Example Research: Perceptions of Alternative Milks

We wanted to understand how consumers perceive alternative milks, so we ran an synthetic market research study to test perceptions, responses to products, and what could be improvedLike a lot of people I've flirted with alternative milks - it just sits better with me and feels less heavy than dairy. Oat milk also makes my coffee taste and foam nicer, which is honestly how this started. It’s convenient too since it lasts longer in the fridge, and I like that it can be a slightly lower-impact choice without me having to overthink it.

The alternative milk market is growing rapidly, and there are a lot of up-and-coming brands, along with well-established products and offerings.

I wanted to show a clear example of how we can use synthetic market research to understand a problem that more people will have encountered - "how to stand out in a busy field" - here's an example of how we can do synthetic market research on alternative milk products

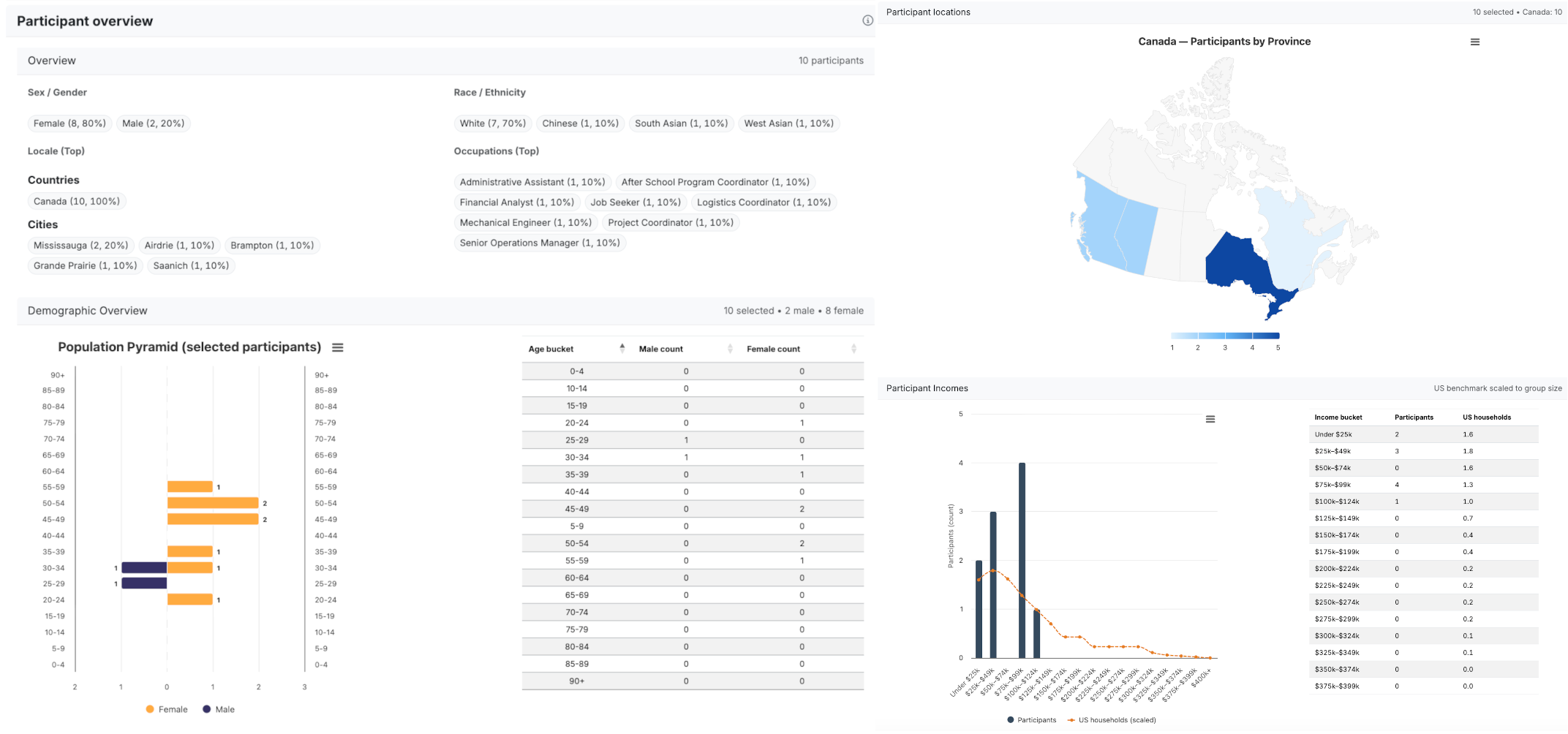

Audience - choosing synthetic personas

I wanted to get a pretty board range of perspectives, so I selected 10 synthetic personas from Ditto's "Canada v3" model (they're all SPL 5 level personas) that confirmed that they have tried or used alternative milks in the past:

