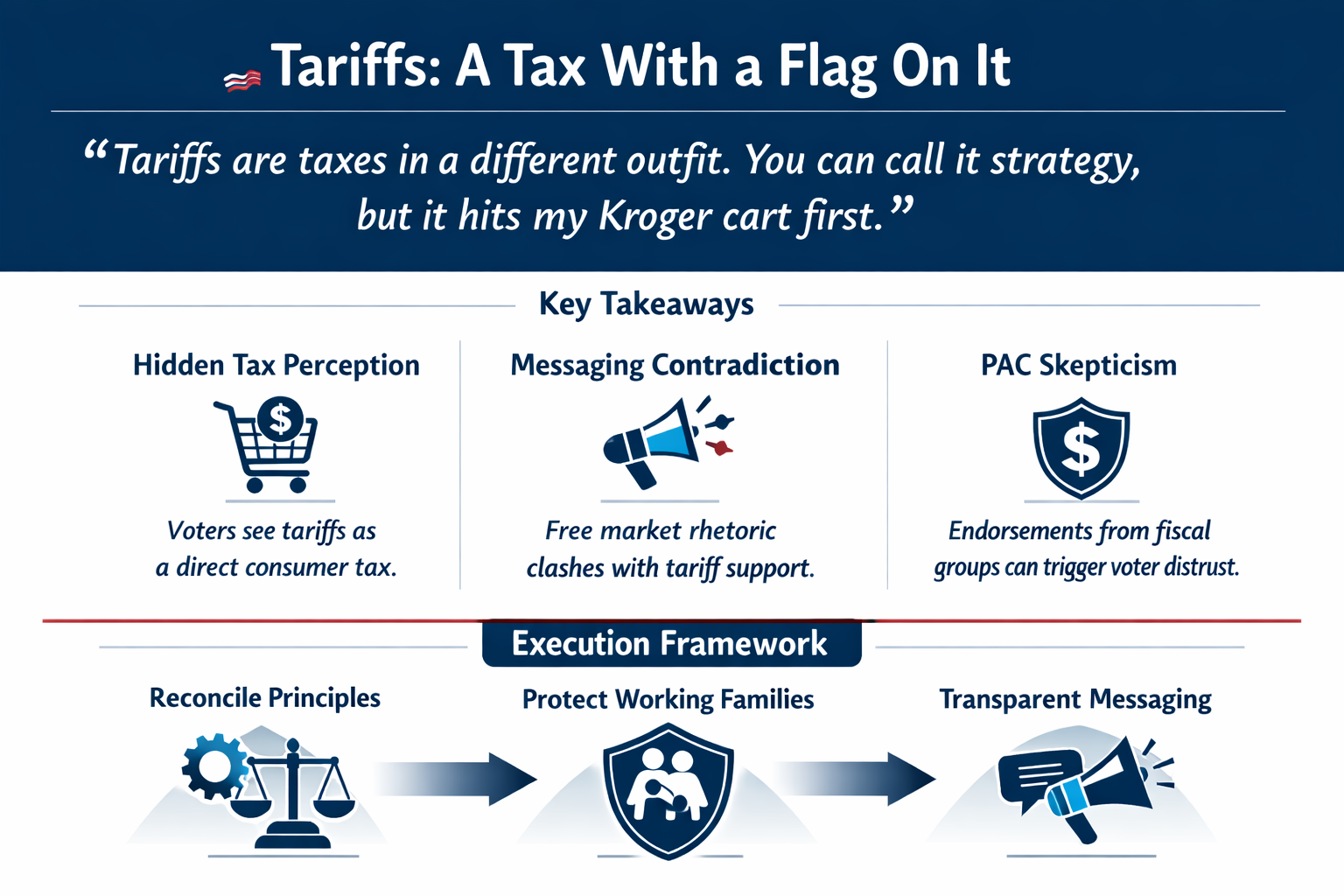

Here's a phrase that came up repeatedly in my research with fiscal conservatives: "Tariffs are a tax with a flag on it." That was Omar, a 39-year-old surgical technologist in Oklahoma, and his framing captures something important about how budget-conscious voters actually think about trade policy.

