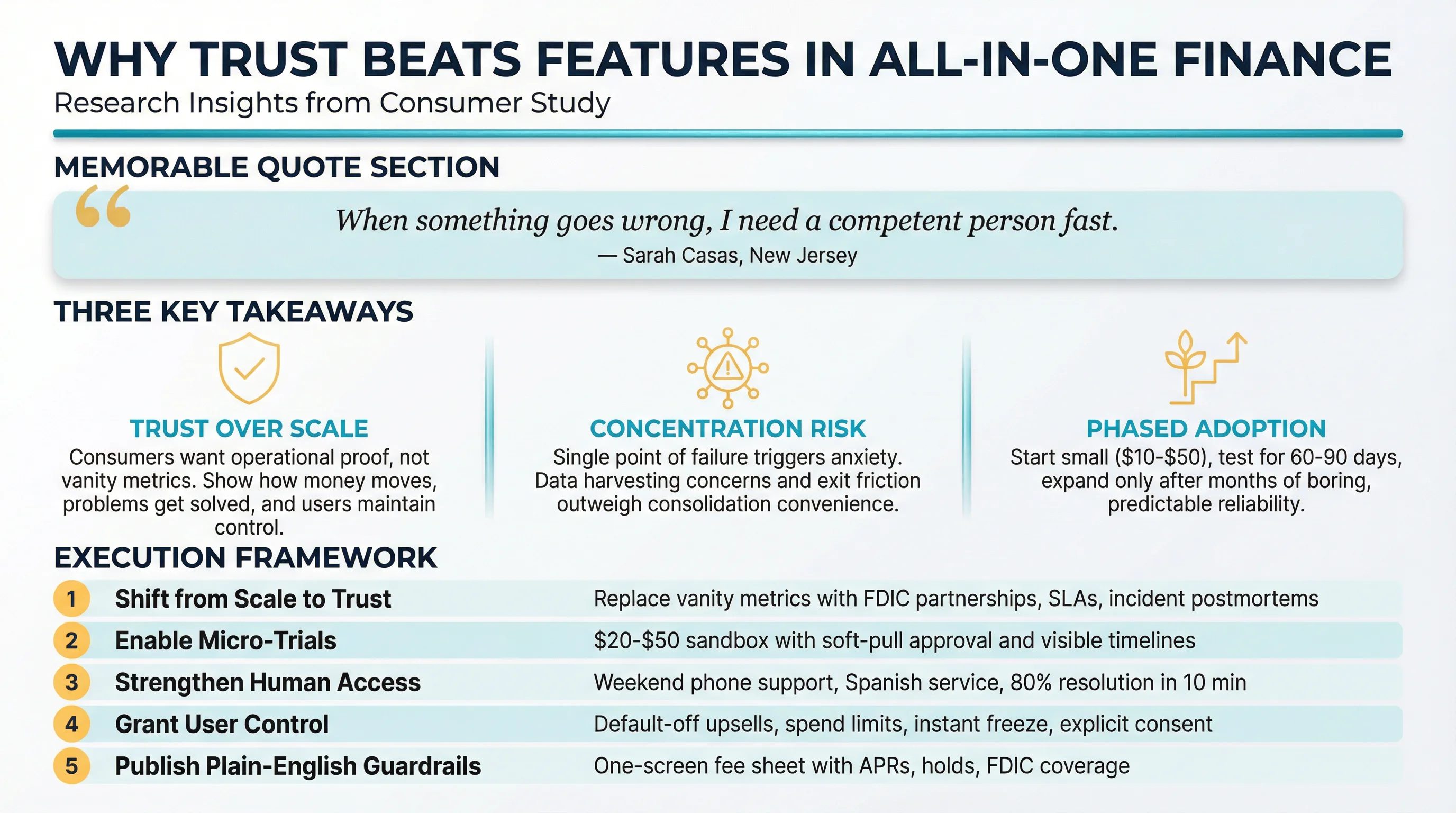

Trust, not features, is the gate to adoption. That was the unanimous verdict when I ran a study with six American consumers to test their reactions to Upgrade's all-in-one personal finance positioning.

The fintech promises one login, one app, combining loans, cards, and banking. On paper, it sounds convenient. In practice, consumers see it as a single point of failure and a data-harvesting machine.

The Participants

Six participants from across the United States: a credit analyst in Paterson, a project manager in Elizabeth, a former rideshare driver in Houston, an auto technician in Vallejo, a hospital experience manager in Houston, and a sales rep in Fort Worth. Ages ranged from 25 to 51, incomes from $4,600 to $172,000. What united them? They all manage money carefully and have finely tuned detectors for marketing claims versus operational reality.

Does 'All-in-One' Build Trust?

I asked participants how they feel about consolidating loans, credit cards, and banking with a single platform. The response was cautious at best.

The perceived benefits were real: one dashboard, unified transfers, cash back landing directly into checking. Mason Hester from Fort Worth captured the appeal: "One login, one app... cash back lands right into checking."

But the concerns outweighed the convenience:

Single point of failure - if the platform has an outage, it affects spending, bills, and income simultaneously

Data harvesting - participants worried about cross-selling with better aim. Brian Gabriel called it a "data-harvesting machine... upsell with better aim"

Hidden costs - teaser rates, opaque fee structures, unclear holds on transfers

Weak support - inadequate dispute resolution and slow human escalation

Exit friction - difficulty closing accounts or exporting data

Key insight: Consolidation convenience is real, but it triggers concentration risk anxiety. Consumers fear being locked into a system they cannot escape when things go wrong.

