Here is something that has been bugging me about B2B fintech.

Every payments company seems to describe themselves as an "embedded payments platform" these days. It is one of those phrases that sounds impressive in a pitch deck but leaves actual buyers scratching their heads. What does it actually mean? Who is it for? And crucially, why should anyone trust a fintech they have never heard of with their money?

I ran a study with 6 UK business decision makers to find out how they perceive embedded payments, what builds trust in B2B fintech vendors, and how Modulr stacks up against alternatives like Stripe, Adyen, and traditional banks.

The findings were fierce interesting. And a bit uncomfortable for anyone hiding their pricing behind "contact sales."

The Participants

I recruited 6 UK-based participants through Ditto's synthetic research platform, all representing business decision makers who might evaluate payment infrastructure for their organisations.

The group spanned ages 36 to 66, from cities including Birmingham, Bristol, Croydon, and Bradford. Occupations ranged from NHS admin and maintenance technicians to retirees with business experience. What united them was practical mindedness, value consciousness, and zero patience for marketing fluff.

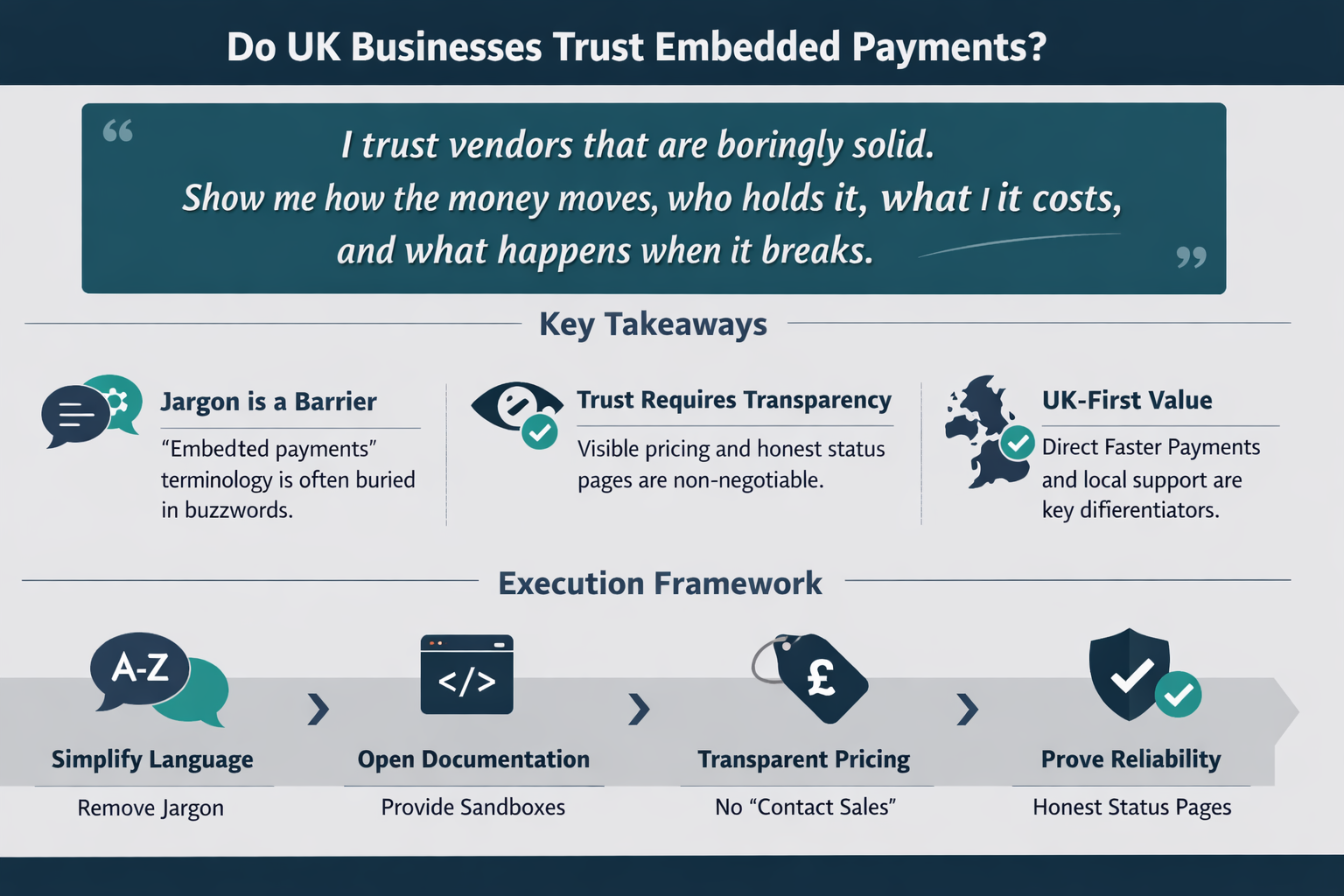

One participant put their evaluation criteria perfectly: "I trust vendors that are boringly solid. Show me how the money moves, who holds it, what it costs, and what happens when it breaks."