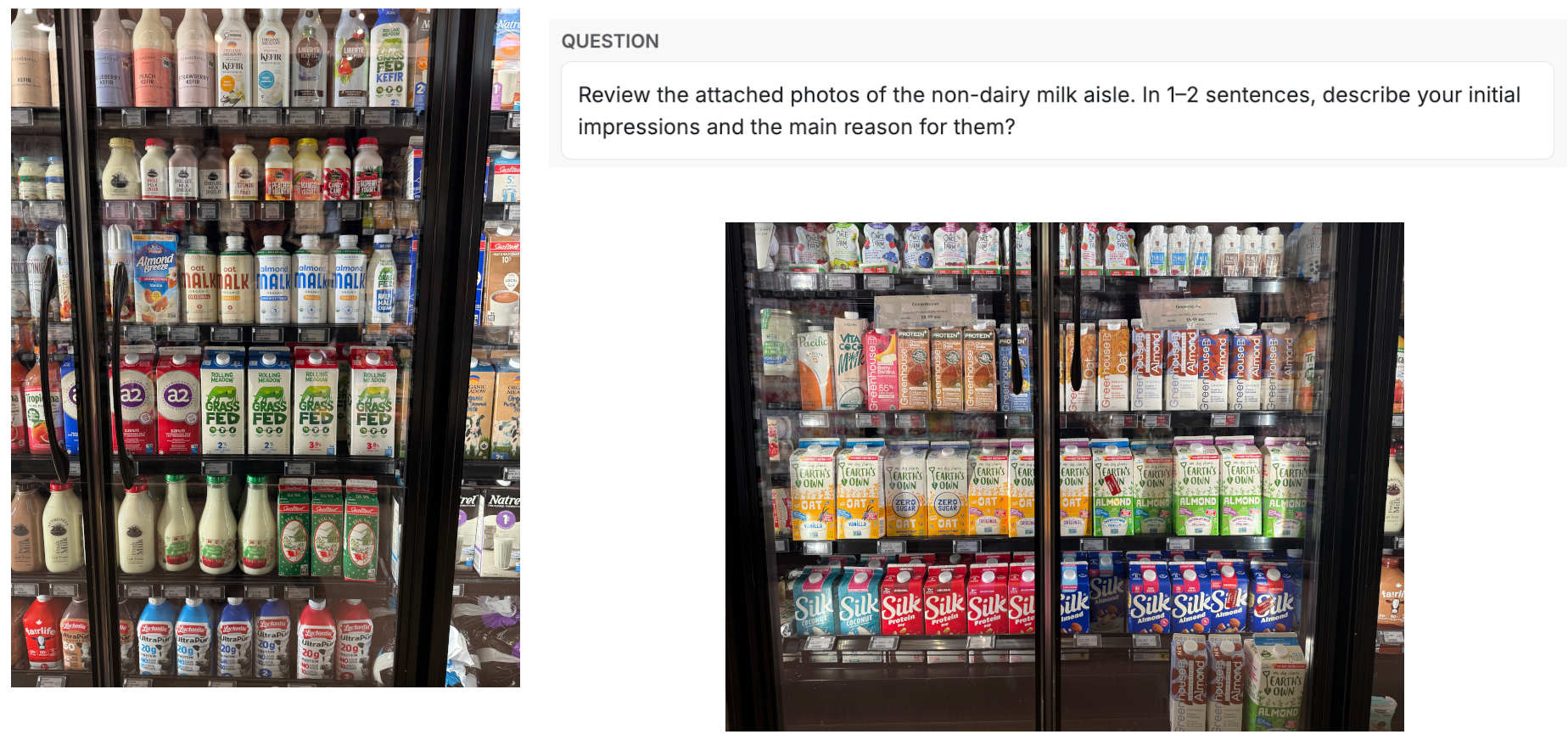

First Question - Use of Alternative Milks

I wanted to get a clear idea of how the participants have used alternative milks in the past, so I asked them "Have you ever tried non-dairy milk alternatives? Briefly explain in 1–2 sentences why you did or did not try them?".

The results were clear and interesting - they all used alternative milks for a variety of different reasons - some of the most interesting reasons given included:

"I keep oat milk around because it tastes fine in an AeroPress, has a smaller footprint than dairy, and the shelf-stable cartons are convenient out here" - Olivier Martin

"I’ve tried oat and almond milk for smoothies and baking because they fit our plant-forward meals and they keep well" - Maureen Campbell

