"The whole thing felt like a stress test I didn't sign up for." That is Daniel, a 41-year-old Syracuse resident explaining his mortgage application experience. And in this cold, he had zero patience left.

I ran a study with 6 US homebuyers to understand the real frustrations with mortgage applications. The findings reveal that document chaos and communication breakdowns are destroying trust, while digital tools are solving the wrong problems.

The Participants

Our panel included 6 US homebuyers or refinancers aged 29-42, from New York, California, North Carolina, and Illinois. We had a security analyst, a caregiver, a pharmacist, a retail manager, an unemployed construction worker, and someone between jobs. All had recently applied for a mortgage or seriously considered buying, and all had war stories to share.

The Document Treadmill

When we asked about the most frustrating part of mortgage applications, one theme dominated: repetitive document requests.

Participants described being asked for the same documents multiple times, often with no explanation for why previous submissions were insufficient.

A Syracuse applicant vented: "Same pay stubs and statements uploaded to three portals, plus letters explaining tiny transfers. Add immigration proof and it felt like I was on trial."

An Illinois pharmacist shared her experience: "Getting asked for the same pay stubs and bank statements twice because they 'expired,' plus writing a Letter of Explanation for every tiny transfer. Yes, that 28.73 Venmo was for choir snacks. No, it is not a mystery windfall."

A rural New York caregiver added: "Every time I thought I'd sent the last document, they wanted one more. Letters explaining a $180 deposit from selling reclaimed boards, screenshots of a maple syrup sale. Felt like confessing my entire life."

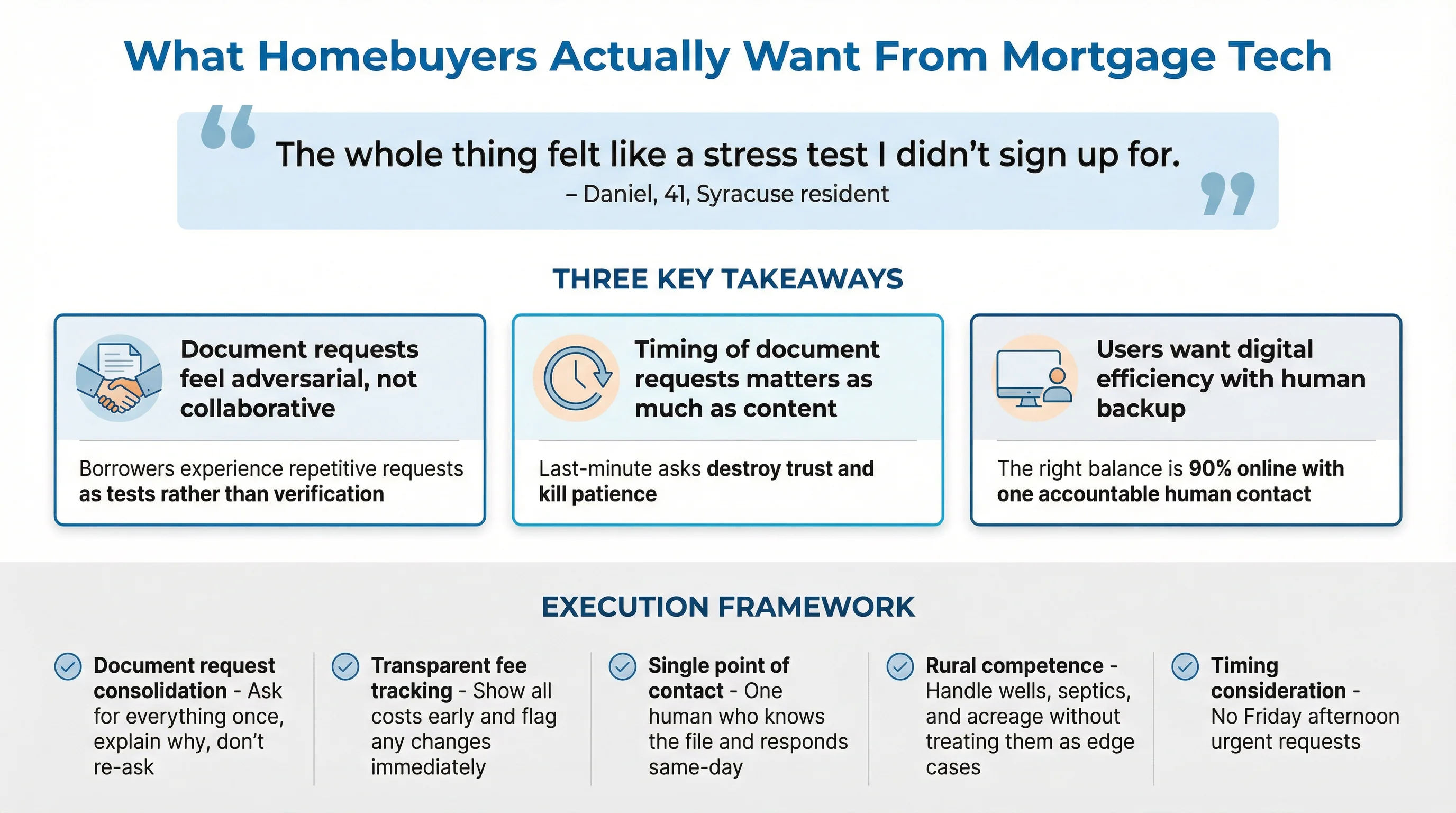

Key insight: Document requests feel adversarial, not collaborative. Borrowers experience them as tests rather than necessary verification.