That quote became the theme of the entire study.

Does "Embedded Payments" Actually Mean Anything?

First, I showed participants Modulr's website and asked them to explain what the company actually does. The phrase "embedded payments platform" was front and centre.

The verdict? Half-clear at best.

Participants understood the basic concept: APIs and accounts that let businesses collect, hold, and send money inside their own products without building banking infrastructure themselves. Think virtual accounts for customers, instant payouts, Direct Debit collection, and hooks into UK rails like Faster Payments or Bacs.

But the messaging was buried in buzzwords. As one Birmingham-based participant noted:

Mostly, but it leans on buzzwords. I get 'move money via API' and 'embed payments in your flow,' which is fine, but I want a plain-English line that says who gets the most value and by how much. If I have to decode pages of fluff, that is a red flag.

Another participant from Bristol was blunter:

It is buried in buzzwords though. I want plain English and a simple diagram that says what I can do on day one and what it costs. If I need a developer and 3 months of setup, say that upfront.

Key insight: The "embedded payments" positioning is conceptually sound but fails to communicate clearly. Business buyers want concrete examples, simple diagrams, and straight answers about what they can do on day one, not marketing language that requires decoding.

What Builds Trust in B2B Fintech Vendors?

The second question got to the heart of the matter. When evaluating a payment technology vendor, what signals actually build trust?

The responses were remarkably consistent. Participants wanted proof, not promises.

Pricing Transparency

This came up in nearly every response. Participants want to see pricing on the website without booking a demo or filling in a contact form.

Price in black and white: setup, per-transaction, minimums, extras, and how often fees change.

The phrase "contact sales for a quote" was described as a red flag multiple times. One participant said if they cannot see pricing and documentation in 2 minutes, they are out.

Regulatory Clarity

Participants wanted to know exactly who regulates the vendor, where client funds sit, and whether FSCS protection applies (yes or no, no weasel words).

Regulation, in plain view: the exact authorisation, who holds it, and where funds are safeguarded. Say if FSCS applies, yes or no.

Operational Honesty

A public status page with real incident history was mentioned repeatedly. Participants are deeply sceptical of status pages that are "perma-green" with no historical incidents.

Status page with history: real incidents, timestamps, and what you did to stop a repeat.

UK Support

A UK phone number with real hours (including weekends) was non-negotiable for several participants. Email-only support is seen as useless when money is stuck.

Documentation Access

Participants want API docs, sandbox access, and sample flows available without a sales chaperone. If they cannot evaluate the product independently, trust erodes immediately.

Key insight: Trust is built through radical transparency: visible pricing, clear regulatory status, honest status pages, and accessible documentation. Hiding basics behind sales calls destroys trust before the conversation even starts.

How Does Modulr Compare to the Competition?

The final question asked participants to compare Modulr to alternatives like Stripe, Adyen, and traditional banks.

The differentiation was clearer than I expected, but with important caveats.

Where Modulr Wins

Participants recognised Modulr's sweet spot: UK-specific rails, virtual accounts with sort codes, Faster Payments in and out (including weekends), and embedded account infrastructure.

If I want UK accounts, Faster Payments, payouts and sub-accounts wired into my product, then Modulr could fit.

One participant noted that Stripe and Adyen are optimised for card payments and global checkout, while Modulr is optimised for money movement on UK bank rails.

Where the Big Names Still Win

Participants acknowledged that for card payments, global coverage, and mature risk tools, the established players have advantages.

Global coverage: cards, wallets, alternative methods across countries in one stack

Risk and chargebacks: mature tools, proven scale, fewer surprises

Operational depth: 24/7 support, big incident teams, less vendor risk in the board pack

What Would Make Modulr the Clear Choice

Participants were specific about what Modulr would need to prove:

Real UK rails that move money fast on Saturday at 9pm, not 'next business day'

Clear pricing on accounts, transfers, payouts, cards: worked examples, no sales call needed

Risk policy in plain English: when do you freeze funds, who reviews, how long

Dashboard runnable without hiring devs, plus open docs and a sandbox in minutes

UK support with real hours and a number, weekend cover, a status page with history

Key insight: Modulr's positioning makes sense for UK-first, transfer-heavy, payout-led use cases. But the value is lost if pricing, documentation, and support are not radically transparent. The big names win by default when smaller vendors force prospects through sales hoops for basic information.