"Dairy sits heavy for me and the shelf-stable cartons are handy" - Evelyn Cheng

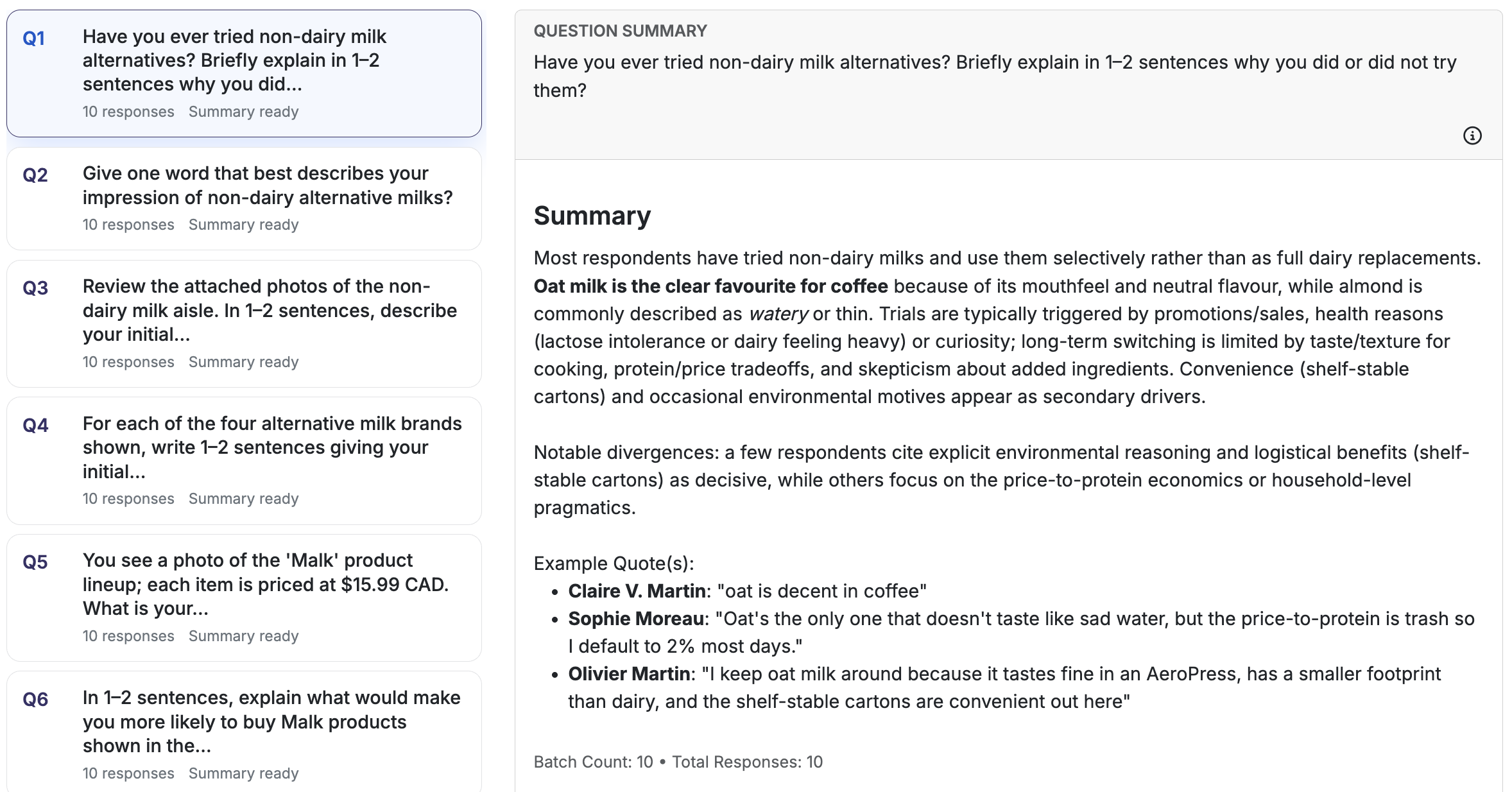

Second Question - Impressions of Alternative Milks

For the second question I wanted to get a feel for general impressions of alternative milks, so I asked the participants "Give one word that best describes your impression of