"I don't like BNPL. It makes me buy more because small payments look easy." That is Nicole, a 41-year-old sales manager in Austin, explaining why she avoids buy now pay later services despite using them a few times.

I ran a study with 6 US shoppers to understand the real consumer sentiment around BNPL. The findings reveal deep skepticism, practical concerns, and a clear gap between BNPL marketing and user reality.

The Participants

Our panel included 6 US shoppers aged 35-44, from Texas, California, North Carolina, Nevada, and Indiana. We had a sales manager, an unemployed engineer, a healthcare administrator, a hospital finance manager, a manufacturing data analyst, and someone between jobs. All had considered BNPL services, and most had used them at least once.

The Overspending Trap

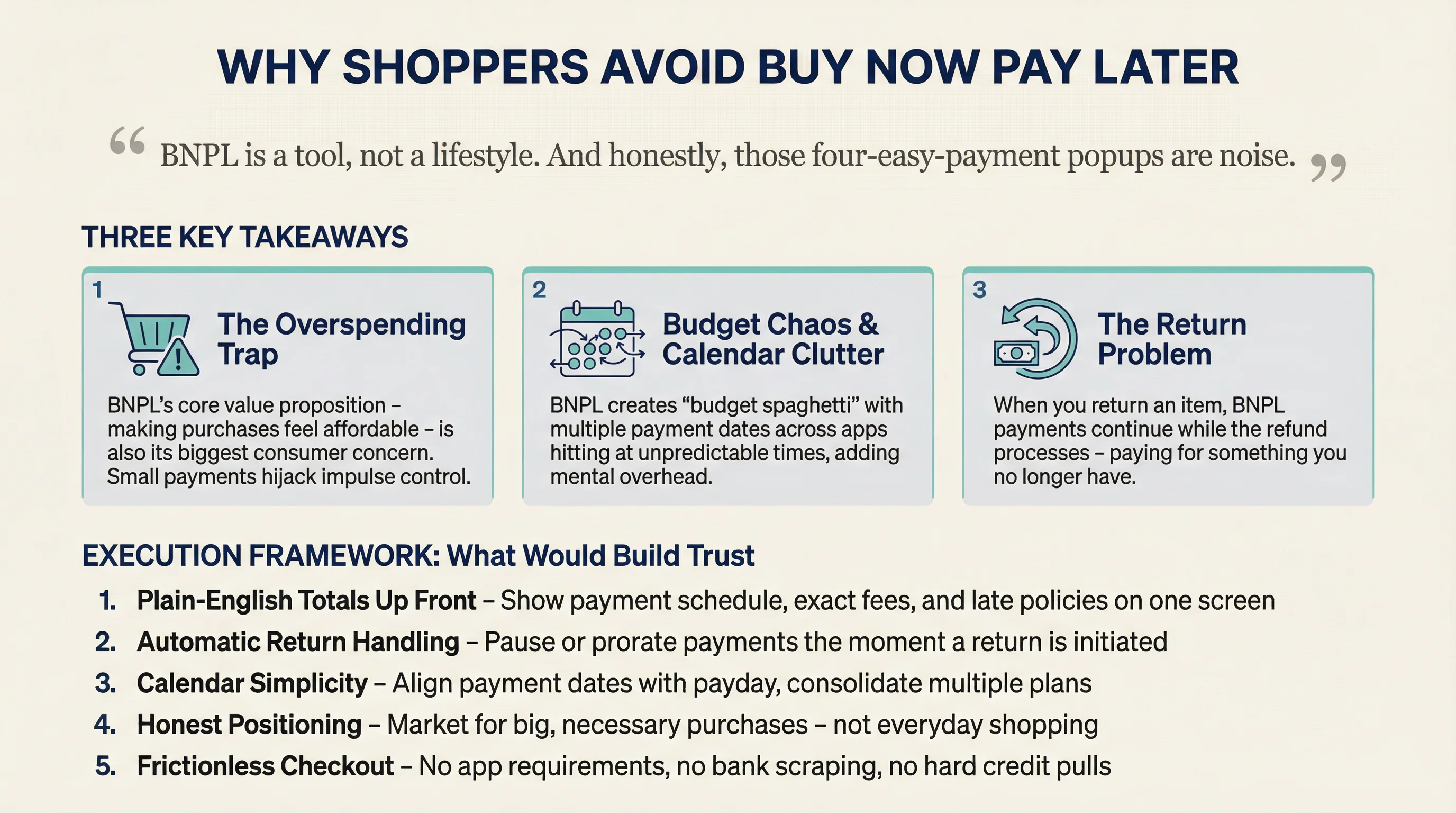

When we asked about concerns with BNPL, the top response was not hidden fees or credit impact. It was overspending.

Every participant mentioned some version of the same concern: small payments make purchases feel cheaper than they are.

A San Jose engineer explained: "The four-easy-payments thing hijacks impulse control. Stuff I'd normally wait for or buy used suddenly looks 'cheap.' It isn't."

A Warren, Michigan mom of three put it bluntly: "Those cute four payments make a $120 cart feel like $30, and my brain underestimates the total."