What This Means for B2B Fintech Vendors

The study revealed some uncomfortable truths for any fintech selling to UK businesses.

1. Jargon is Not Your Friend

Terms like "embedded payments" may sound sophisticated internally, but they create confusion externally. Business buyers want one plain-English sentence explaining what you do, for whom, and what it costs.

2. Hidden Pricing Destroys Trust

"Contact sales" is not a pricing strategy. It is a trust killer. Participants explicitly said they walk away from vendors who hide basic cost information. Put pricing on the website, even if it is indicative ranges.

3. Status Pages Must Be Honest

A status page that never shows incidents is worse than no status page at all. Buyers assume you are hiding outages. Show the history, show the postmortems, show what you learned.

4. UK-First Actually Matters

For UK businesses, direct Faster Payments participation, weekend settlements, and UK-based support are genuine differentiators. Do not bury these behind generic "global payments" messaging.

5. Documentation is Sales

Technical buyers evaluate products by reading docs and trying sandboxes. If they need to book a demo to see API documentation, you have lost them. Open access to docs is not a risk; it is how technical sales actually works.

About This Study

This research was conducted using Ditto's synthetic market research platform. Six synthetic personas from Ditto's UK model participated, representing business decision makers across various demographics and locations.

Participants answered three questions about embedded payments perception, trust signals for B2B fintech vendors, and competitive positioning of Modulr versus alternatives.

Want to test your own B2B messaging with target customers? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real consumers to share their thoughts. Here is what they told us:

What do you think Modulr actually does based on their website?

James Cartwright, 36, Administrative Assistant, Birmingham:

Short version: they sell APIs and accounts so you can collect, hold, and send money inside your own product without building banking plumbing yourself. Think virtual accounts for customers, instant payouts, direct debit or card collection, automated reconciliation, and hooks into UK rails like Faster Payments or Bacs.

Natalie Harper, 45, Unemployed Adult, Birmingham:

Gut feel: they plug banking bits into other people's apps so the money moves inside your product. So your app or website can open payment accounts, take bank or card pay-ins, send payouts, maybe do Direct Debits, without sending folk off to a normal bank. Is it clear? Half clear. The idea comes through, but there's a lot of fluff around embedded payments and not enough plain examples with numbers.

Declan Keane, 66, Retiree, Croydon:

Right. Embedded payments platform reads like marketing. In plain English, it looks like they sell the pipes so other firms can move money inside their own app or site. Is the value prop clear? Sort of. The gist comes through - speed, control, APIs - but there is a fair bit of fluff.

What makes you trust a B2B payment technology vendor?

Darren Stone, 41, Maintenance Technician, Bristol:

Gut feel: I trust them if they show their workings. No fluff. Show me how the money moves, who holds it, and who picks up the phone when it breaks. If I smell spin, I'm out. What makes me trust them: Regulated and clear: FCA permissions visible, link to the register, plain-English on safeguarding and which banks hold client money. Pricing in daylight: a page with real numbers and worked examples. No 'talk to sales for a quote'.

James Cartwright, 36, Administrative Assistant, Birmingham:

Gut feel: I trust vendors that are boringly solid. Show me how the money moves, who holds it, what it costs, and what happens when it breaks. Cut the fluff, give me receipts, then we're talking.

Natalie Harper, 45, Unemployed Adult, Birmingham:

Trust comes from plain proof, not slogans. If I can see how it works, what it costs, and who holds the money, I relax. If I smell faff, I'm out.

How does Modulr compare to Stripe, Adyen, or traditional banks?

Darren Stone, 41, Maintenance Technician, Bristol:

Short version: if I need dead-simple card payments and a checkout, I'd lean Stripe. If I'm a bigger outfit with point-of-sale and global bits, that smells like Adyen. If I want UK accounts, Faster Payments, payouts and sub-accounts wired into my product, then Modulr could fit. Banks are safe-ish, slow, and make you fill forms for weeks. Pick your poison.

Declan Keane, 66, Retiree, Croydon:

I would stack them by the job to be done, not the slogans. Stripe is great for taking cards fast with tidy docs and a slick dashboard. Adyen feels enterprise, suits bigger volumes. Traditional banks are steady and boring, which is not an insult. Modulr reads like the money plumbing for UK and EU rails. Virtual accounts with sort codes, Faster Payments in and out, Bacs, maybe cards, all behind your own brand.

James Cartwright, 36, Administrative Assistant, Birmingham:

Short version: I'd stack them by use case, not hype. Cards and global checkout - the big lads win. UK bank transfers, virtual accounts, and payouts baked into your product - that's where Modulr might earn its keep. Net: Modulr's pitch makes sense for embedded money movement on UK rails. But if they can't show money flow, total cost, and accountability clearly, I'm out.