Synthetic Market Research 101

Synthetic market research is a rapidly growing field that makes it very easy for individuals to perform accurate market research, at scale, in minutes....

From Fortune 500 CEOs in the US to cattle farmers in Brazil to elderly GLP-1 patients in the UK - Ditto's panels of Synthetic Personas give you access to audiences traditional market research simply can't reach.

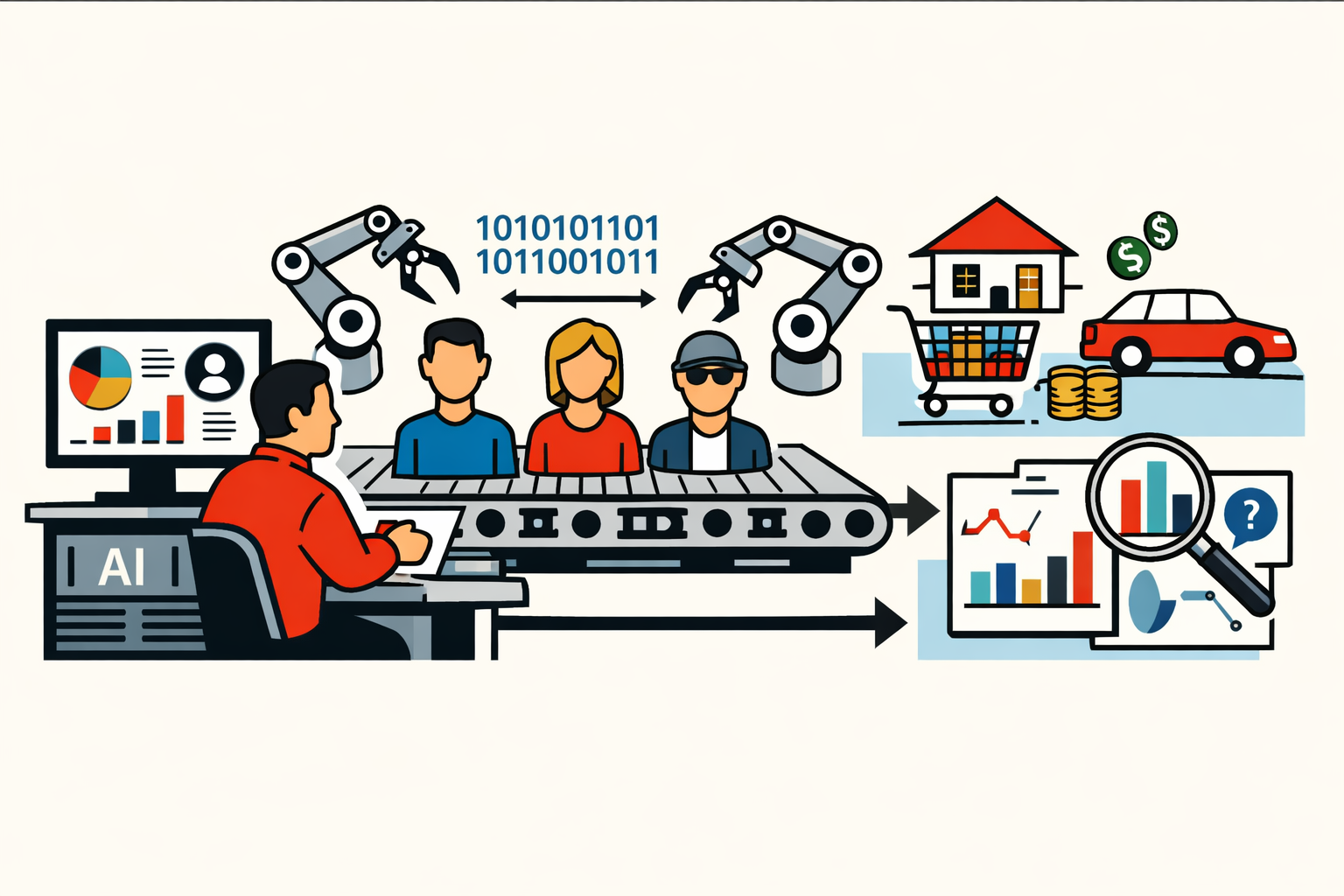

Synthetic Market Research allows you to perform market research in minutes with anyone. Complex AI "brain models" accurately recreate humans for market research.