non-dairy alternative milks?". The results were a bit "meh"...

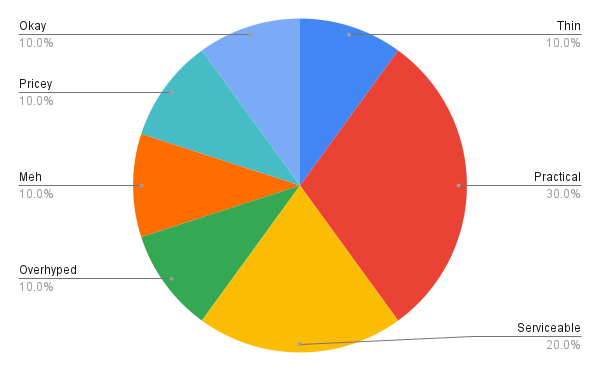

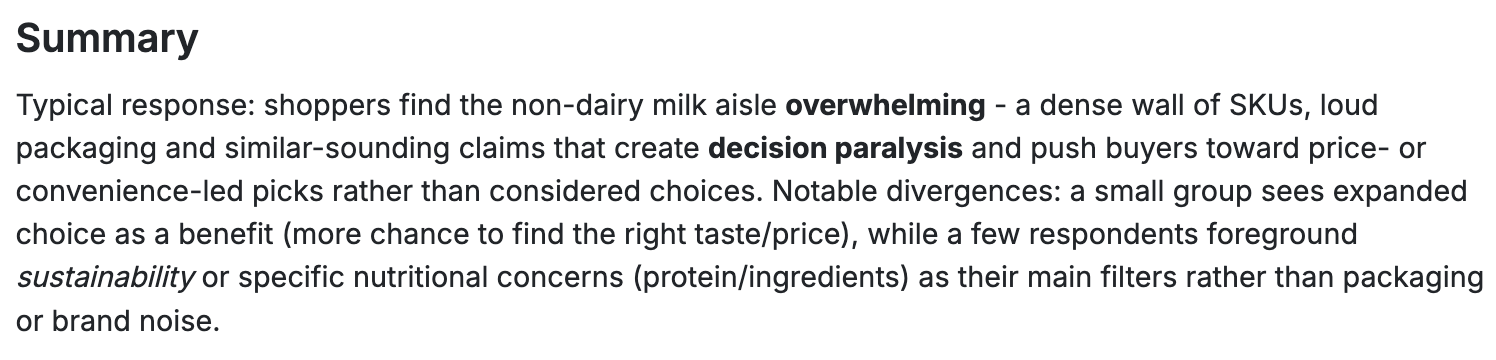

Third Question - Alternative Milk Aisle

One of the biggest challenges for CPG brands is making their product stand out on the shelves when they're in a category that is busy and full of competitors.