I ran a study with 6 voters who self-identify as caring about fiscal responsibility: they budget carefully, hate hidden fees, and want government to show its maths. I asked them about tariffs, spending cuts, and how they evaluate "fiscal conservative" endorsements. The results challenge some common assumptions about what this voter segment actually wants.

The Participants

The six participants ranged from ages 25 to 46, spanning Mississippi, Missouri, Oklahoma, Florida, California, and Illinois. They included a product operations coordinator in suburban Mississippi; a stay-at-home mother in Springfield, Missouri; a surgical technologist in Oklahoma; a linehaul truck driver in Florida; a car salesman in rural California; and an administrative assistant in Chicago.

What unites them: all described themselves as budget-conscious and skeptical of hidden costs. Several explicitly mentioned managing tight household budgets, sending money to family, or making decisions based on "total cost of ownership." These are voters who calculate, compare, and verify.

How Fiscal Conservatives View Tariffs

When asked whether tariffs fit with conservative free-market principles, the response was nearly unanimous: broad tariffs contradict free-market talk. They're seen as government picking winners and hiding a tax inside consumer prices.

"Tariffs are a tax with different wrapping. If the goal is fiscal responsibility, hiking my checkout total at Tractor Supply and Aldi is a lousy way to do it."

That was Brett, 46, a night-shift truck driver in Florida. He sees tariff impacts directly: in his grocery cart, at the auto parts store, in freight patterns at work. His verdict: "Use tariffs like a torque wrench, not a sledgehammer: precise, limited, and with a click when you're done."

Daniel, 25, the car salesman in rural California, explained how tariffs hit his work: "Parts and reconditioning get pricier, so out-the-door numbers creep up. Then buyers stretch, payments get risky, and deals fall apart over 20 bucks a month. It's like slapping a dealer markup and pretending it's value."

Megan, 38, in Chicago was blunt: "I don't like broad tariffs. They feel like a tax on my grocery cart with a different label, and they don't square with all the 'free market' talk."

What Kind of Tariffs Could Work

Despite their scepticism, participants weren't opposed to all tariffs. They articulated a clear framework for acceptable trade policy:

Targeted, time-limited, and specific: hit clear dumping or security-sensitive goods only

Transparent goals: state the objective and the sunset date in plain English

Show the maths: tell consumers what it will cost on specific items

No corporate cover: don't use tariffs to protect lazy incumbents who should innovate

Plan for the revenue: use it to lower other regressive costs or don't pretend it's discipline

Key insight: Fiscal conservatives see broad tariffs as fundamentally inconsistent with free-market principles. They're acceptable only as narrow, time-boxed tools with clear objectives and transparent costs.

