The supplement aisle is a confidence game. Every tub screams EXPLOSIVE ENERGY and MAXIMUM PUMP, plastered in neon with ingredient lists that read like a chemistry exam nobody asked you to sit. So I wanted to know: what do actual fitness consumers think about all of this? Do they buy the hype, or are they quietly rolling their eyes?

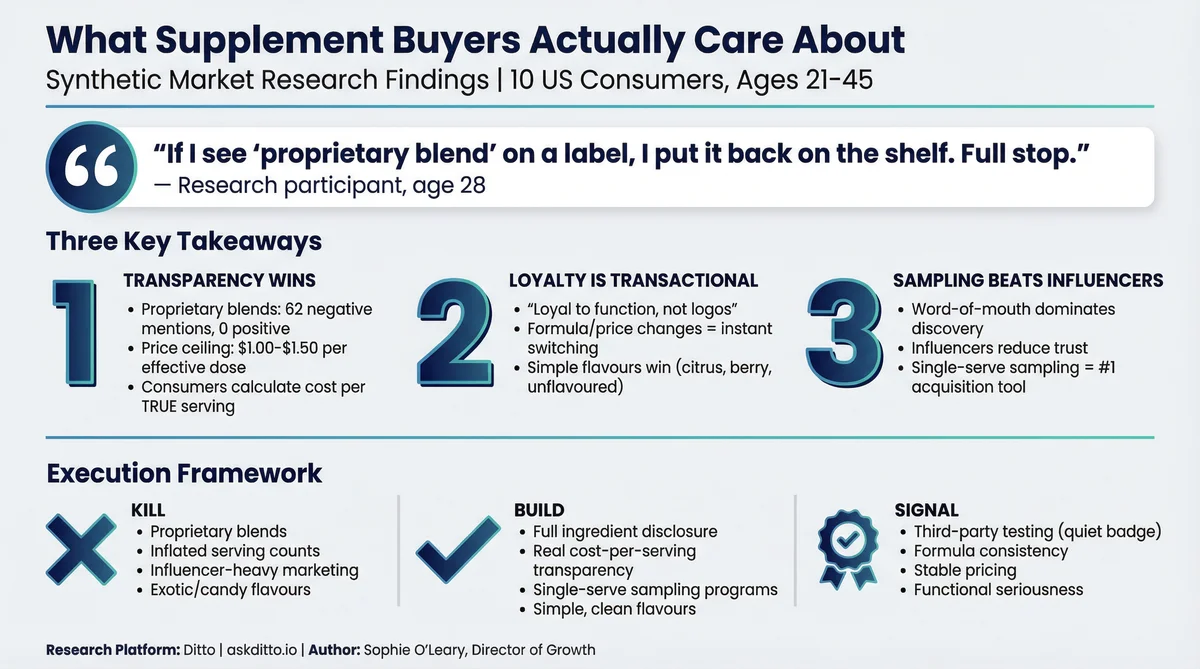

I ran a study with 10 US fitness consumers using Ditto's synthetic research platform. Ages 21 to 45, all active supplement buyers, spread across different life stages and fitness goals. The responses were blunt, specific, and surprisingly unanimous on several points that should make any supplement brand sit up and pay attention.

Who Took Part

The group included 10 consumers from across the United States, aged 21 to 45. They span a wide range of fitness contexts: parents juggling workouts around childcare, shift workers training at odd hours, competitive athletes tracking every macro, price-conscious urban gym-goers, rural shoppers with limited retail access, and Spanish-language community-networked buyers who rely heavily on personal recommendations.

What unites them is simple: they all buy supplements, they all have opinions, and they are all deeply sceptical of marketing nonsense. This is not a group that responds well to flashy labels. They want to know what is in the product, how much it costs per serving, and whether it actually works.

Proprietary Blends: The Trust Killer

This was the single most emphatic finding in the entire study. Across all 10 participants, proprietary blends triggered immediate distrust. The term came up 62 times across responses, and every single mention was negative.

If I see 'proprietary blend' on a label, I put it back on the shelf. Full stop. I need to know exactly what I'm putting in my body and how much of each ingredient is in there.

Participants described proprietary blends as a red flag, a dealbreaker, and a sign that a brand has something to hide. The consensus was clear: if you are not willing to disclose your doses, consumers assume you are underdosing the expensive ingredients and padding with cheap fillers.

Key insight: Full ingredient transparency is not a selling point. It is table stakes. Brands still using proprietary blends are actively repelling informed buyers.

Price: The Hard Ceiling

Price sensitivity came through sharply, but with an important nuance. Consumers are not looking for the cheapest product. They are calculating cost per true serving, factoring in whether they need one scoop or two, and whether the ingredient doses actually deliver at the stated serving size.

The consensus price ceiling landed between $1.00 and $1.50 per serving. Above that, and you need exceptional proof of efficacy. Below that, and consumers start questioning quality. It is a narrow band, and most brands do not communicate their per-serving cost clearly enough.

I divide the price by the number of actual servings, not the number the label says. If I need two scoops to feel anything, that $30 tub just became a $60 tub.

Key insight: Price-per-serving transparency could be a genuine differentiator. Brands that print the real cost per effective dose on the label would stand out in a category drowning in inflated serving counts.

Third-Party Testing: Trust Amplifier, Not Selling Point

Here is something interesting. Every participant valued third-party testing (NSF, Informed Sport, USP verification), but none of them said it was why they chose a product. It functions as a trust amplifier: it confirms a decision already being made, rather than driving the initial purchase.