To test this practically, I took some photos of the alternative milks aisle in my local grocery store, and asked the participants what their initial impressions were:

The results were relatively unsurprising - comments about wide range of varieties, SKU bloat, and overwhelming amount of options:

"The choices are overwhelming, but it’s convenient to see so many in one place. The range of brands and formulations is impressive." - Evelyn Cheng

"Just a wall of brands and flavors all yelling at me. The loud, flashy packaging makes me think they’re trying to distract from what’s actually inside." - Owen Clarke

"That aisle is pure SKU bloat... labels trying to justify premium pricing while delivering weak protein." - Sophie Moreau

"Looks like there are a lot of options now. It’s a bit overwhelming, but also practical, I guess." - Maureen Campbell

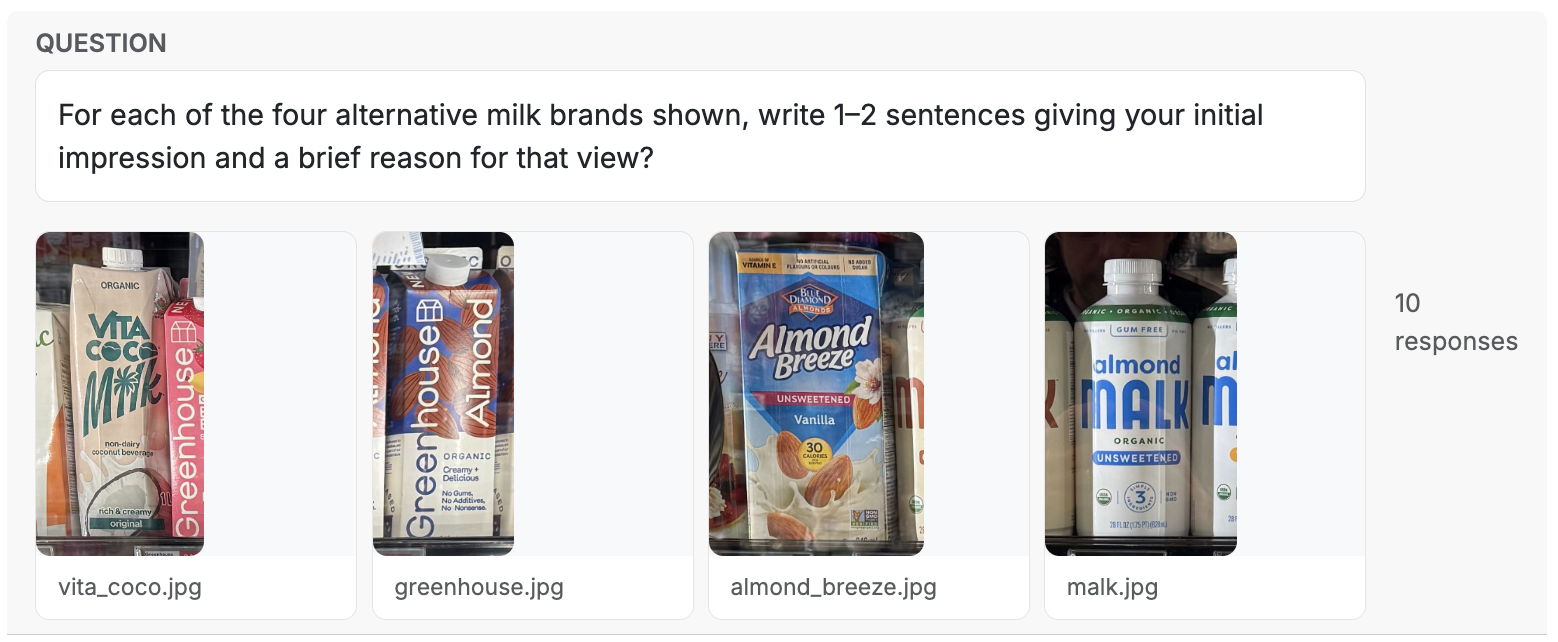

Fourth Question - Specific Alternative Milk Brands

This is the part I was most curious about, because “the aisle is overwhelming” is basically a universal truth at this point - but what happens when you zoom in on specific brands and force yourself to actually form an opinion?