The same person gives different answers on different days, and both are true. It depends on the news, their mood, what they read that morning, whether they're hungry or not. With traditional research, you only get one single narrow slice.

Synthetic personas capture that naturally messy behavior and give you the freedom to explore multiple realities.

Which means you can test how your concept performs when your customer is anxious vs. optimistic. When news is good vs. bad. When they're rushed vs. deliberate.

Traditional research asks "what do people want right now?"

We answer "when do they actually buy?"

A Synthetic Persona (DT) panel is a statistically grounded, context‑rich and exact simulation of the consumers or decision‑makers you care about.

We start with official statistics and market structure for statistically grounded baselines.

We add media, culture, price realities, and category behavior for realistic responses.

Test three price points across US Gen Z and UK Millennials, compare lift and sentiment in minutes.

Read more about synthetic personas, our methodology, and how our clients use our research.

Synthetic market research is a rapidly growing field that makes it very easy for individuals to perform accurate market research, at scale, in minutes....

Synthetic market research is a new way to answer an old question: ...

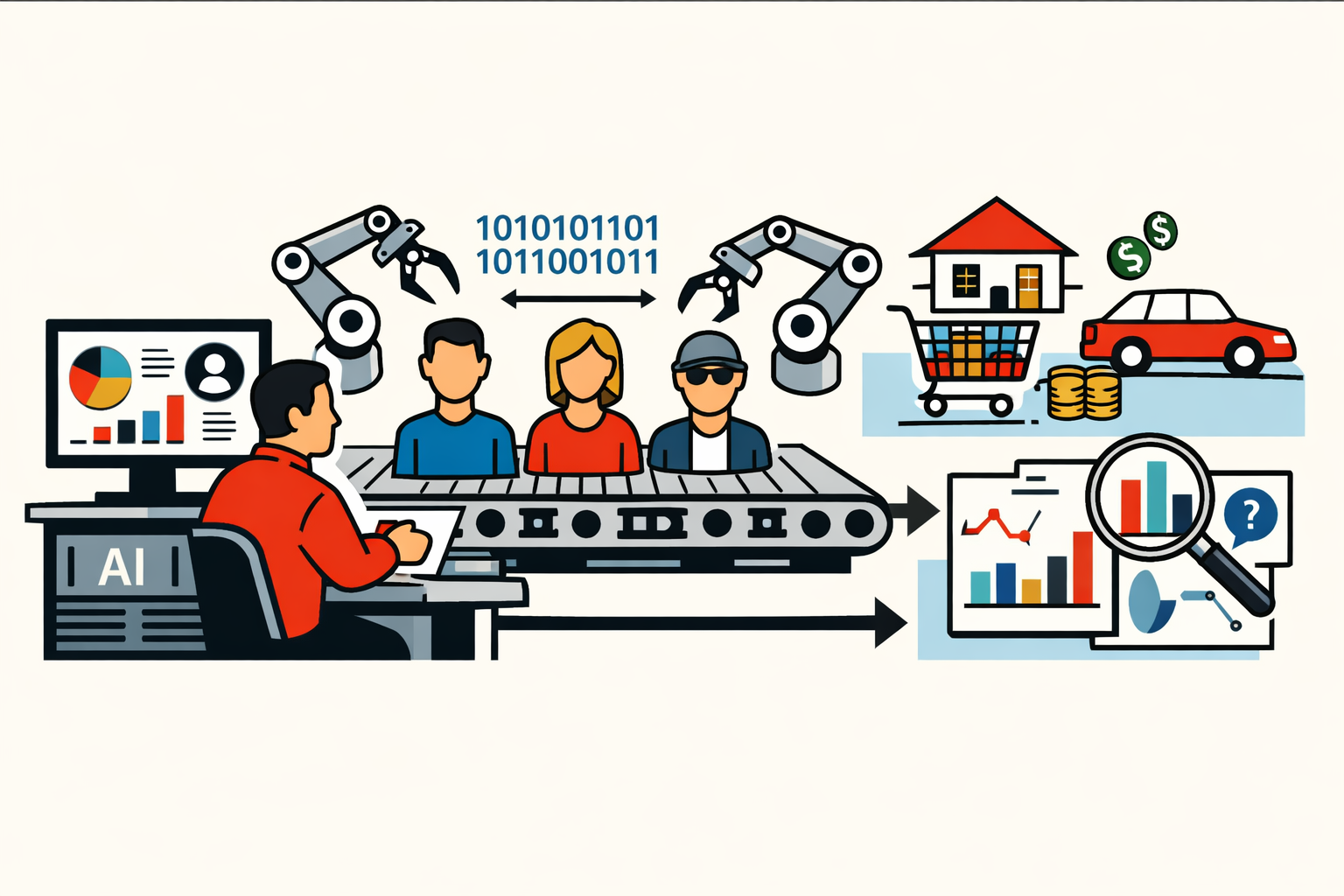

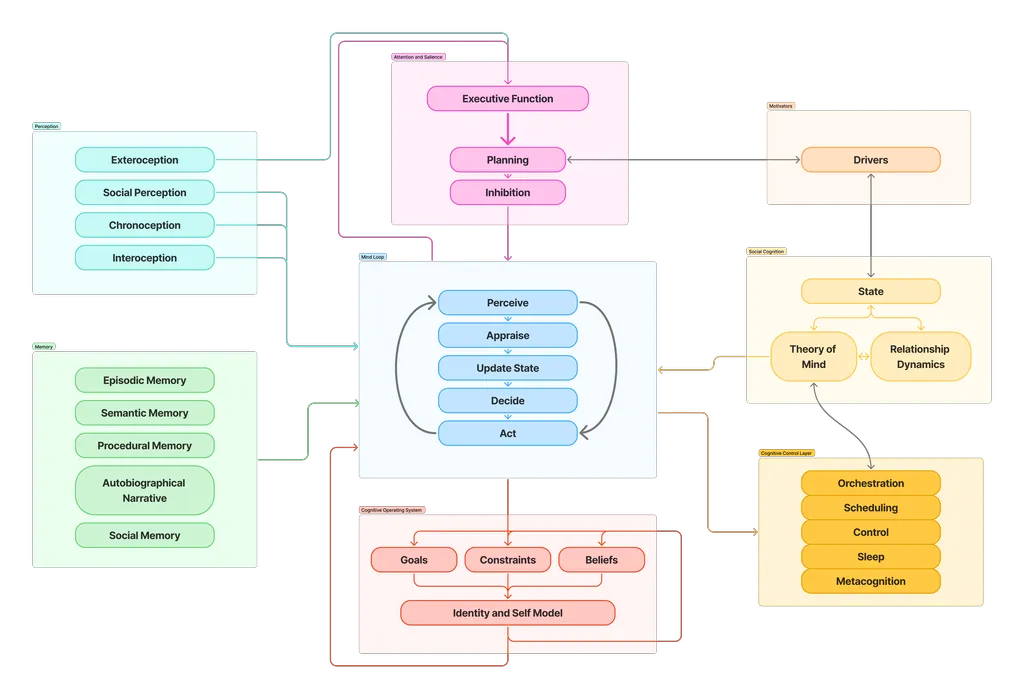

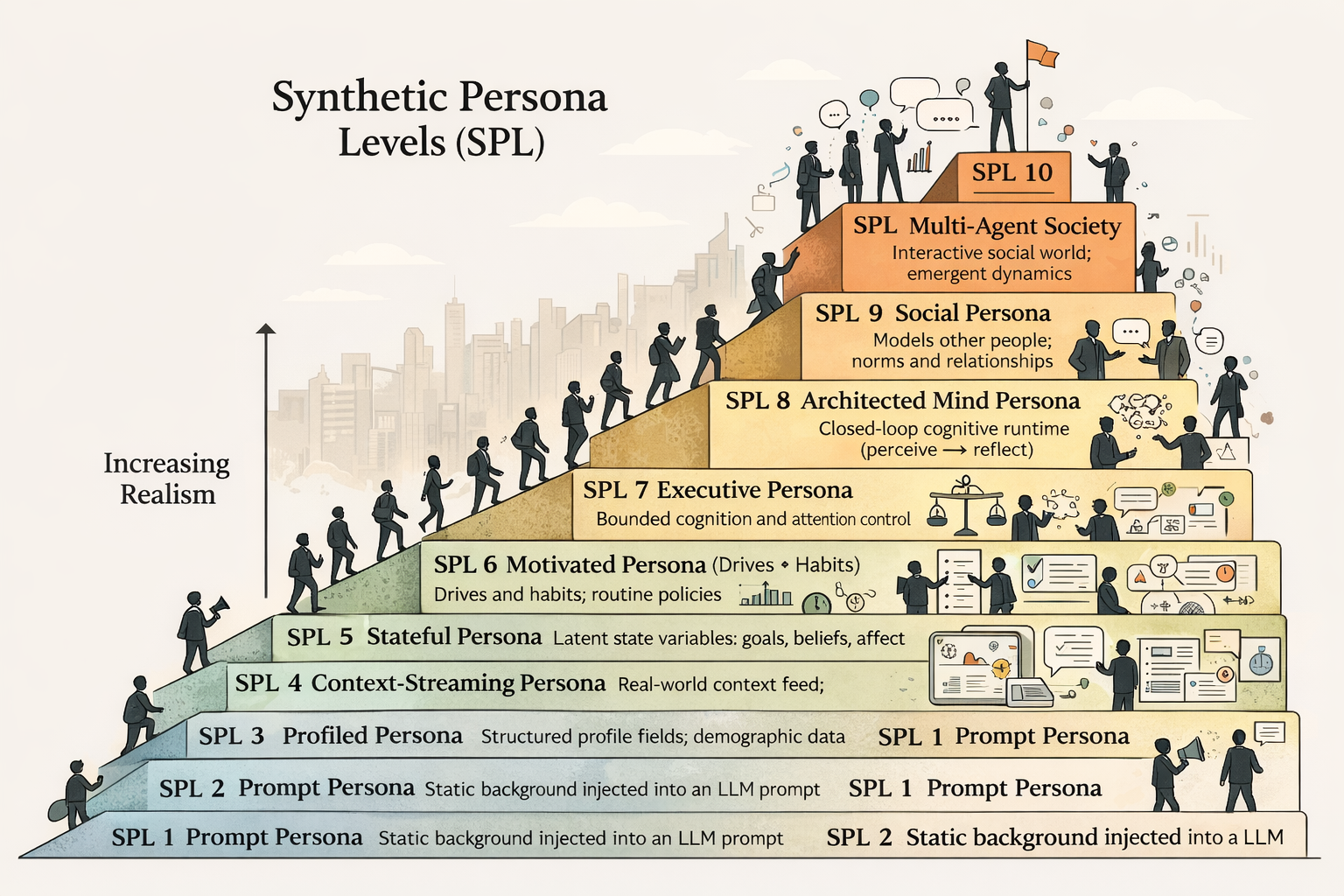

The technical blueprint for cognitively grounded synthetic personas...

Synthetic Persona Population available for research recruitment. Populations can interact in their native language to support local teams.

~65% of global GDP IMF/World Bank mix. More countries coming soon.

We program a dedicated environment powered by population-true synthetic personas specifically selected for your market, trained on category data, and calibrated to your business context.

This isn't outsourced research - it's your own always-on intelligence system.

Population-true synthetic personas, calibrated to your business

We don't rent you access to a generic panel. We build you a dedicated environment populated with synthetic personas that mirror your actual market demographics, psychographics, and behavioral patterns.

Each twin is trained on category-specific data, your brand context, competitive landscape, and market dynamics. This becomes your private intelligence asset - not a shared resource you're borrowing.

No middleman. No research brief translations. Just direct dialogue.

Your team gets direct access to your synthetic persona environment. Ask questions in plain English. Test concepts as they emerge. Run parallel scenarios across segments, regions, and price points.

Instead of waiting weeks for "research findings," you get immediate, contextual feedback that keeps pace with your business decisions. Your intelligence system is always on, always current, always yours.

Every interaction makes your system smarter about your business

Unlike traditional research that gives you static snapshots, your owned intelligence system learns from every query, test, and campaign you run. It builds institutional memory about what works for your brand, in your categories, with your customers.

Over time, you develop intelligence that no competitor can access or replicate - because it's trained specifically on your business context and success patterns.

Instead of relying on static data, the behaviour of our synthetic personas is affected by breaking news, from politics to weather to celebrity gossip.

Our model monitors hundreds of global news sources to ensure your synthetic personas are exposed to the same information environment that shapes real human decisions.

