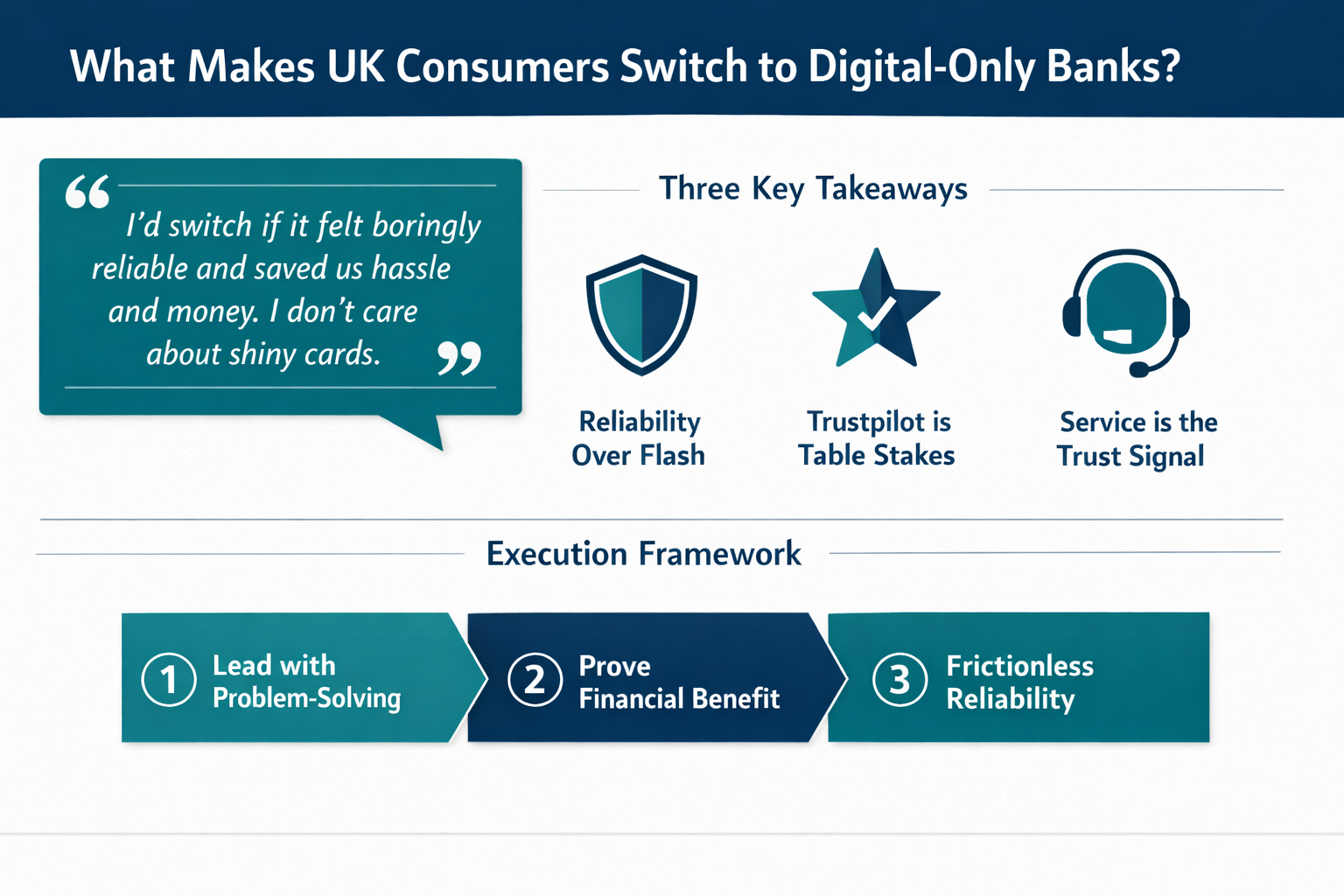

Six UK consumers. Three questions about digital banking. One surprising consensus: Trustpilot ratings don't matter nearly as much as you'd think.

I ran a quick study with Ditto to understand what would actually make people switch their main banking to a digital-only bank like Zopa. The responses challenged some common assumptions about fintech trust-building.

The Participants

Six UK adults aged 25-55, all with existing bank accounts and varying degrees of digital banking experience. Mix of employed professionals, caregivers, and self-employed. They represent the exact audience digital banks need to convert: people with established banking relationships who might be persuaded to switch.

What Would Actually Make You Switch?

The first question cut straight to the heart of digital banking adoption: what would it take to make you move your main banking to a digital-only bank?

The responses clustered around three themes:

Demonstrably better customer service when things go wrong

Genuine financial benefits (better rates, lower fees)

Seamless hybrid access (some physical presence or partnership)

First reaction: fine, but I roll my eyes at fast decisions and no hidden fees. Everyone says that. One app is nice, but I already run pots in Monzo, so it is not new. I care if the rate holds, the app does not crash, and they do not play games with teaser deals. If it saves real money and cuts faff,...

