Expert networks are brilliant. GLG, AlphaSights, Third Bridge, Guidepoint - they've built a $4.2 billion industry on a genuinely valuable premise: the right person's hour is worth $950 to the right client. And for certain questions, nothing else comes close.

But here's the problem with how most firms actually use them: they're calling expert networks first.

The typical workflow goes like this. An analyst needs to understand a sector, a company, a competitive dynamic. They submit a request to the expert network. Wait 2-5 days for scheduling. Get on a call. Spend the first 15 minutes orienting themselves - asking broad contextual questions to map the landscape before they can even get to the sharp, specific questions the call was booked for. At $950 an hour, that's $237 worth of orientation.

Then they book another call, because the first one raised three new questions they hadn't anticipated. Another $950, another week of scheduling. By the time they've built their thesis, they've spent $4,000-$8,000 and two weeks on calls that were partly background research and partly genuine expertise.

What if you walked into every expert call already knowing the landscape?

What 300,000 Synthetic Professionals Actually Means

Synthetic research platforms like Ditto maintain 300,000+ AI personas grounded in census data, behavioural research, and professional backgrounds. That number matters because of what it covers.

These aren't 300,000 variations of "generic consumer." They include synthetic professionals across practically every niche that matters to research buyers:

CISOs and cybersecurity directors who can reason about threat landscapes, vendor selection, and security architecture

Oncologists and healthcare specialists who understand treatment protocols, clinical trial design, and regulatory pathways

Supply chain directors who can walk through procurement dynamics, inventory optimisation, and logistics trade-offs

Deep tech researchers who can discuss semiconductor fabrication, battery chemistry, or biotech platform approaches

Retail buyers, fintech compliance officers, pharmaceutical marketers, automotive engineers, CPG brand managers, SaaS product leaders

The breadth is the point. Whatever professional niche your research requires, there are synthetic personas who occupy it - and the underlying language models bring genuine depth to these roles. We're talking about PhD-level domain knowledge across thousands of specialisations. Ask a synthetic oncologist about checkpoint inhibitor mechanisms and you'll get a substantive, technically literate answer. Ask a synthetic CISO about zero-trust architecture trade-offs and they'll reason through it with the kind of structural understanding you'd expect from someone in the role.

What They Know (and What They Don't)

Here's where we're going to be completely honest, because credibility matters more than a clean sales pitch.

Ditto's synthetic personas can engage with remarkable depth across complex professional domains. The knowledge embedded in the underlying LLMs is vast - spanning published research, industry literature, regulatory frameworks, technical standards, clinical data, and professional practice across thousands of fields. For any question that draws on the accumulated, published knowledge of a domain, they perform extraordinarily well.

What they don't have:

Non-public information. A synthetic former VP at Company X hasn't sat in Company X's boardroom. They don't know what the CEO said on last Tuesday's all-hands, what the unpublished Q3 numbers look like, or which supplier relationship is quietly deteriorating. If your question requires literal insider knowledge, a synthetic persona cannot answer it.

Absolutely cutting-edge research. If a breakthrough paper was published last month and hasn't yet permeated the broader literature, a synthetic researcher may not reflect it. They work from the deep corpus of established knowledge, not from yesterday's preprint server.

The scar tissue of personal experience. There's a particular kind of knowledge that comes from having personally navigated a specific crisis, managed a specific integration, or watched a specific strategy fail from the inside. Synthetic personas can reason about these situations with genuine sophistication, but they haven't lived them.

These are real limitations. They also define exactly where human expert networks add irreplaceable value. And that's the whole point.