Months to recruit the right demographics across markets

Studies take weeks, insights arrive after decisions are made

Sample sizes too small for reliable cross-cultural patterns

Budget constraints limit global market exploration

Traditional panels miss hard-to-reach decision makers

Access any audience instantly: CEOs to consumers, any market

Test concepts in real-time, decisions move at market speed

Insights from millions of population-true synthetic personas

Explore any market globally without recruiting constraints

Model executives and niche audiences others can't reach

Our model stands on foundations developed by researchers from leading universities, including Harvard, Cambridge and Washington

Versioned bases (vYYYY.Q) with weights and visible drift tracking.

Out‑of‑sample prediction, test–retest stability, and prompt/wording sensitivity.

Where signals exist, we check correlation with market outcomes (e.g., preference shares, review sentiment) over time.

Debiased question wording, randomized variants, personality spread, and skeptic checks reduce conformity bias.

Lightweight human validation flow for regulated decisions or stakeholder assurance.

Informed by the digital‑twin concept and by peer‑reviewed research on MRP and LLM‑based human simulations.

Keep a live, evidence‑based ranking of ideas—even across countries.

Iterate headlines, claims, and RTBs as often as you need; see which segments move and why.

Model executives, decision-makers, and hard-to-reach audiences with realistic constraints and incentives.

Fresh insights on synthetic personas, market testing, and research innovation.

Like a lot of people I've flirted with alternative milks - it just sits better with me and feels less heavy than dairy. Oat milk also makes my coffee taste and foam nicer, which is honestly...

Every December, humanity splits into three camps around the question of "Is Die Hard a Christmas movie?": ...

A practical classification system for synthetic personas, from prompt-only profiles to interactive multi-agent societies....

Synthetic market research is full of confident-sounding phrases that are often used imprecisely. Some are borrowed from engineering, others from statistics, and a few from marketing departme...

ChatGPT guesses the next word based on the word that came before it. Digital twins are built on facts—starting with census data, market structure, cultural context, media consumption patterns, and economic realities. We create statistically grounded simulations of real populations, not word predictions.

A Synthetic Persona Panel is a simulated audience that mirrors a real population. We combine official statistics with behavior, culture, media, and price context so the twins respond like real people—at speed and scale.

Traditional panels are slow, expensive, and episodic. Digital twins are always‑on, so teams can iterate daily, compare markets side‑by‑side, and make decisions in days—not weeks.

Concepts, messages, headlines, pack designs, RTBs/claims, naming options, creative variants, pricing/offer tests, and more. You can also bring segment definitions or customer data to condition the twins.

Most concept or message tests return results in minutes. Large multi‑market testbeds may take longer depending on scope.

Currently: USA, Canada, UK, France, Germany, Spain, Italy, Turkey, Poland, Japan, South Korea, India, Mexico, Brazil.

Yes. We build constrained twins (e.g., by role, industry, firmographics) and validate against any signals you can share (pipeline mix, win/loss, CRM cohorts). For ultra‑narrow groups, we emphasize repeatability and human bridge options.

We run generalization checks, test–retest stability, wording sensitivity analyses, and alignment to real‑world signals (e.g., sentiment, share movements). EY Americas found 95% correlation with traditional research.

Absolutely. For regulated or high‑stakes decisions, add our Human Bridge step: a small targeted human read to confirm directionality before you ship.

We minimize drift by constraining tasks, enforcing reasoning scaffolds, and scoring against rubrics. We show traceable rationales and segment‑level drivers so you can audit the "why," not just the score.

Clear scores and ranks, segment breakdowns, rationales/commentary, and a concise decision brief (what to keep, cut, change). Multi‑market runs include country comparisons.

Yes. We securely upload segment definitions, CRM cohorts, or past research summaries. We use them to condition twins or evaluate against your proprietary segments.

Legal compliance questions requiring jurisdiction‑specific legal advice, safety‑critical UX without human validation, ultra‑novel stimuli with no grounding context, or claims requiring lab measurement. For these, use our Human Bridge or traditional research.

We use your uploads to run your tests and improve your private workspace performance. We do not sell your data or use it to train public models. Full DPAs and NDAs available.

Contact us to discuss your specific research needs. We'll work with you to design a solution that fits your team's requirements and timeline.

Typically by workspace (users/markets) plus usage (volume of tests). Pilots are fixed‑fee. Enterprise packages include dedicated support and custom twin development.