The Friday 4:45 PM Problem

Multiple participants described a specific frustration: last-minute document requests that arrive at the worst possible times.

A Menifee, California applicant explained: "Quiet all week, then boom, urgent stuff when offices close. Killed my weekend and my patience."

A San Jose security analyst added: "8 PM emails for one more letter of explanation or an updated insurance quote. If it's that important, ask sooner."

Key insight: The timing of document requests matters as much as their content. Last-minute asks destroy trust.

Rural Property Complications

Participants from rural areas described additional complications that digital tools rarely address:

Appraisal challenges - Lack of comparable sales, long waits for appraisers to visit.

Property type confusion - Wells, septics, barns, and acreage that don't fit standard forms.

Internet reliability - Portals that time out on rural connections.

A rural New York caregiver described the appraisal process: "Waiting weeks for some guy to drive in from who-knows-where, then getting dings because the barn and acreage don't slot into their template. They acted like a functioning woodstove was a UFO."

Key insight: Digital mortgage tools are optimised for suburban properties. Rural applicants feel like edge cases that the system wasn't designed for.

What Would Build Trust

When we asked what would make participants trust a lender, four factors emerged in clear priority order:

1. Transparent fees - Show the full itemized costs early, in writing. No junk add-ons. If the number shifts at closing, trust evaporates.

2. Human support - One real contact who calls back, speaks plainly, and can handle complexity. Not a chatbot.

3. Clear communication - Simple emails with dates and next steps. Don't make me upload the same doc twice.

4. Speed - Nice, but only if the numbers stay the same. Fast and sloppy feels like a trap.

A Menifee applicant summarised: "Transparent fees, no contest. Show me every cost up front, line by line, and don't move the goalposts at closing or I'm out."

A Syracuse applicant added: "Don't assume I'm a citizen. Ask what docs I have, don't run my credit without saying it, and skip the hard sell."

The Digital vs Human Balance

When we asked about fully digital mortgage experiences, participants wanted a hybrid approach:

90% online - Uploads, e-sign, clear timeline, status tracking.

10% human - One real contact for complex questions and when things go wrong.

A rural Illinois pharmacist explained: "Pretty important. If a lender makes me drive to a branch or play phone tag for routine stuff, I'm out unless the rate is wildly better. But I still want a named person I can message for weird underwriting questions."

A Syracuse applicant added: "I want to do 90% online and have one real person I can text or email when stuff gets weird. I hate calls. Give me a paper trail."

Key insight: Users want digital efficiency with human backup, not one or the other. The right balance is mostly digital with one accountable human contact.

What This Means for Mortgage Tech

Based on this research, mortgage platforms that want to build trust should focus on:

Document request consolidation - Ask for everything once, explain why, don't re-ask.

Transparent fee tracking - Show all costs early and flag any changes immediately.

Single point of contact - One human who knows the file and responds same-day.

Rural competence - Handle wells, septics, and acreage without treating them as edge cases.

Timing consideration - No Friday afternoon urgent requests.

Conclusion

The mortgage application process is broken in ways that digital tools are not solving. Document chaos, last-minute requests, and fee surprises destroy trust regardless of how pretty the portal is.

What homebuyers want is surprisingly simple: transparent fees, one human who knows their file, clear communication, and a process that respects their time. They want digital efficiency, not digital abandonment.

As one participant put it: "Give me a clean, all-in sheet up front that doesn't sprout junk line items 48 hours before closing. That's all I'm looking for."

Want to understand how your customers really feel about your product? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

Selected Participant Responses

What was the most frustrating part of the mortgage process?

Daniel Rodriguez, 41, Syracuse NY: "Same pay stubs and statements uploaded to three portals, plus letters explaining tiny transfers. Add immigration proof and it felt like I was on trial. Days of silence, then three people email at once with different answers."

Joshua Stark, 40, Rural NY: "The appraisal circus. Out here, there aren't three neat comps within two miles. Waiting weeks for some guy to drive in, then getting dings because the barn and acreage don't slot into their template."

What would make you trust a bank or lender more?

Raymond Romero, 35, Menifee CA: "Transparent fees - Show every line item, points, cash to close, the real monthly with taxes and insurance. No junk add-ons hiding in the last PDF. If I catch one surprise fee, I'm out. It's like a bid on a job - if your numbers move, I don't trust your work."

Kourtney Shibuya, 29, Rural IL: "Transparent fees, then clear communication, then human support, then speed. If the Loan Estimate matches the Closing Disclosure down to the weird little line items, I relax. Spell out points, escrow, and every junky line so I can compare total cost."