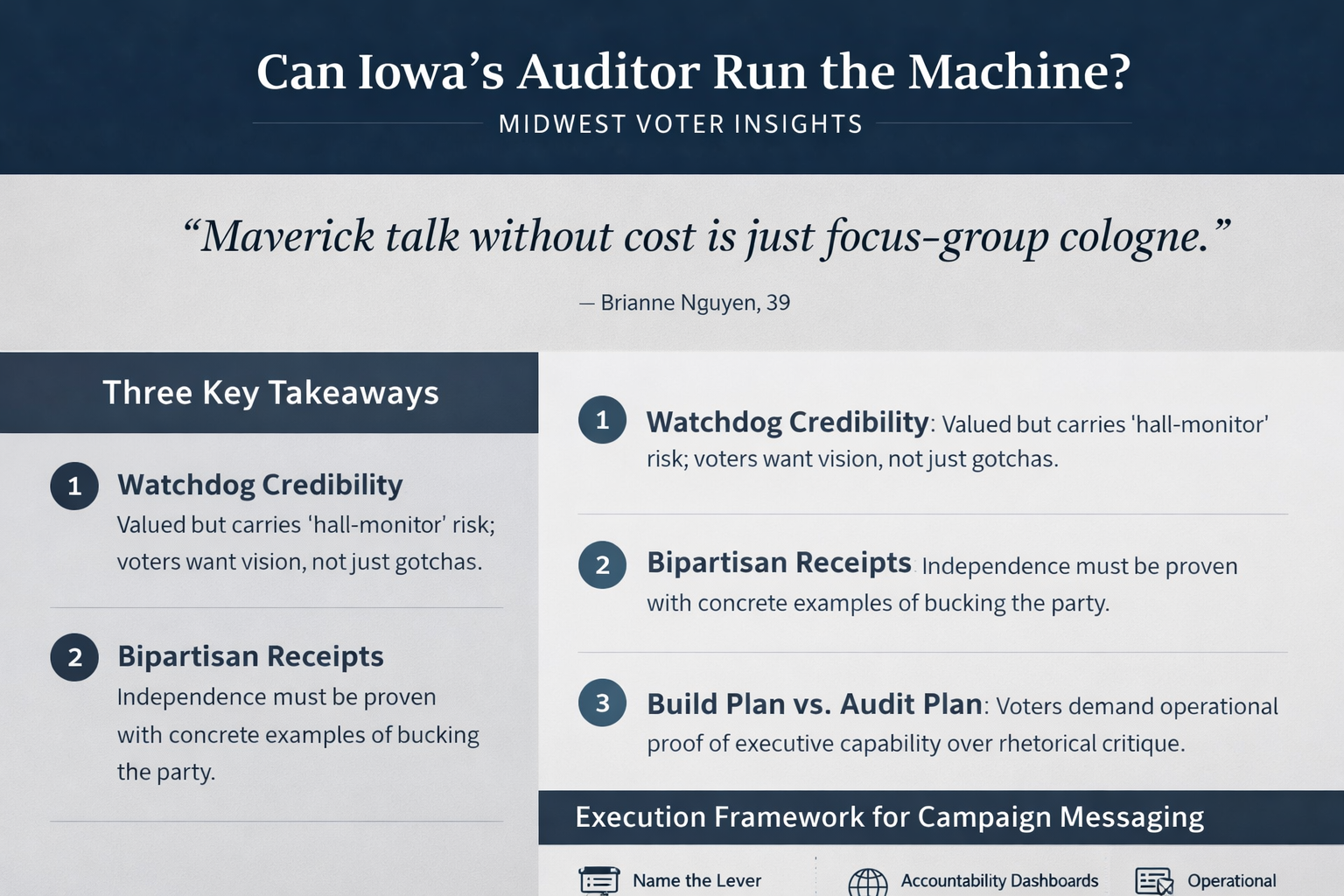

What Spending Cuts Do They Actually Support?

When asked about Republican messaging on spending cuts and deficit reduction, the responses revealed a nuanced position: cut fat, not bone. Voters want to see waste eliminated, but they're protective of programmes that touch working families.

Cuts They Support

Corporate welfare: tax breaks for stadiums, subsidies for profitable companies, sweetheart deals

Defence bloat: gold-plated projects, contractor sprawl, procurement waste

Consultant and PR contracts: studies about studies, glossy campaigns, no-bid deals

Big-agribusiness subsidies: help small farms, not conglomerates

Administrative layers: trim management, keep front-line staff

Duplicate programmes: merge offices doing the same job

Congressional perks: lead by example

Programmes They Protect

Even self-described fiscal conservatives draw firm lines on what not to cut:

Social Security and Medicare: "Non-negotiable. People paid in."

Kids' programmes: CHIP, WIC, school meals, special education

Public schools and practical school choice

Community health clinics and mental health services

Infrastructure: roads, bridges, water, broadband

Disaster relief and emergency services

Veterans' care

Workforce training for trades and healthcare

"If someone says 'cut school lunches' or 'just raise the retirement age,' I'm sorry, I'm side-eyeing hard. Cut the fluff first, then we can talk about the rest like adults."

That was Brandi, 45, in Missouri. Her framing was echoed across participants: they want fiscal discipline, but not at the expense of programmes that keep families stable.

Key insight: "Fiscal conservative" doesn't mean "cut everything." These voters want corporate welfare and administrative bloat cut first, while protecting programmes that serve working families, seniors, and veterans.