Do Scale Metrics Build Confidence?

I tested whether Upgrade's scale claims (7M customers, $40B in credit) would reassure potential users. The answer was a resounding no.

Esperanza Mayfield from Houston dismissed it as "chest beating, not safety." Scale metrics were treated as vanity statistics rather than trust signals.

What would actually build confidence?

Explicit FDIC coverage with named partner banks

Plain-English fee disclosures in a one-screen summary

Published SLAs for holds, transfers, and dispute resolution

Incident postmortems within 72 hours when things go wrong

Fast human support with weekend hours and Spanish language service

Granular security controls including per-merchant spend limits and instant card freeze

Key insight: Big numbers backfire. Consumers want operational proof, not vanity metrics. Show them how money moves, how problems get solved, and how they maintain control.

The Phased Adoption Model

Every participant described the same trial strategy: start small, wait, then expand only after months of boring, reliable performance.

The pattern was remarkably consistent across income levels:

Test with a small balance ($10-$50) or a single use case like a savings bucket

Run one recurring bill through it for 60-90 days

Expand only after months of "boringly reliable" performance

Forced bundling and credit pulls on core accounts were dealbreakers. Participants wanted the freedom to test one product without committing to the ecosystem.

Key insight: Trust is earned through boring predictability, not flashy onboarding. Micro-trials with soft-pull approval are the path to adoption.

Segment-Specific Barriers

Different consumer segments had distinct concerns:

Low-income users worried about expensive withdrawals, data-heavy apps, and unclear hold timelines. They need low-fee cash rails and local ATM access.

Mid-to-high income household heads wanted FDIC clarity, predictable transfer timing, and easy exit. Forced bundling and surprise freezes were their dealbreakers.

Tech-savvy professionals demanded status pages, SOC 2 audits, and published SLAs. Marketing scale claims triggered scepticism, not trust.

Spanish-speaking younger workers needed fast multilingual support and simple opt-outs for marketing offers.

Key insight: One-size-fits-all onboarding fails. Each segment has distinct gates that must be cleared before trust is earned.

What This Means for Fintech Platforms

If you are positioning an all-in-one financial platform, here is what actually earns adoption:

Shift from scale to trust. Replace "7M customers" with published FDIC partnerships, ACH/hold SLAs, and incident postmortems within 72 hours.

Enable micro-trials. Offer a $20-$50 sandbox account with soft-pull approval, visible hold timelines, and scripted test scenarios.

Strengthen human access. Phone support with weekend hours and Spanish service. Target 80% first-contact resolution within 10 minutes.

Grant user control. Default-off upsell toggles, per-merchant spend limits, instant card freeze, and explicit consent for any data sharing.

Publish plain-English guardrails. One-screen fee sheet covering APRs, holds, FDIC coverage, and dispute timelines.

The Bottom Line

All-in-one finance sounds convenient, but consumers see it as concentration risk. They will trial with tiny amounts and expand only after months of predictable, boring reliability.

Sarah Casas from New Jersey summed it up: "When something goes wrong, I need a competent person fast." That is the benchmark. Not 7 million customers. Not $40 billion in credit. Fast, competent help when things break.

Want to test your own fintech positioning? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real consumers to share their thoughts. Here is what they told us:

How do you feel about consolidating loans, credit cards, and banking with a single platform?

Reynaldo Hernandez, 47, Credit Analyst, Paterson, NJ, USA:

Mixed. One login is handy, but one lockout or breach hits everything at once. I would only do it if the platform shows clear FDIC backing, no hard pulls for basic accounts, published hold and transfer timelines, and real human support that speaks Spanish.

Sarah Casas, 49, Project Manager, Elizabeth, NJ, USA:

Practical but cautious. The convenience is real but so is the concentration risk. When something goes wrong, I need a competent person fast. Not a chatbot, not a three-day ticket queue.

Brian Gabriel, 42, Master Auto Technician, Vallejo, CA, USA:

Skeptical convenience. One dashboard is nice until one outage hits spending, bills, and income at once. Feels like a data-harvesting machine with better aim for cross-sell.

Would seeing that a platform has served 7 million customers and extended $40 billion in credit make you more confident?

Esperanza Mayfield, 47, Unemployed, Houston, TX, USA:

Not really. Numbers that big sound like chest beating, not safety. I want to see how my money moves, not how many other people gambled on them.

Roxanne Baumler, 51, Patient Experience Manager, Houston, TX, USA:

Numbers are noise without proof. Show me FDIC coverage details, average dispute resolution time, and what happens when ACH fails. That builds confidence, not vanity metrics.

Mason Hester, 25, Sales Representative, Fort Worth, TX, USA:

Mildly. Scale is a starting point, not a finish line. I want to see how they handle freezes, how fast support responds, and whether I can actually close my account if I need to.

What would it take for you to trust an all-in-one platform with your primary banking?

Reynaldo Hernandez, 47, Credit Analyst, Paterson, NJ, USA:

Start small. I would test with $50 for 90 days. If transfers clear on time, holds release when promised, and support answers in Spanish within 10 minutes, I would consider moving more.

Sarah Casas, 49, Project Manager, Elizabeth, NJ, USA:

Show my likely APR and full fee sheet upfront. Promise in writing they will not tap checking to cover credit automatically. Give me a kill switch to freeze everything instantly. Then maybe.

Brian Gabriel, 42, Master Auto Technician, Vallejo, CA, USA:

Boringly reliable for 6 months. Status page with incident postmortems. Clear SLAs for holds and transfers. No forced bundling. If I want just savings, let me have just savings.