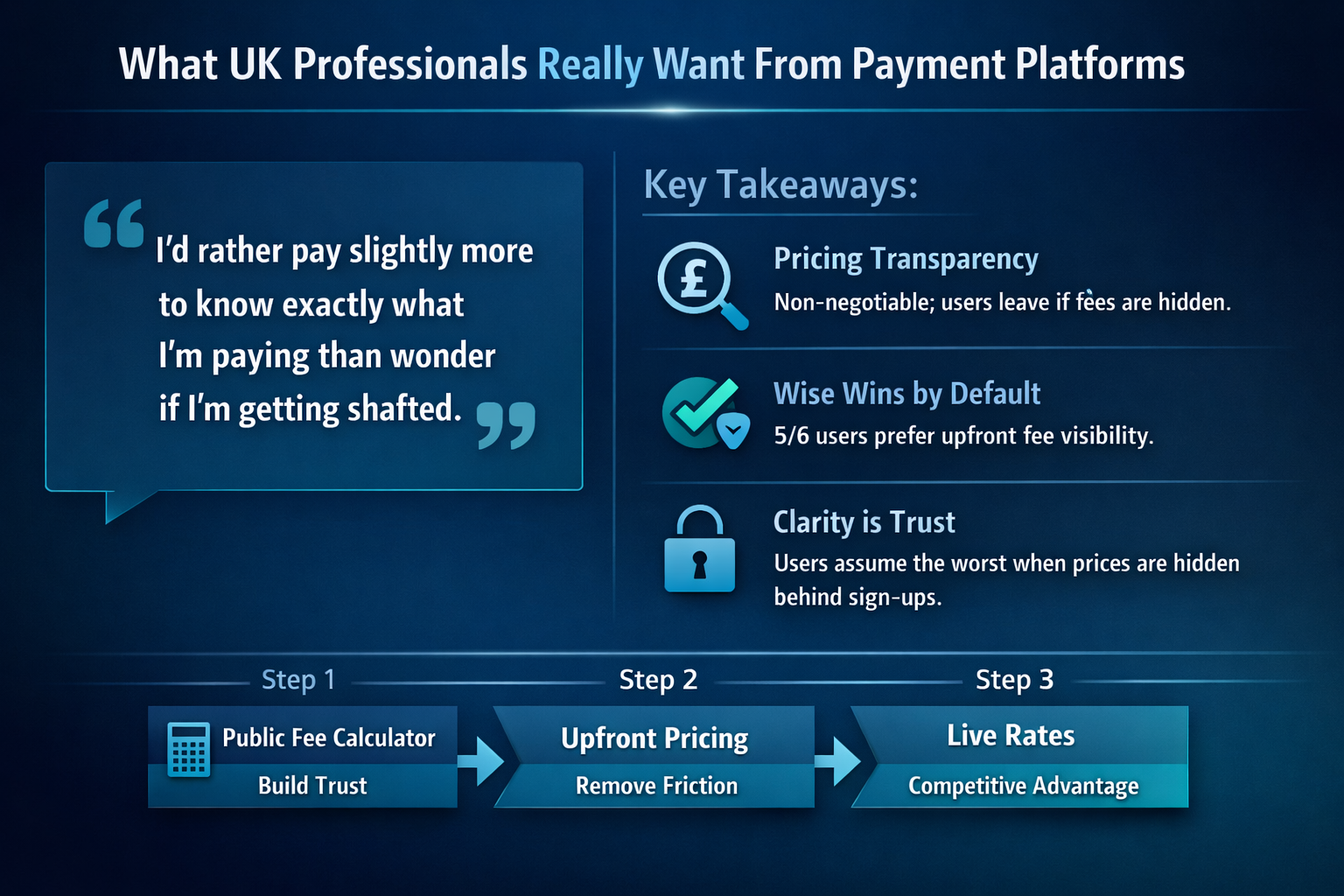

Right, so. I asked 6 UK business professionals about payment platforms and 5 of them said they'd pick Wise over Payoneer by default. Not because Wise is better at everything. Because they can see the fees before signing up. That's it. That's the whole thing.

The Study Setup

We recruited 6 UK professionals who regularly receive international payments. Ages 30-54, from London to Liverpool, including a volunteer coordinator, speech therapist, electrician, and admin staff. Real people with real money concerns. We asked them about what they look for in payment platforms, what builds trust, and how they'd choose between Payoneer and Wise.

What We Found

Three findings stood out:

1. Pricing Transparency Is Non-Negotiable

This came up in literally every response. If users have to create an account to see fees, they close the tab. One respondent put it perfectly: "If I have to create an account to see fees, jog on." Another said: "Show me the fees up front or I'm out."

The sentiment was unanimous. Fee transparency isn't a nice-to-have. It's table stakes. And Payoneer's approach of requiring sign-up to see full pricing is actively driving users away.

2. Wise Wins By Default

When asked to choose between the two platforms, 5 of 6 participants said they'd go with Wise unless forced otherwise. The reason? Wise shows the total cost upfront, no login required.

I'd pick Wise by default for receiving, because the fees are upfront and I can sanity-check the FX before I even think about sign-up.

One respondent summed it up as "Wise unless forced". That's brutal for Payoneer. Users aren't saying Wise is better. They're saying Wise is more honest. And honesty wins.

