The Segmentation Fallacy

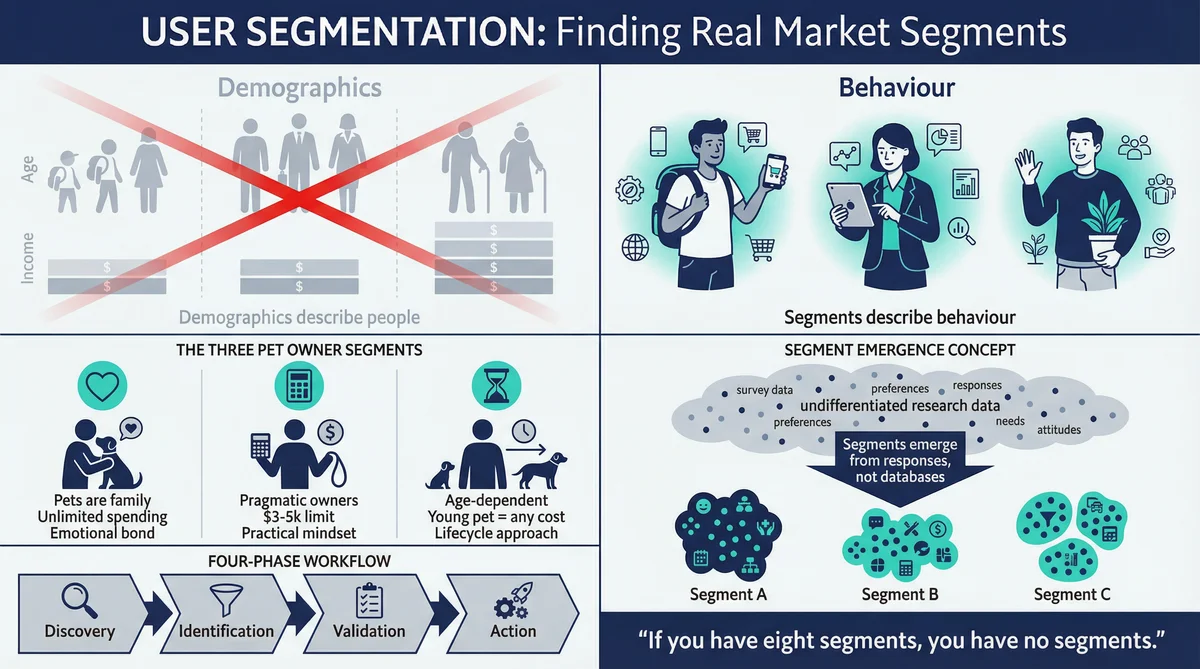

Most teams segment their market before they've spoken to it. They carve up potential users by demographics or firmographics, create neat personas with stock photos and invented names, then wonder why their product resonates with no one in particular.

This approach has it precisely backwards. Real segments don't come from spreadsheets. They emerge from research.

Discovery research gives you depth. You understand what the problem feels like. Segmentation gives you structure. You understand that different people experience the same problem in fundamentally different ways.

What Makes a Real Segment

A genuine market segment has three characteristics:

1. Distinct behaviour patterns: People in the segment act differently. They make different tradeoffs, use different workarounds, and have different thresholds for what's "good enough."

2. Distinct pain priorities: They experience the same problem but care about different aspects of it. One group might prioritise speed. Another might prioritise accuracy.

3. Distinct purchase triggers: What makes them buy is different. The crisis moment, the switching cost calculation, the trust requirements.

Notice what's missing: demographics. Age and income and location are proxies at best. Demographics describe people. Segments describe behaviour.

The best segments emerge from responses, not from pre-defined filters.

How to Run Segmentation Research in Ditto

Ditto makes segmentation research practical. Instead of weeks of interviews and analysis, you can identify meaningful segments in an afternoon. Here's the complete workflow.

Step 1: Create a Diverse Research Group

Segmentation requires diversity in your research group. If everyone you talk to is identical, you won't find segments.

In Ditto, create a research group with intentional variation. The key is casting a wide net. Don't pre-filter too aggressively. You want variation in income, life stage, and context. The segments will emerge from responses, not from your recruitment filters.

For segmentation studies, 12-15 personas is the sweet spot. Fewer than 10 makes patterns hard to detect. More than 20 creates analysis overhead without proportional insight.

Step 2: Design Segmentation-Focused Questions

Segmentation questions differ from discovery questions. You're specifically trying to surface behavioural differences and priority tradeoffs.