So I showed the personas four brands (Vita Coco Milk, Greenhouse Almond, Almond Breeze, and Malk) and asked for a quick 1–2 sentence “initial impression + why.”

A couple of things popped really fast:

1) People are using packaging as a shortcut for trust. Short ingredient lists and “clean label” cues landed as a major trust signal - especially anything that screamed “simple” and “transparent.”

2) BUT… “clean” also triggers performance anxiety. The second someone sees “gum-free / three ingredients,” they love the idea… and then immediately worry it’ll separate, look weird, or taste thin in coffee (because many are using alt milks for coffee-first, not for cereal nostalgia).

3) Confusing claims get called out instantly. The “unsweetened vanilla” type messaging made people go 🤨 and ask what that actually means.

Here are a few highlights (these are initial-impression reactions - not a full taste test, just what the shelf is communicating):

Vita Coco Milk: Comes across as “the coconut people doing milk,” which gives it familiarity and a bit of a health halo. But coconut also reads as more specific-use (smoothies, baking, tropical vibes) vs. the default everyday milk replacement.

Greenhouse Almond: The overall vibe is premium / “fancy fridge section” - it looks like something you’d pay more for. (And that can be good… until you hit the price tag.)

Almond Breeze: Feels like the “safe, familiar” choice - but the label language and marketing-y front-of-pack stuff can also trigger skepticism, especially around terms like “unsweetened vanilla.” One persona literally asked: “why add vanilla if you’re cutting sweetness?”

Malk: Biggest “clean label” win - people like the simplicity. One response basically summed it up as “only three ingredients is a plus.” But the gum-free + minimal ingredient story also raised fear about separation / creaminess (“gum-free usually kills creaminess…likely to separate and look gross in coffee”).

If you’re a brand trying to stand out, this is the big lesson: your packaging is doing two jobs at once - (1) “can I trust this?” and (2) “will this actually work in my coffee without ruining my morning?”

