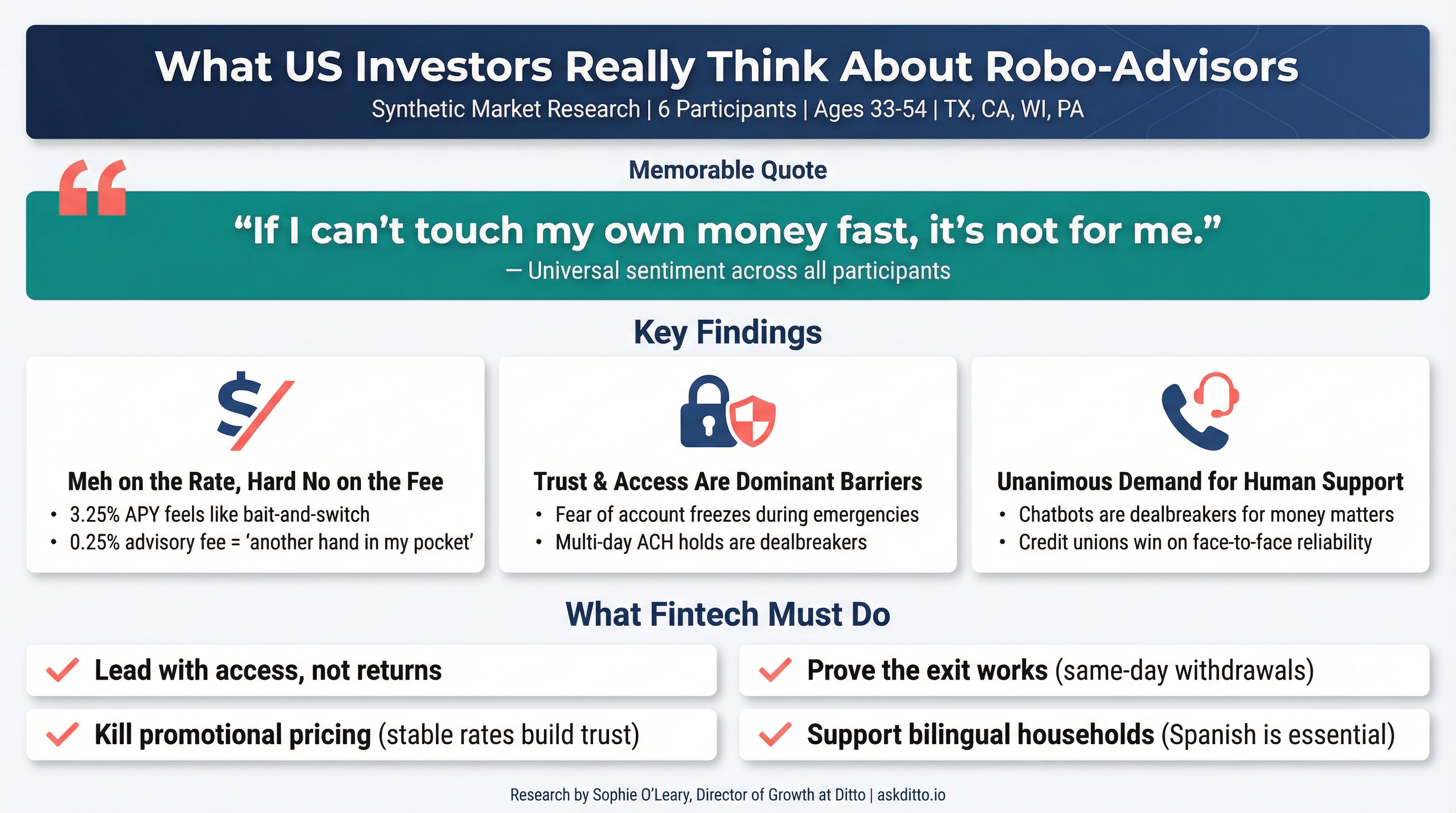

What US Investors Really Think About Robo-Advisors

Six Americans. Three questions about where they put their savings. One surprising consensus: ...

Read StudyTag: Fintech

Financial technology promises convenience but requires trust. These studies explore how consumers evaluate fintech products, overcome adoption barriers, and decide which financial tools deserve their data and money.

From mortgage tech expectations to all-in-one finance app scepticism, understand the specific trust factors and feature preferences that drive fintech adoption or abandonment.

What You'll Discover

Discover what drives fintech adoption and trust.

FAQ

What drives fintech adoption?

Key drivers include clear value proposition, perceived security, ease of use, and trust in the provider. Convenience alone rarely overcomes trust concerns in financial products.

Why do consumers distrust some fintech products?

Trust barriers include data security concerns, unclear business models, lack of regulatory familiarity, and the high stakes of financial mistakes. Established brand trust transfers slowly.

Do consumers want all-in-one financial apps?

Desire varies. Some value consolidation; others prefer specialised tools. The key is demonstrating competence in each function, not just aggregation convenience.

How can fintech companies build trust?

Trust builds through transparency about security, clear communication about fees and data use, regulatory compliance visibility, and demonstrated reliability over time.