Key insight: It's not about flashy features. It's about proving the bank will be there when problems arise.

Does Trustpilot Actually Build Trust?

Zopa has a 4.5-star rating on Trustpilot with 1.5 million customers. Surely that builds confidence?

The answer was more nuanced than expected. Multiple participants expressed skepticism about review platforms entirely.

4.5 stars is nice, but I treat Trustpilot like a vibe check, not gospel. I already bank mostly on my phone with Monzo, so digital-only is fine; what matters is what happens when stuff breaks and I need a real person fast. If they’re FSCS covered, pic...

Key insight: High Trustpilot scores are table stakes, not differentiators. What consumers want to see is how the bank handles complaints and problems, not just positive reviews.

First Impressions of the Zopa Proposition

We showed participants Zopa's core offering: digital bank with loans, savings, credit cards, and a mobile-first approach.

Short version: I’d switch if it felt boringly reliable and saved us hassle and money. I don’t care about shiny cards. I care about bills clearing on time, no hidden faff, and my wife and I having a clean view of pots and spend. If they can prove that...

Key insight: Consumers are rightfully skeptical of marketing claims. They want evidence, not promises.

What This Means for Digital Banks

Lead with problem-solving stories, not just positive reviews

Show how you handle complaints, not just collect praise

Consider hybrid models or partnerships for physical access

Make the switching process frictionless and low-risk

Prove financial benefits with concrete comparisons

The path to digital banking adoption isn't paved with star ratings and feature lists. It's built on demonstrated reliability when things go wrong. For Zopa and other digital banks, the message is clear: show your problem-solving, not just your polish.

Want to test your own fintech positioning? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real consumers to share their thoughts. Here's what they told us:

What would actually make you switch your main banking to a digital-only bank like Zopa? And what features or reassurances would you need before moving...

Daniel Hargreaves, 34, Stay-at-Home Parent, Sheffield, South Yorkshire, United Kingdom:

Short version: I’d switch if it felt boringly reliable and saved us hassle and money. I don’t care about shiny cards. I care about bills clearing on time, no hidden faff, and my wife and I having a clean view of pots and spend. If they can prove that, I’d move the salary, not before. What would make me switch: Stability over hype. Clear track record on outages, a status page, and honest comms when stuff breaks. I want dull and steady, not fireworks. Joint account done right. Real-time notifications for both of us, bill pots that cannot be raided by accident, and sane permissions. Fees that st...

Nikhil Thomas, 33, Project Coordinator, Leeds, West Yorkshire, United Kingdom:

I don’t switch for hype. Show me money and safety, or I stay put. Main bank - what makes me move Net gain £150+ a year after fees. Cash switch bonus helps. Ongoing perks, not a 3 month tease. CASS done right. All DDs moved, no missed payments, clean exit if it’s rubbish. UK phone line that answers fast. Chat is fine, but I want a human inside 3 minutes. App that never flakes on payday. Instant alerts, freeze card, Google Pay, spend pots. Cash and cheques sorted. Post Office or PayPoint deposits at low cost. Cheque imaging. Clear overdraft rules. No gotchas. No unarranged fee nonsense. Limits...

Lauren Bennett, 25, Upholsterer & Furniture Restorer, Barnet (London Borough), Greater London, United Kingdom:

Short version: I’m already app-first with Monzo, so to pull me over to something like Zopa it has to be boringly reliable and actually better for budgeting, not just a shiny card. Branch closures in the news just make me think, fine, but then the app cannot fall over. If it’s faffy or full of teaser gimmicks, I’m out. What would actually make me switch my main banking: Real bills pots that ring-fence direct debits and rent, auto-sort on payday, and never let a Netflix nibble bounce a mortgage payment.Consistently good savings rates inside those pots without bait-and-switch. No hoops, no “for ...

Mateusz Nowak, 41, Electrician, Croydon (London Borough), Greater London, United Kingdom:

Short version: I would not move my salary and all bills to a flashy app for a £200 carrot or a pretty UI. I would move if it is boringly reliable, transparent, and treats risk like I treat live conductors - no shortcuts. What I need to see, in plain English: Full banking licence and FSCS on current and savings. Clear brand-group mapping so I know what actually counts toward £85k. No e-money funny business for the main pot. Reliability and comms: public status page with uptime, real post-mortems after outages, and in-app banners when things break. Not PR fluff. Human support that answers fast...

Zopa has a 4.5 star rating on Trustpilot with 1.5 million customers. Does this social proof make you more likely to consider them, or do you have othe...

Lauren Bennett, 25, Upholsterer & Furniture Restorer, Barnet (London Borough), Greater London, United Kingdom:

4.5 stars is nice, but I treat Trustpilot like a vibe check, not gospel. I already bank mostly on my phone with Monzo, so digital-only is fine; what matters is what happens when stuff breaks and I need a real person fast. If they’re FSCS covered, pick up the phone quickly, and don’t have a sketchy trail of freezes or outages, I relax a bit; if not, I don’t care how slick the app looks. Branches are vanishing anyway, but I still keep one boring high-street account as a backup because direct debits and proofs can be a faff if an app hiccups. So the rating makes me consider them, sure, but I’d st...