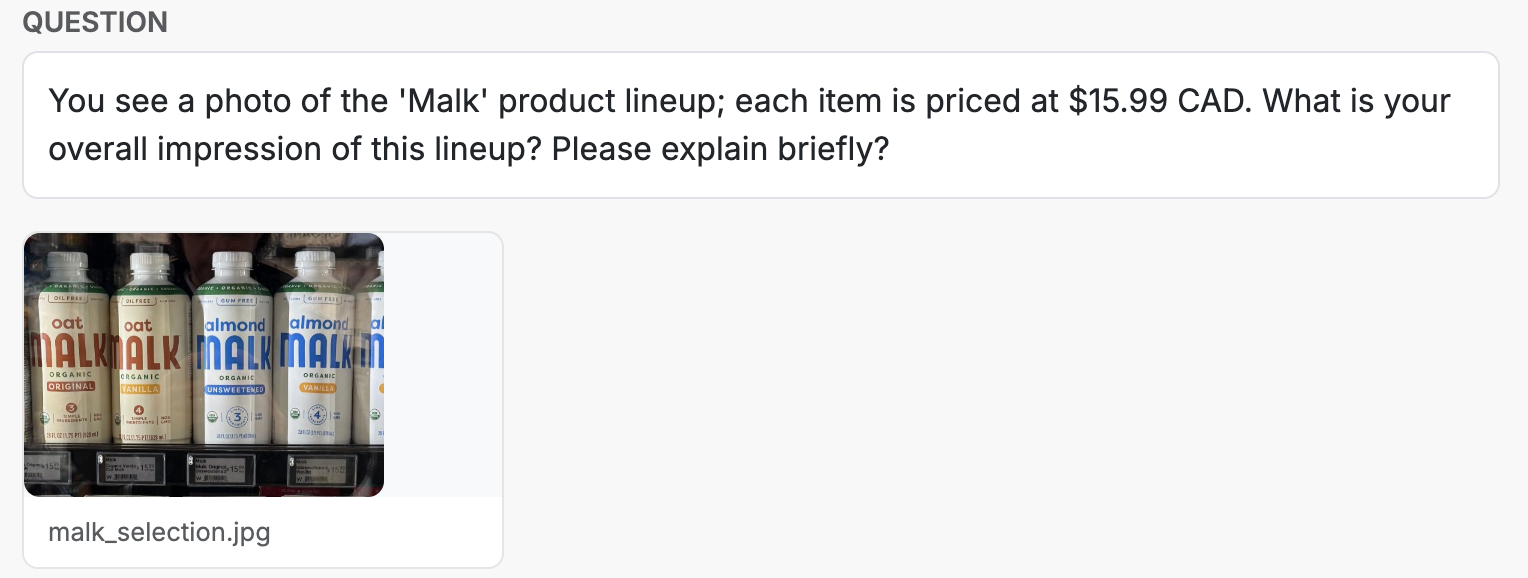

Fifth Question - The Malk $15.99 Moment

Okay, now the fun part (aka the part where wallets start sweating). I showed the personas the Malk product lineup - and told them each one was priced at $15.99 CAD - and asked for their reaction:

This was… not subtle. Price was basically the dominant friction point, and “that’s steep” was the overall mood. One persona literally called it “pretty steep.”

And the interesting nuance wasn’t just “expensive bad.” It was more like:

“I’m not paying that unless it’s noticeably better.”

“At that price, it can’t just be ‘clean’… it has to be clean and creamy and nutritious.”

“This is giving ‘premium wellness product’ and I need proof it’s not just fancy marketing.”

The study summary basically nails it: premium SKUs hit a wall unless the sensory experience and measurable nutrition justify the price - especially since people treat the category as functional, not indulgent.