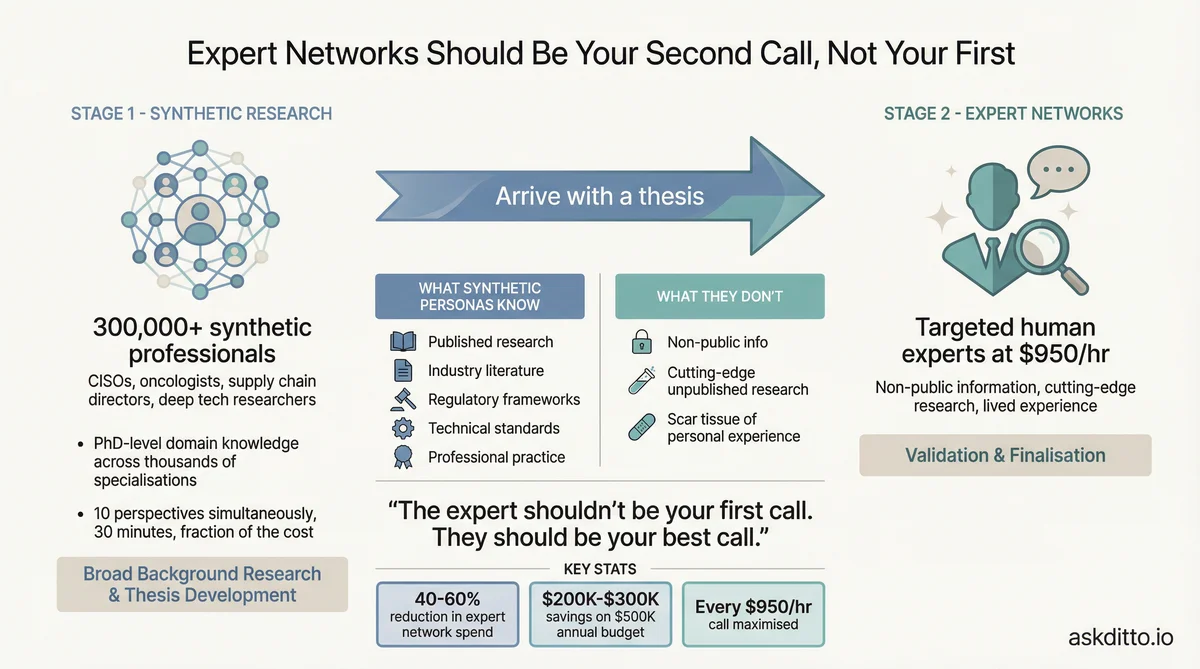

The Two-Stage Research Model

The smartest research teams in 2026 won't choose between synthetic research and expert networks. They'll use both - in sequence.

Stage 1: Synthetic Research (Broad, Fast, Cheap)

Before you spend a penny on expert calls, run synthetic studies across the domain. Ten personas with relevant professional backgrounds, seven structured questions, thirty minutes. You'll walk away with:

A map of the competitive landscape and where opinions diverge

The key operational and strategic questions that actually matter in this sector

Preliminary thesis points - validated or challenged across multiple professional perspectives

A clear picture of what you don't know yet - the specific gaps that require human expertise to fill

This is the background research that currently consumes the first 15 minutes of every expert call and the first 2-3 calls of every project. Do it synthetically. It takes an afternoon, not a fortnight.

Stage 2: Expert Networks (Targeted, Validated, Sharp)

Now book your expert calls. But instead of arriving with broad orientation questions, you arrive with a thesis. You've already mapped the landscape. You've already identified where professional opinion diverges. You know exactly which questions require a specific human's non-public knowledge, personal experience, or cutting-edge insight.

The result: every minute of that $950/hr call is spent on the questions only a human expert can answer. No orientation. No broad context-setting. No "can you walk me through the industry?" You're straight into: "Our research suggests X - does your experience at Company Y confirm or challenge that? And why?"

The expert gets a better conversation. The analyst gets sharper answers. The firm gets more value per dollar spent. Everyone wins.

What This Looks Like in Practice

Private Equity Due Diligence

A mid-market PE firm evaluating a healthcare services acquisition. The old way: book 12-15 expert calls over two weeks - healthcare operators, former executives at the target, regulatory specialists, payer relationship experts. Cost: $11,000-$14,000. Timeline: 10-14 days. The first 3-4 calls are mostly landscape orientation.

The two-stage way: run three Ditto studies in an afternoon (healthcare operations professionals, regulatory specialists, payer-side personas). Build the thesis. Identify the three specific questions that require human validation - the non-public dynamics, the recent regulatory shift, the specific competitive threat. Book 3-4 targeted expert calls. Walk in armed. Cost: a fraction of synthetic spend plus $2,850-$3,800 in expert calls. Timeline: 3-4 days. Better thesis, half the cost, a third of the time.