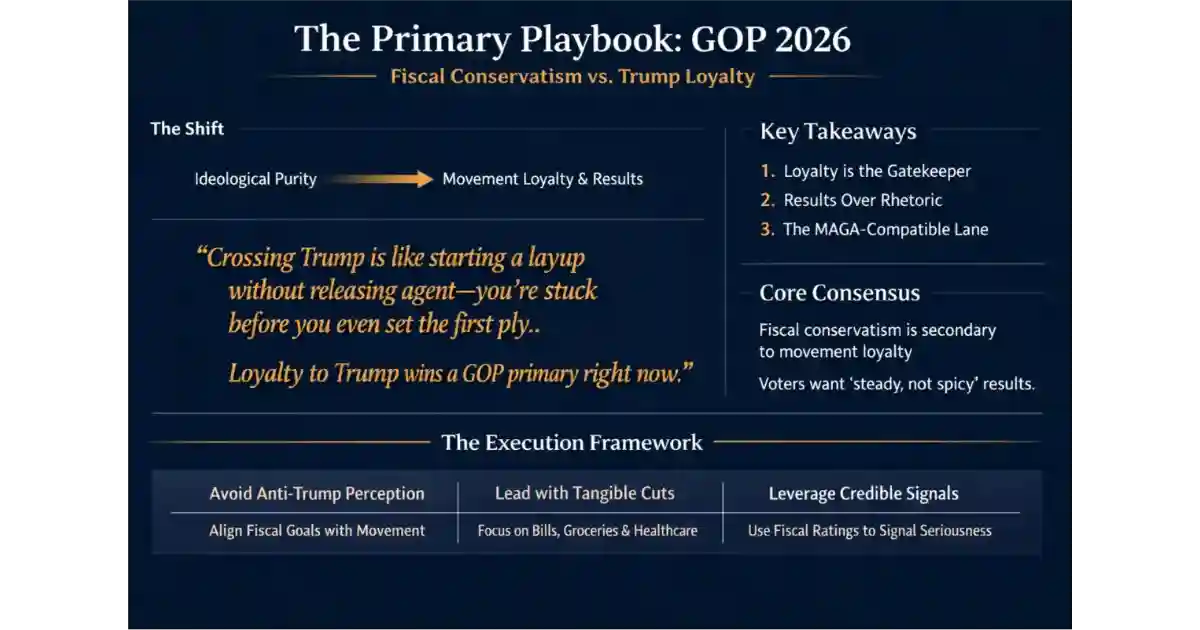

How They View "Fiscal Conservative" Endorsements

When asked how an endorsement from a group like Club for Growth affects their vote, the response was consistent: sceptical to negative. These endorsements trigger suspicion rather than trust.

"An endorsement like that makes me less likely to support the candidate. Nine times out of ten it reads as code for tax cuts up top and 'tighten your belt' for everyone else."

That was Jazmin, 28, in Mississippi. She's a Marketplace-insured mom with a tight budget, and she reads "lower taxes, less spending" as a threat to programmes her family uses.

Brett in Florida: "An endorsement like that does not sway me. If anything, I get sceptical until I see the receipts. Logos are cheap. Show me the cuts, not the cheerleading."

What would they need to see before trusting such an endorsement?

Who funds the organisation: top donors, industries, dark money connections

Exactly which cuts they propose: line items, not slogans

Track record: what happened after their endorsed candidates won?

Stance on corporate welfare: do they cut that, or just safety net programmes?

Tariff consistency: do they call tariffs a tax, or cheer them on?

Worker impact: position on wages, training, leave policies

Governance style: do they punish compromise and cause shutdowns?

Transparency: plain-language reports, clear methodology

Key insight: "Fiscal conservative" endorsements are actually a yellow or red flag for many budget-conscious voters. They associate these groups with protecting wealthy interests while cutting programmes working families use.