Conor Kavanagh, 37, Engineering Technician, Vale of Glamorgan, Vale of Glamorgan, United Kingdom:

Honestly, the 4.5 stars and the big customer number is nice, but it doesn’t sway me much. Reviews get gamed and swing with whatever promo was on that week, so I don’t treat that as solid. What matters to me is can I get my money fast if something goes wrong, is it FSCS covered, and can I ring a real human instead of arguing with a chatbot. With all the chat about delays and systems being slow lately, I’m extra twitchy about an app-only setup choking on payday. No branch is fine most days, but cash or a random cheque from my dad turns into a faff. I’d maybe test them with a small pot, but I wou...

Daniel Hargreaves, 34, Stay-at-Home Parent, Sheffield, South Yorkshire, United Kingdom:

Short answer: not really. A shiny Trustpilot score is nice, but it tells me most folks had a smooth signup or a quick win. It does not tell me how they act when the app locks you out, a payment gets stuck, or a fraud case drags on. I care more about the boring stuff. What actually moves me: FSCS cover and a proper UK banking licence. No e-money funny business.Outage record and how fast they unblock transfers. I check for horror stories, not star averages.Fraud handling. Do they answer within hours, or leave you hanging for weeks.Rate stability. No teaser that drops after three months with hoo...

Mateusz Nowak, 41, Electrician, Croydon (London Borough), Greater London, United Kingdom:

Short answer: no. A shiny Trustpilot score is like a bright LED on a dodgy adaptor. Looks good, tells me almost nothing. I already use a digital-only bank for budgeting, so I am not anti-app. But I only trust one after a few specific checks: FSCS coverage and banking licence shown clearly in writing. If it is not obvious in two clicks, I am out. Rate stability - do they bait with a bonus and then drop it fast. I read the 1-star reviews first for this. Access friction - how fast can I withdraw to my main account on a bad day. Same day or do they sit on it. Lockout recovery - new phone, SIM...

Zopa is a UK digital bank that offers loans, savings accounts, and credit cards through a mobile app. They promise fast loan decisions, no hidden fees...

Daniel Hargreaves, 34, Stay-at-Home Parent, Sheffield, South Yorkshire, United Kingdom:

First reaction: fine, but I roll my eyes at fast decisions and no hidden fees. Everyone says that. One app is nice, but I already run pots in Monzo, so it is not new. I care if the rate holds, the app does not crash, and they do not play games with teaser deals. If it saves real money and cuts faff, I am in. If it is shiny metal cards and slogans, I am out. What makes me trust a fintech over a high street lot: FSCS shown up front, not tucked away. Total cost in big type. APR, fees, and total repayable before a hard search. Rate history and notice before cuts. No bait then drop. Real UK suppo...

Lauren Bennett, 25, Upholsterer & Furniture Restorer, Barnet (London Borough), Greater London, United Kingdom:

First reaction? Sounds tidy, but also a bit glossy. "Fast decisions" makes me think upsell-you-a-loan when you are stressed, which I hate. "No hidden fees" is nice, but I want to see the fee table and the exit fees up front. One-app-for-everything is convenient until the app flakes and you are stood there at Tesco with a dead phone. With branches closing this week, I feel twitchy about banking anyway, so they would have to earn it. What would make me actually trust a fintech over a high street lot: FSCS protection front and centre, plain English, plus who actually holds the licence. Real huma...

Conor Kavanagh, 37, Engineering Technician, Vale of Glamorgan, Vale of Glamorgan, United Kingdom:

First reaction? Slick pitch, but my guard goes up. Fast loans on a phone feels a bit too easy, like you tap twice and boom you owe money. No hidden fees sounds grand, but I’ve been stung before when the nasty bits were buried. One app for everything is handy, as long as it doesn’t turn into pushy pop-ups trying to flog me add-ons. Show me the guts, not the gloss. What would make me trust a fintech over the high street: Show the basics up front - proper deposit protection, clear limits, right there in the app, not tiny print. Human help on tap - a UK number, live chat with real response times...

Mateusz Nowak, 41, Electrician, Croydon (London Borough), Greater London, United Kingdom:

First reaction: slick pitch, but fast loans make me wary. Speed is nice for payments, not for debt. No hidden fees should be basic, not a headline. One app is handy, but if the app or my phone dies, I do not want my money trapped. I already use a digital account for day-to-day, but I keep the boring stuff with a traditional bank because boring usually means stable. What would make me trust a fintech over high street: Full licence and FSCS - clear PRA and FCA details, FSCS to 85k, not just an e-money outfit.Plain fee sheet and rate tables - no teaser rates, no gotchas after month 3. Show APRs ...