The segmentation question framework:

1. Baseline behaviour: "Walk me through how you currently handle [situation]."

2. Priority tradeoffs: "When you have to choose between [A] and [B], which matters more? Why?"

3. Spending thresholds: "At what point does cost become a deciding factor for you?"

4. Emotional relationship: "How would you describe your relationship with [domain]?"

5. Decision triggers: "What would make you immediately [take action]? What would make you hesitate?"

6. Past behaviour: "Tell me about a time when you had to make a difficult decision about [topic]."

7. Hypothetical choice: "If [scenario], what would you do? Walk me through your thinking."

These questions are designed to reveal HOW people think, not just WHAT they think. The "how" is where segments live.

Step 3: Create the Study and Add Questions

With your research group recruited, create the study via Ditto's API. Set a clear objective that mentions you're looking for behavioural segments. Then add your segmentation questions one by one.

Each question should invite detailed, narrative responses. Avoid yes/no formats. You want to see how people reason through decisions.

Step 4: Monitor and Collect Responses

Ditto personas respond asynchronously. Poll for completion by checking the study status. Watch for the "complete" stage to indicate all responses are in.

As responses arrive, look for natural clustering. Do some personas use similar language? Do they describe similar tradeoffs? Do they have similar emotional relationships with the topic?

Step 5: Trigger Completion Analysis

Once all responses are collected, trigger Ditto's AI analysis. This automatically identifies segments based on response patterns.

The completion analysis output includes:

Key segments: Distinct groups with different attributes and behaviours

Segment attributes: What characterises each segment (attitudes, not just demographics)

Supporting agents: Which personas belong to each segment

Divergences: Where segments disagreed with each other

Shared mindsets: Universal truths that apply across all segments

This automated segmentation gives you a starting point. The AI has identified clusters based on response patterns.

Step 6: Validate Segments with Follow-Up Research

Ditto's auto-segmentation is a hypothesis, not a conclusion. Validate with targeted follow-up.

Create segment-specific research groups with tighter filters. Run focused studies with segment-specific questions. This validation confirms whether the segment is real and surfaces its specific characteristics.

Using Claude Code to Orchestrate Segmentation

Claude Code can manage the entire segmentation workflow programmatically. Here's how the orchestration works.

The Complete Workflow

Tell Claude Code what you want to learn. Describe your target market, what you want to understand, and ask it to identify behavioural segments.

Claude Code then executes a four-phase workflow:

Phase 1: Discovery Study

Creates research group via Ditto API with diverse demographics. Designs segmentation-focused questions. Creates study and adds questions. Monitors for response completion. Triggers completion analysis.

Phase 2: Segment Identification

Parses Ditto's auto-segmentation output. Reviews individual responses for additional patterns. Names candidate segments with descriptive labels. Calculates segment size as percentage of research group. Documents distinguishing characteristics.

Phase 3: Segment Validation

Creates segment-specific research groups. Designs validation questions for each segment. Runs parallel validation studies. Compares responses to confirm distinctiveness. Refines segment definitions based on validation.

Phase 4: Output Generation

Produces structured segment analysis. Includes representative quotes from each segment. Documents universal truths (cross-segment findings). Articulates strategic implications for product and marketing.

Example Claude Code Output

After running the workflow, Claude Code produces a structured segment analysis including: segment name and size, key behaviour, pain priority, purchase trigger, messaging implication, and a representative quote.

It also documents universal truths that apply across all segments and strategic implications for product, marketing, and sales.

Case Study: Pet Healthcare Financing Platform

A startup building a pet healthcare financing platform ran segmentation research with 12 synthetic personas. They wanted to understand how pet owners approach expensive veterinary decisions.

What Ditto's Analysis Revealed

Three distinct segments emerged from responses:

Segment 1: "Pets Are Family"

These participants referred to pets as "children," "babies," and "family members." Their relationship with spending was essentially unlimited.

"Whatever it takes. She's been with me through everything. There's no number where I'd say no."

Attributes: Strong emotional language, resistant to cost discussions, interested in QUALITY signals not PRICE signals, would finance without hesitation.

Segment 2: "Pragmatic Owners"

These participants loved their pets but had thought carefully about limits.

"I've thought about this. My limit is probably $3,000-$5,000. Above that, I'd have to make a really hard decision."

Attributes: Clear spending ceiling ($3-5k), had already done mental math, wanted transparency, interested in financing to spread cost not increase it.

Segment 3: "Age-Dependent Deciders"

These participants made decisions primarily based on pet age and expected lifespan.

"For my 3-year-old, I'd do anything. But my 14-year-old... it depends on quality of life."

Attributes: Age was primary decision variable, younger pet = higher willingness to spend, same person showed BOTH patterns with different animals.

How This Shaped the Product

The startup realised they needed different messaging for different segments:

"Pets are family": Lead with quality, outcomes, emotional reassurance

"Pragmatic owners": Lead with transparency, no-surprises pricing, value

"Age-dependent": Lead with quality-of-life outcomes and expected recovery

One product. Three marketing approaches. The segmentation shaped everything from landing page copy to sales conversations.

