question, highlighting where responses converge (shared market characteristics) and where they diverge (meaningful segmentation dimensions). This is the primary analytical output and the foundation for all subsequent deliverables.

Segment Prioritisation Framework. Not all segments are equally valuable. Claude Code assesses each segment on three dimensions: resonance (how strongly they respond to your problem space), urgency (how pressing the problem is), and accessibility (how easily you can reach and convert them). The output is a prioritised list with a recommendation for primary and secondary target segments.

Data-Backed Persona Documents. For each identified segment, a complete persona document with demographic profile, psychographic traits, goals, pain points, decision criteria, channel preferences, language patterns, and representative quotes drawn directly from persona responses. These are not constructed personas. They are discovered personas with evidence.

Segment-Specific Messaging Recommendations. The cross-segment comparison reveals that different groups respond to different value propositions, use different language, and have different objections. Claude Code produces tailored messaging recommendations for each segment, grounded in their actual words.

Segment Migration Map. Where segments overlap and where they don't. This map identifies opportunities for segment expansion ("Group A and Group C share the same decision criteria, suggesting a unified international messaging strategy") and segment boundaries ("Group B's price sensitivity means they require a fundamentally different packaging model").

The entire process, from study design to finished deliverables, takes approximately ninety minutes for a five-group study. A traditional segmentation engagement producing equivalent outputs would take four to eight weeks.

Advanced: Behavioural Segmentation Beyond Demographics

The five-group design above uses demographic filters (age, geography, parental status) as the segmentation axis. This is the easiest approach because Ditto's recruitment filters are demographic. But it is not the most powerful.

Behavioural segmentation, grouping people by what they do rather than who they are, produces sharper insights. The method is to use the study questions themselves as the segmenting mechanism. You recruit a single, broadly defined group (say, fifty personas across a wide age and geography range), ask questions that reveal behavioural differences, and then let Claude Code cluster the responses into behavioural segments post hoc.

The behavioural segmentation questions replace some of the standard seven:

"How many times per week do you [relevant activity]?" Frequency reveals intensity. Heavy users have different needs, different willingness to pay, and different feature priorities from occasional users.

"Do you currently use any tools or services for [category]? Which ones?" Current tooling reveals sophistication and switching costs. Someone using three competing tools is a different buyer from someone using a spreadsheet.

"On a scale of one to ten, how urgent is solving [problem] for you right now?" Urgency is the most underrated segmentation variable. A segment with high urgency and low current spend is the ideal target. High urgency and high current spend means you are fighting for share. Low urgency means you are creating demand, which is structurally harder.

"Can you make a purchase decision alone, or do you need approval?" Budget authority determines sales motion. Self-serve works for autonomous buyers. Enterprise sales is required for committee buyers. Most companies design one motion and hope it works for both. It does not.

Claude Code cross-references the behavioural answers with the demographic profiles of each persona and identifies the clusters that actually matter. The output might be: "Your market segments into three behavioural groups: Power Users (high frequency, multiple tools, autonomous budget, urgency 8+), Evaluators (moderate frequency, currently using a competitor, committee budget, urgency 5-7), and Curious Bystanders (low frequency, no current tools, no budget authority, urgency 2-4). Your TAM is in the first two groups. Ignore the third."

That insight is worth more than any demographic segmentation could produce, and it takes the same ninety minutes.

Persona Validation: Testing What You Already Believe

Not every team needs to build personas from scratch. Many have existing personas that inform their strategy. The question is whether those personas are accurate.

The persona validation workflow is simpler than the full segmentation study. You take your existing persona definitions, recruit Ditto groups that match each persona's demographic profile, and then test whether the persona's assumed pain points, goals, decision criteria, and behaviours actually hold.

The diagnostic questions are direct:

Your persona says "biggest pain point is proving marketing ROI." Does the matched Ditto group confirm this, or do they rank it third behind "getting budget approved" and "hiring good people"?

Your persona says "discovers products through LinkedIn and industry events." Does the matched group confirm this, or do sixty percent say "I ask my professional network first"?

Your persona says "price-sensitive, prefers monthly billing." Does the matched group confirm this, or do seventy percent prefer annual billing because their procurement process makes monthly approvals a nightmare?

The output is a persona validation scorecard: which assumptions hold, which are wrong, and which are partially right but need refinement. This is the cheapest, fastest segmentation work you can do, and it has the highest immediate impact because it corrects the foundations on which your current strategy rests.

Where Segmentation Fits in the PMM Stack

Segmentation is both the starting point and the recurring calibration mechanism for the entire product marketing function. The sequence:

Customer segmentation identifies who you are building for and who you are not. It defines the lens through which every subsequent decision is made.

Positioning validation tests whether your positioning resonates with each segment. Different segments may require different positioning, and the segmentation study tells you whether that is the case.