Participants described it as a "checkbox" or "safety net" rather than a feature. The brands that shout loudest about their certifications might be solving the wrong problem. Consumers want to see the certification badge quietly present on the label, not splashed across the front as if it is the product's primary value proposition.

Key insight: Third-party testing reassures but does not persuade. It is most effective when presented as a quiet confidence signal alongside transparent dosing, not as a headline feature.

Brand Loyalty Is Transactional

One of the more striking findings: brand loyalty in supplements is almost entirely functional. Consumers described themselves as "loyal to function, not logos." They stick with a product because it works consistently, not because they feel an emotional connection to the brand.

I'll use the same brand for years if it works. But the second they change the formula or jack up the price, I'm gone. There's no emotional attachment here.

This has significant implications for supplement brands investing in lifestyle marketing or influencer partnerships. Consumers in this study were indifferent to brand narratives. What kept them coming back was consistent results, stable pricing, and no formula changes.

Key insight: Loyalty in supplements is earned through consistency, not storytelling. Any formula or price change is a risk event that can lose a customer overnight.

Flavour Preferences: Keep It Simple

Flavour preferences split cleanly. The preferred end of the spectrum was simple citrus, berry, or unflavoured. The rejected end was anything described as neon, candy-like, or artificially sweet. Participants used words like "chemical" and "synthetic" when describing over-flavoured supplements.

Preferred: Lemon-lime, orange, berry, unflavoured, light fruit

Rejected: Cotton candy, birthday cake, sour gummy, neon-coloured anything

Deal-breaker: Overpowering artificial sweetness that lingers

Key insight: The supplement industry's arms race toward increasingly exotic flavours may be alienating core buyers. Simple, clean-tasting options signal functional seriousness rather than novelty.

How They Discover Products

This is where the research challenged a common industry assumption. Participants did not discover supplements through influencers. The primary discovery channels were word-of-mouth from training partners, gym staff, or family members, followed by in-store browsing at retailers like GNC, Vitamin Shoppe, or local nutrition shops.

Influencer recommendations were mentioned, but almost always with scepticism attached. Participants questioned whether influencers actually used the products they promoted, and several mentioned that influencer deals actively reduced their trust in a brand.

If I see a fitness influencer pushing a brand, I assume they got paid. I trust my gym buddy who's been using something for six months and has nothing to gain from recommending it.

Key insight: Word-of-mouth and retail discovery dominate. Supplement brands over-investing in influencer marketing may be spending in the wrong channel for this audience.

Single-Serve Sampling Reduces Purchase Friction

Across the board, participants said that single-serve sachets or sample packs were the most effective way to get them to try a new product. The risk of buying a full tub (typically $30 to $50) and hating it was cited repeatedly as the biggest barrier to trying new brands.

Several participants described a pattern: they try a sample at the gym or buy a single stick pack from a store, and if they like it, they commit to the full tub. Without that trial step, many default to whatever they already know works.

Key insight: Single-serve sampling is the most effective acquisition tool for supplement brands. Removing the financial risk of a full purchase converts curious buyers into committed ones.

The Consumer Segments That Emerged

The study revealed six distinct consumer segments, each with different priorities and pain points:

Parents and Caregivers: Prioritise safety, simplicity, and products that fit around unpredictable schedules. They want clean labels and nothing they would be embarrassed to have in the kitchen.

Price-Sensitive Urban Buyers: Calculate everything by cost-per-serving. They shop sales, compare unit prices, and will switch brands instantly for a better deal on equivalent ingredients.

Technical/Performance Focused: Research-driven buyers who read clinical studies, compare dosages against published efficacy thresholds, and dismiss any brand that cannot cite peer-reviewed evidence.

Shift Workers: Need flexible timing and formats. They are looking for products that work whether taken at 6am or 6pm, and they value stimulant-free options for late-night training sessions.

Spanish-Language/Community-Networked: Discovery is heavily influenced by community recommendations and family networks. They value brands that communicate in Spanish and show up in community-relevant retail channels.

Rural Shoppers: Limited retail access means they rely more on online purchasing, but they distrust brands they cannot physically examine first. Sampling through subscription boxes or regional retail partnerships matters disproportionately.

What This Means for Supplement Brands

The findings point to a clear set of actions for any pre-workout or sports supplement brand:

Kill the proprietary blend. Full ingredient disclosure with exact doses is non-negotiable for informed buyers. Every hidden dose is a lost sale.

Print real cost per serving. Not the label-inflated number. The actual cost based on an effective dose. This alone could differentiate a brand.

Invest in sampling, not influencers. Single-serve packs at gyms, nutrition shops, and online trial bundles convert better than sponsored posts.

Simplify your flavours. Citrus, berry, unflavoured. Stop chasing novelty and start signalling functional seriousness.

Use third-party testing as a quiet badge. Present it on the label, but do not make it your headline. It confirms trust rather than creating it.

Earn loyalty through consistency. Do not change your formula, do not change your pricing unpredictably, and do not assume a rebrand will excite your base.

The Bottom Line

Supplement consumers are more sophisticated, more sceptical, and more price-aware than most brand marketing suggests. They are not swayed by flashy packaging or influencer endorsements. They want transparency, consistency, and proof. The brands that win in this category are the ones that treat their customers like informed adults rather than impulse buyers.

The gap between what supplement marketing says and what consumers actually want is substantial. Closing that gap is not complicated, but it does require a willingness to drop the hype and lead with honesty.

Want to test your own supplement positioning with real consumer reactions? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.