Case Study: Children's Educational Gaming App

A startup building educational games for children ran segmentation research with parents about screen time attitudes.

The Segments That Emerged

Segment 1: "Guilt-Ridden Parents"

Screen time = shame. They felt constantly judged and conflicted.

"I know I shouldn't let them have so much screen time, but some days I just need the break."

Behaviour: Would pay premium for apps that reduce guilt (educational, limited-time features).

Segment 2: "Rule-Setters"

Had clear time limits but struggled with enforcement.

"30 minutes a day. That's the rule. Does it always happen? No."

Behaviour: Valued apps with built-in timers and parental controls.

Segment 3: "Quality-Seekers"

Didn't feel guilty about screen time IF content was worthwhile.

"Interactive, creative apps get a pass. Passive watching doesn't."

Behaviour: Would grant unlimited time for apps that met quality criteria.

Universal Truths Across Segments

Ditto's analysis also surfaced findings that applied to ALL segments:

"Educational" claims are table stakes but not trusted. Everyone says their app is educational.

Ad-free is non-negotiable. Ads in children's apps = instant delete.

Social features are feared. Anything involving other people is a red flag.

The startup learned they needed to address universal concerns while tailoring their pitch to segment-specific motivations.

Interpreting Ditto's Segmentation Outputs

When Ditto's completion analysis runs, it produces structured segment data. Here's how to read the signals.

Strong Segment Signals

Consistent within-segment language: Everyone in the segment uses similar phrases

Clear between-segment differences: Segments want fundamentally different things

Different emotional intensity: Some segments are much more invested than others

Different purchase thresholds: Willingness to pay varies predictably by segment

Different decision processes: Segments think through choices differently

Weak Segment Signals

Segments differ only demographically: Not useful if they behave identically

Within-segment inconsistency: People in the segment describe completely different experiences

Trivial differences: Segments exist but the differences don't affect product decisions

Forced clustering: You've named segments but responses don't actually cluster naturally

What to Do with Ambiguous Signals

If segments aren't emerging clearly, use Claude Code to recruit a more diverse group, add tradeoff questions, test a specific hypothesis, or accept that the market may be more homogeneous than expected.

Common Segmentation Mistakes

Mistake 1: Starting with Demographics

"Millennials vs Gen X" or "SMB vs Enterprise" are not segments. Real segments are defined by behaviour. Let segments emerge from Ditto's analysis.

Mistake 2: Too Many Segments

If you have eight segments, you have no segments. Practical product decisions require 2-4 actionable groups.

Mistake 3: Inventing Segments from Insufficient Data

Three personas said something similar. That's not a segment. Require at least 30-40% of your research group to exhibit a pattern.

Mistake 4: Ignoring Universal Truths

Sometimes the most valuable finding is what EVERYONE agrees on. Ditto surfaces these as "shared_mindsets" in the completion analysis.

Mistake 5: Segments That Don't Affect Decisions

If knowing the segment doesn't change what you build or how you market, the segmentation isn't useful.

What Good Segmentation Output Looks Like

At the end of segmentation research with Ditto and Claude Code, you should have:

Named segments with clear boundaries and descriptive labels

Behavioural definitions: What distinguishes each segment (not demographics)

Size estimates: Rough proportions based on your research

Pain priorities by segment: What each segment cares about most

Purchase triggers by segment: What would make each segment buy

Messaging implications: How to talk to each segment

Universal findings: What applies to everyone

Ditto study links: Shareable links to the underlying research

The Speed Advantage: Segmentation in Hours, Not Weeks

Traditional segmentation research takes weeks. You recruit participants, schedule interviews, conduct them one by one, transcribe, code, analyse.

With Ditto and Claude Code, you can run complete segmentation research in a single afternoon:

Recruit participants: 2 minutes (vs 1-2 weeks)

Design questions: 10 minutes (vs 2-3 days)

Collect responses: 30-60 minutes (vs 2-3 weeks)

Analyse and cluster: 5 minutes with AI (vs 1-2 weeks)

Validate segments: 1-2 hours (vs 2-3 weeks)

Total: 2-3 hours (vs 6-10 weeks)

This speed advantage isn't just about efficiency. It changes what's possible. You can test segment hypotheses. Run multiple variations. Iterate on your understanding. The fast feedback loop produces better segments than the slow one ever could.

Explore the Research

The case studies in this article demonstrate how segments emerge from synthetic research. Pet healthcare financing revealed three segments (emotional, pragmatic, age-dependent). Children's educational gaming revealed three parent segments plus universal truths.

These studies show segmentation as it actually happens. Not invented. Discovered.

Ready to discover the segments in your market? Learn more at askditto.io