Messaging testing validates which messages land with which segments. The segmentation data tells you which messages to test with whom.

Pricing research reveals willingness-to-pay by segment. If your segmentation shows three distinct buyer groups, your pricing study should test each separately.

Competitive intelligence maps how different segments perceive your competitors. A feature that is a competitive advantage with one segment may be irrelevant to another.

Segmentation is not a one-time activity. Markets shift. New competitors enter. Customer needs evolve. Pragmatic Institute's framework recommends revisiting segmentation at least annually. With Ditto and Claude Code, quarterly validation becomes practical: run the same study every three months with fresh personas and Claude Code produces a trend analysis showing how segments are shifting. This transforms segmentation from a static strategic document into a living, continuously updated intelligence feed.

Cross-Market Segmentation for International Expansion

Perhaps the most powerful application of multi-group segmentation is international market research. Ditto covers fifteen-plus countries representing sixty-five percent of global GDP. Claude Code can orchestrate parallel studies across markets to answer the question that every company expanding internationally needs answered: does our segmentation hold across borders?

The methodology is identical to the domestic multi-group study, but with country as the primary filter variable. Same seven questions. Different markets. The output reveals:

Which segments exist in all markets (suggesting a unified global strategy may work)

Which segments are market-specific (requiring localised positioning and messaging)

Which markets show the strongest resonance (informing market entry prioritisation)

Where cultural differences affect decision-making (alerting you to messaging that will land differently, or badly, in certain markets)

A traditional multi-market segmentation study involving four countries would require commissioning research agencies in each market, coordinating questionnaire translation, aligning timelines, and consolidating results. Budget: $100,000 to $200,000. Timeline: three to six months. The same study with Ditto and Claude Code takes approximately two hours and produces a directly comparable cross-market analysis because the methodology is identical across all groups.

Limitations and When Traditional Research Still Wins

Synthetic segmentation research has genuine limitations that are important to acknowledge honestly.

First, Ditto personas have not used your specific product. They can tell you about their problems, preferences, and decision-making processes, but they cannot give you product-specific feedback. If you need to segment your existing customer base by usage patterns, you need product analytics (Pendo, Amplitude, Mixpanel) and real customer interviews.

Second, segmentation built on synthetic research should be validated against real-world data before making irreversible strategic commitments. If a Ditto study suggests that your UK segment cares primarily about data privacy whilst your US segment cares primarily about speed, that is a strong hypothesis worth testing. It is not a fact until your sales data and customer feedback confirm it.

Third, the ninety-five percent correlation between synthetic and real-world research holds for attitudinal and preference data. Behavioural predictions ("would you actually switch?") are inherently less reliable than behavioural observations ("they actually switched"). The mitigation is to use synthetic segmentation as the fast first pass, then validate the most consequential findings with real customers, real A/B tests, or real market experiments.

The right mental model is not "synthetic instead of traditional." It is "synthetic before traditional." Use Ditto and Claude Code to explore the segmentation landscape quickly and cheaply, identify the most promising hypotheses, and then invest traditional research budget only where the stakes justify it. This approach typically reduces traditional research spend by sixty to eighty percent whilst increasing research frequency by five to ten times.

Getting Started

If your personas were built in a workshop and have not been validated since, the quickest win is persona validation. Take your three existing personas, recruit matching Ditto groups, run the seven-question study against each, and see where reality matches your assumptions and where it does not. Time investment: one hour. Potential impact: every downstream decision that depends on persona accuracy, which is to say, every decision.

If you are entering a new market, launching a new product, or suspect your segmentation has gone stale, the full multi-group study will produce a data-backed segmentation framework in ninety minutes. It will not have the statistical precision of a $50,000 segmentation engagement. It will have directional clarity that eliminates the worst errors and focuses your resources on segments worth pursuing.

Ditto provides the always-available research panel across fifteen-plus countries. Claude Code handles the orchestration: designing studies, recruiting groups with the right demographic filters, running parallel studies, comparing responses, identifying clusters, and producing the five deliverables listed above. The combination transforms segmentation from a quarterly strategic project into an ongoing research programme that keeps your personas honest and your strategy grounded.

Tamara Grominsky is right: segmentation is the foundation. The question is whether your foundation is built on evidence or on a workshop from 2023. Ninety minutes will tell you which.

This is the sixth article in a series on using AI agents for product marketing. The first, Using Ditto and Claude Code for Product Marketing, provides a high-level overview. The second, How to Validate Product Positioning with AI Agents, covers positioning validation. The third, Competitive Intelligence with AI Agents, covers competitive battlecard generation. The fourth, How to Test Product Messaging with AI Agents, covers iterative message testing. The fifth, How to Research Pricing with AI Agents, covers pricing research and willingness-to-pay analysis. The final article will address the research-to-publication content engine.