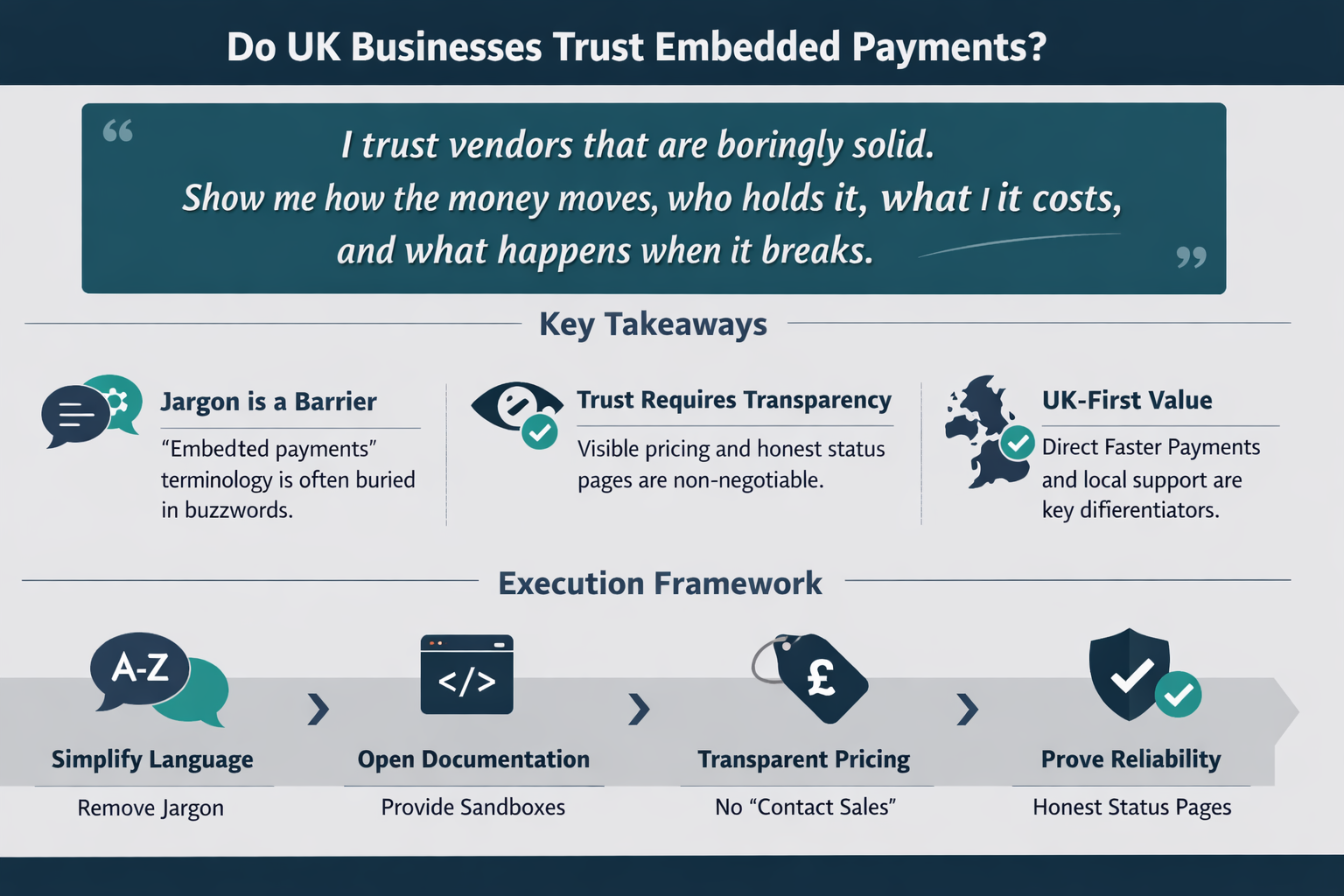

3. The Landing Page Value Prop Is 'Half-Clear'

Respondents understood that Payoneer is a cross-border payments platform. But when pushed, they said the value proposition was "half-clear" - they knew what it did broadly, but had to dig for critical details like fees, speed limits, and withdrawal timelines.

One user said: "I'm not about to create an account just to find out what it costs." That's a conversion killer right there. Users who need to dig for information often don't bother - they just leave.

The Quote That's Living Rent-Free In My Head

I'd rather pay slightly more to know exactly what I'm paying than wonder if I'm getting shafted.

I mean. COME ON. That's the whole thing in one sentence. Users will literally pay more for transparency. They don't want the cheapest option. They want the most honest one.

What This Means For Product Teams

If you're building a payment platform (or any fintech product), here's what this study tells you:

Fee transparency is a competitive advantage, not just a nice-to-have

Requiring sign-up to see pricing actively drives users to competitors

Users don't trust 'from X%' or 'as low as' language - they assume the worst

Clear, upfront pricing beats lower prices hidden behind account creation

A public fee calculator with live rates builds more trust than testimonials

About This Study

This study was conducted using Ditto's synthetic research platform, surveying 6 AI personas grounded in real UK demographic data. The personas represent business professionals aged 30-54 who regularly handle international payments. For more details on our methodology and the 95% correlation with traditional research methods, visit askditto.io.

Want to run a similar study for your product? We can help you understand what your users actually think about your pricing, landing page, or competitive positioning - in about 20 minutes. Drop us a line.