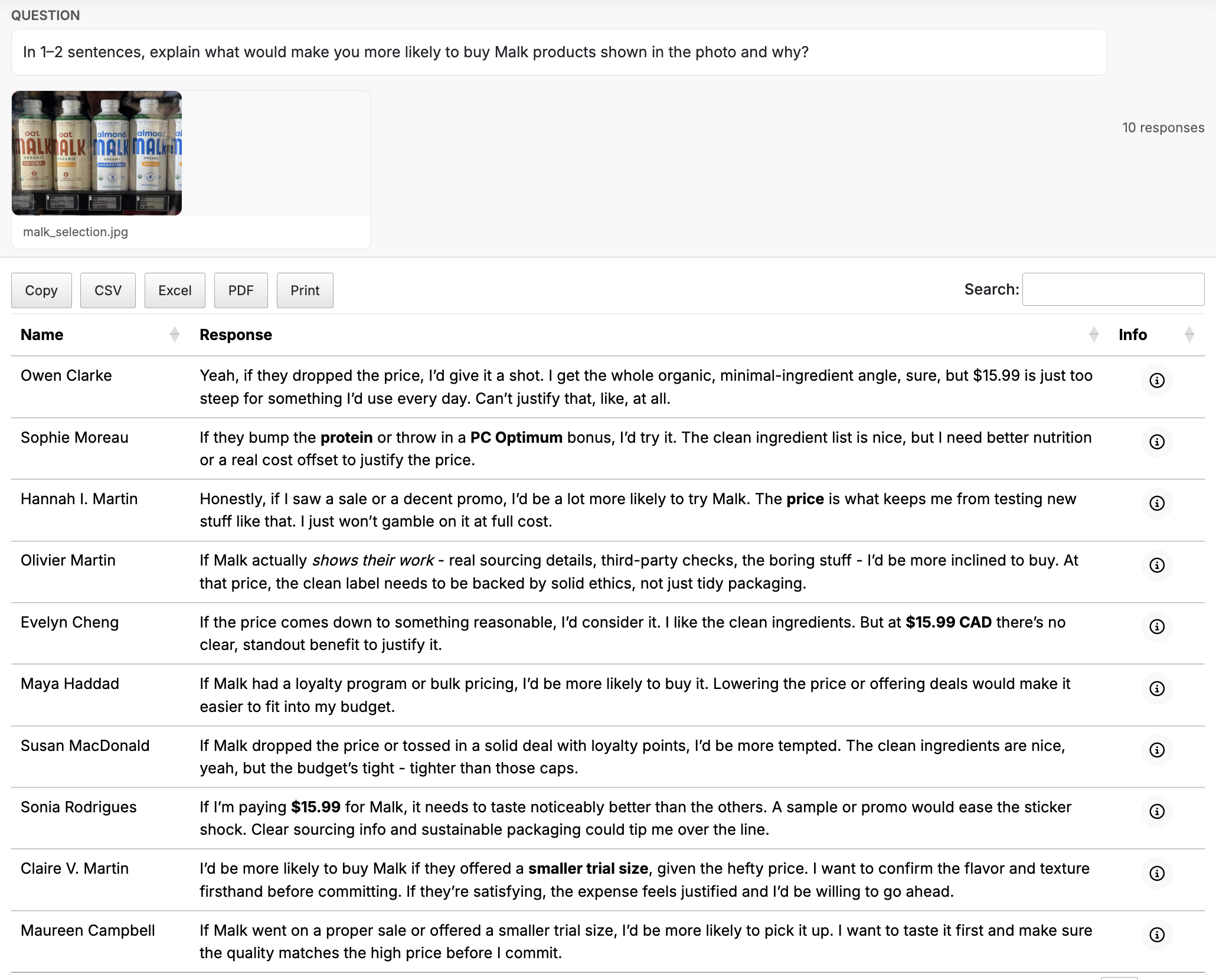

Sixth Question - What Would Make People More Likely to Buy Malk?

After the price shock, I asked the obvious follow-up: what would make you more likely to buy it?

And honestly, the answers were super practical. People basically want the purchase to feel lower risk and more justified.

Here’s what kept coming up:

1) Price relief / lower-risk trial Promotions, discounts, loyalty points, bundles - anything that makes the first purchase feel less like a gamble. Smaller formats or trial sizes so you’re not committing $16 to something you might hate.

2) Proof that it performs (especially in coffee) If “gum-free” is part of the story, people want reassurance it won’t separate, look gross, or feel watery. Basically: show the latte. Show the foam. Show the texture.

3) Better nutrition (or at least clearer value) A lot of people evaluate value in super utilitarian ways - like a rough “price-to-protein” vibe check. If it’s expensive, they want a reason that’s not just vibes.

4) Traceability / credibility This one surprised me a little, but it makes sense for premium: if you’re charging that much, some shoppers want evidence that the sourcing story is real. One persona basically said brands should “show their work…third-party checks.”

Net-net: people aren’t anti-premium - they’re anti-unproven premium.

Summary - So What Did We Learn?

If I had to boil this whole thing down into a few simple points (aka the stuff I’d actually use if I was building / marketing an alt milk brand):

1) Alternative milks are “use-case” products, not emotional replacements for dairy. A lot of people aren’t switching “forever” - they’re picking oat for coffee, almond for something else, dairy for baking, etc. Oat comes through as the coffee winner because of mouthfeel, while almond gets labeled thin/watery a lot.

2) The shelf is chaos - and chaos makes people default to what they know (or what’s cheapest). “Overwhelming” was the dominant reaction to the aisle photos, and it creates decision paralysis.

3) “Clean ingredients” builds trust fast… but raises the bar for texture. People like short ingredient lists, but they immediately worry about separation and creaminess (especially in coffee) if the product is gum-free / minimal.

4) Premium pricing needs real, obvious justification - not just a prettier carton. At $15.99 CAD, Malk got treated as a hard “value hurdle.” People would need proof (taste/texture), stronger nutrition, credible sourcing, or a lower-risk first try (sale, trial size, loyalty, etc.).

And zooming out: this is exactly where synthetic market research is useful. You can test reactions to the shelf reality (clutter, claims, price anchoring) and get directional insight before you spend a bunch of money on redesigns, promos, or positioning that doesn’t land.