A Raleigh healthcare administrator added: "Breaking $200 into $50 chunks tricks the brain and the cart grows. At the end of the day it is still $200."

Key insight: BNPL's core value proposition - making purchases feel affordable - is also its biggest consumer concern. Users do not trust themselves with the format.

Budget Chaos and Calendar Clutter

The second major concern: budget complexity.

Participants described BNPL as creating "budget spaghetti" with multiple payment dates across multiple apps hitting at unpredictable times.

An Indianapolis hospital finance manager explained: "I don't want six little autopays hitting on random Tuesdays. I like one card bill, paid in full, same day every month."

A Nevada participant added: "Micro-debts hit on random days from three different apps. Daycare auto-draft, truck insurance, then a BNPL ding lands and the whole week's cash flow gets goofy."

Key insight: For budget-conscious users, BNPL adds mental overhead rather than reducing it. The simplicity of one credit card statement is a competitive advantage.

The Return Problem

Multiple participants flagged returns as a major pain point with BNPL.

The issue: when you return an item, BNPL payments continue while the refund processes. This creates a confusing period where you are paying for something you no longer have.

A San Jose engineer shared: "I tried BNPL once for a tool I ended up returning. Took three weeks to unwind and I kept getting 'friendly' reminders while waiting. Never again."

An Austin sales manager added: "One time I paid late and got a fee. I got mad. Now I only use it if it's zero fee and quick."

Key insight: BNPL refund processes are a significant friction point. Users expect automatic adjustment when they initiate a return.

When BNPL Actually Works

Despite the concerns, participants identified scenarios where BNPL makes sense:

Big, necessary purchases - Tires, appliances, emergency repairs.

True 0% with clear terms - No interest, no fees, fixed payment dates.

Timing alignment - Payment dates that match payday.

Cash flow preservation - Keeping emergency funds intact while spreading a planned expense.

A Warren mom explained her one exception: "Winter tires for our Ford Edge. I used Affirm at 0% for 6 months. It was December, daycare tuition and Christmas hit at the same time, and I refused to gut our emergency fund for a safety thing."

Key insight: BNPL is accepted for big, necessary, planned purchases - not for everyday shopping. The use case is narrower than BNPL marketing suggests.

What Would Build Trust

When we asked what would make participants choose one BNPL provider over another, the answers focused on simplicity and transparency:

Plain-English totals up front - Show the payment schedule, exact fees, and late policies on one screen.

Soft pull only - No credit impact for approval, no reporting unless default.

Automatic return handling - Pause or prorate payments the moment a return is initiated.

Autopay control - Choose your date, pay early without penalty, use your existing card.

No forced app - Web checkout that works without downloading another app.

An Indianapolis analyst summarised: "If the Loan Estimate matches the Closing Disclosure down to the weird little line items, I relax. Spell out points, escrow, and every junky line so I can compare total cost."

What This Means for BNPL Providers

Based on this research, BNPL providers that want to build genuine trust should focus on:

Overspending guardrails - Consider cart-level warnings or spending limits.

Calendar simplicity - Align payment dates with payday, consolidate multiple plans.

Automatic return handling - Pause payments immediately when returns are initiated.

Honest positioning - Market for big, necessary purchases, not everyday shopping.

Frictionless checkout - No app requirements, no bank scraping, no hard credit pulls.

Conclusion

US shoppers are not embracing BNPL as enthusiastically as adoption numbers might suggest. Most participants actively avoid it, using it only for specific, planned, necessary purchases when cash flow is tight.

The concerns are practical, not moral: overspending temptation, budget complexity, return hassles, and hidden fees. BNPL providers that address these concerns directly will build more sustainable customer relationships.

As one participant summarised: "BNPL is a tool, not a lifestyle. And honestly, those four-easy-payment popups are noise."

Want to understand how your customers really feel about your product? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

Selected Participant Responses

What concerns do you have about using BNPL services?

Eric Perez, 35, San Jose CA: "I don't like BNPL. The four-easy-payments thing hijacks impulse control. Stuff I'd normally wait for or buy used suddenly looks 'cheap.' It isn't. Budget fragmentation, refund purgatory, late-fee roulette. I hate turning a simple purchase into a mini calendar job."

Catherine Kelly, 39, Warren MI: "Those cute four payments make a $120 cart feel like $30, and my brain underestimates the total. I already juggle daycare drafts, tithing, 529 transfers, and the gas bill. Layering three different BNPL schedules? That is how you wake up to five tiny autopays you forgot about."

What would make you choose one BNPL provider over another?

Tara Klemens, 44, Raleigh NC: "I'll pick the one that's boring, clear, and stays out of my business. Plain terms up front - show me 4 payments of $X, date stamps, 0% stated clearly, and any fees in big print. No gotchas. No late-fee games."

Robin Mccracken, 42, Indianapolis IN: "I pick the one that makes the math obvious and does not try to snoop on my bank. App sparkle means nothing if the terms are fuzzy. Brand matters only when something goes wrong and I need a human who answers email."