Hedge Fund Sector Research

An analyst building a position in enterprise cybersecurity. Instead of booking 6 expert calls with CISOs over three weeks to understand the vendor landscape and budget dynamics, run a synthetic study with 10 CISO-profile personas first. Map vendor preferences, budget allocation patterns, threat prioritisation, and switching triggers. Then book 2 calls with actual CISOs to validate the thesis and probe the specific areas where synthetic research flagged disagreement. The analyst arrives at those calls knowing exactly what to ask. The CISOs - who are giving up time from demanding jobs - get asked genuinely interesting questions rather than introductory ones.

Consulting Market Entry

A consulting firm advising on European market entry for a US fintech. Synthetic study across UK, German, and French financial services professionals - regulatory differences, competitive landscape, customer acquisition dynamics. Four markets, thirty perspectives, one afternoon. Then targeted expert calls with 2-3 specific humans who have actually navigated fintech licensing in each jurisdiction. The synthetic research builds the framework; the expert calls fill in the regulatory specifics and political nuances that require lived experience. We've covered the cross-market research methodology in our positioning validation guide.

The Speed Advantage (and Yes, the Cost Too)

The cost savings matter. But they're not the real story. The real story is time to decision.

Expert networks operate on calendar time. Submit a request. Wait for the network to identify and screen candidates. Coordinate schedules across time zones. Book the call for next Tuesday. Realise you need a follow-up. Book that for the week after. A research project that requires 8-12 expert calls doesn't take 8-12 hours. It takes 2-4 weeks of elapsed time, threaded through everyone's diary.

Synthetic research operates on your time. Run a study with 10 CISO-profile personas at 9am. Read the results at 9:30am. Spot an unexpected divergence in vendor preferences. Run a follow-up study targeting that specific question at 10am. Have the answer by 10:30. Refine your thesis over lunch. By the afternoon, you have the landscape mapped, the key questions identified, and a clear brief for the 2-3 expert calls that will actually move the needle.

That's not a marginal improvement. That's the difference between a research cycle measured in weeks and one measured in hours.

For PE firms in competitive deal processes, this changes what's possible. Due diligence that previously took 10-14 days of expert scheduling compresses to 3-4 days: one afternoon of synthetic research to build the thesis, then a handful of targeted expert calls to validate it. When multiple bidders are racing toward a deadline, the firm that builds conviction fastest wins.

For hedge fund analysts tracking a fast-moving sector, it means responding to a market event with structured professional research the same day - not two weeks later when the trade has already moved.

For consulting teams, it means arriving at the client kickoff meeting having already mapped the landscape, rather than spending the first two weeks of the engagement on orientation research the client is paying for.

The cost savings are real too - typically 40-60% reduction in expert network spend, because you're replacing commodity landscape calls with synthetic research and only booking expert calls for the sharp, validation-dependent questions. For a firm spending $500,000 annually on expert networks, that's $200,000-$300,000 redirected. But the speed advantage is what changes behaviour. Once a research team discovers they can have professional-grade landscape research in 30 minutes instead of 3 weeks, they don't go back.

First Call, Not Only Call

Ditto's 300,000 synthetic professionals represent a breadth of domain expertise that would have been unimaginable five years ago. CISOs, oncologists, supply chain directors, deep tech researchers, financial analysts - engaging at PhD-level depth across thousands of specialisations. For broad background research, landscape mapping, and initial thesis development, they are faster, cheaper, and more comprehensive than any expert network can be.

They are not a replacement for the human expert who sat in the room when the decision was made, who knows the unpublished data, who can tell you what's about to change before it changes. That expert is worth every penny of $950 an hour.

But that expert shouldn't be your first call. They should be your best call - the one you walk into already knowing the landscape, already holding a thesis, already armed with the exact questions that only they can answer. Synthetic research makes that possible.

Ditto offers synthetic research with 300,000+ personas across 15 countries, validated by EY Americas (95% correlation with traditional research) and peer-reviewed by researchers at Harvard, Cambridge, Stanford, and Oxford. See how it works.