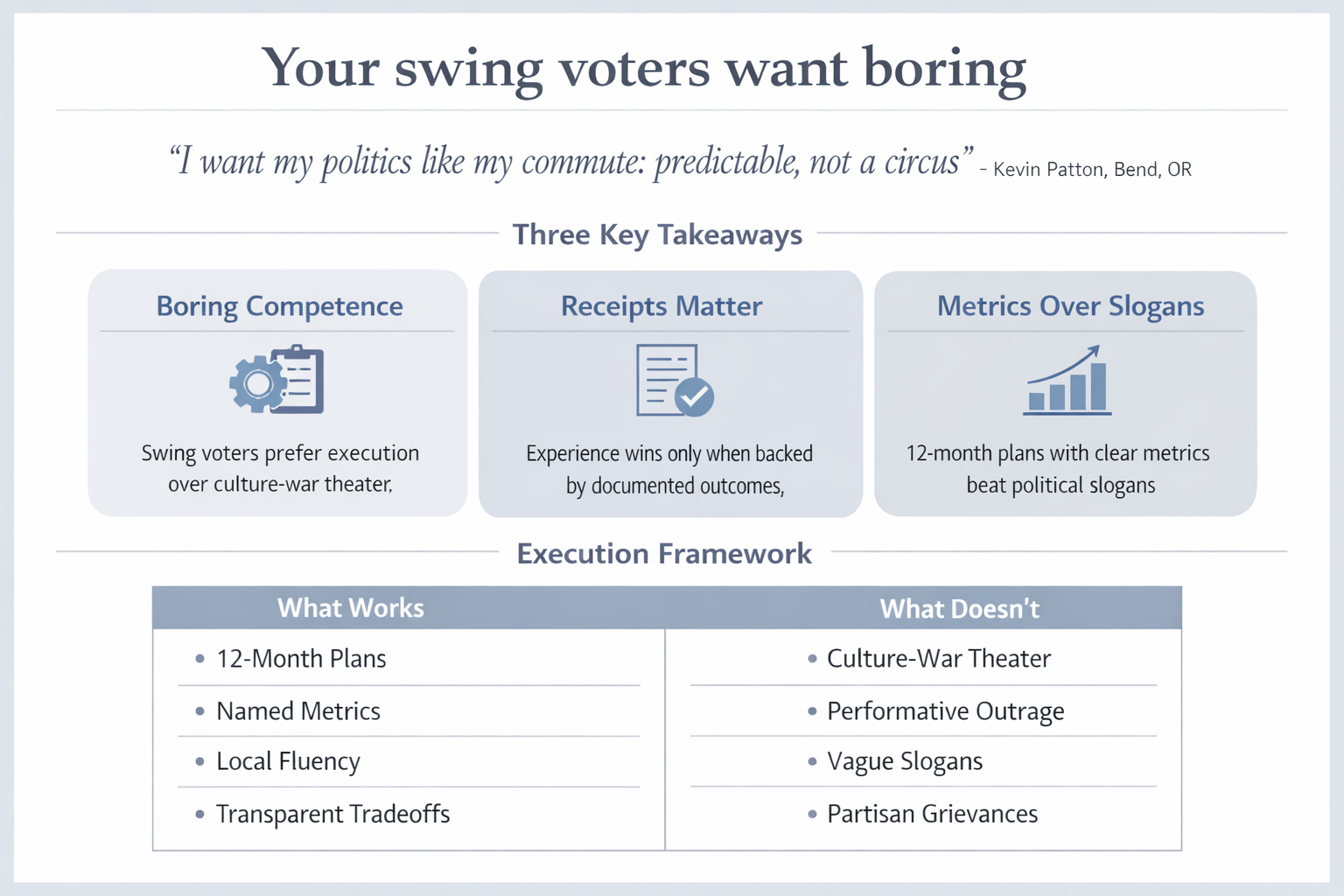

What This Means for Economic Messaging

The findings suggest a significant opportunity for candidates who want to appeal to fiscally-minded voters:

Lead with corporate welfare cuts, not safety net cuts. These voters hate subsidies for profitable companies more than they hate deficits.

Call tariffs what they are: taxes. Fiscal conservatives see through the patriotic branding and resent the hidden cost.

Show your maths. Line items, timelines, and pay-fors beat slogans every time. These voters calculate.

Protect the basics. Schools, healthcare, infrastructure, and Social Security are protected categories. Don't touch them.

Cut the fluff first. Administrative bloat, consultant contracts, and duplicate programmes are fair game.

Be specific about endorsements. If a group endorses you, be prepared to explain who funds them and what they actually cut.

The Bottom Line

Fiscal conservatives aren't ideologues who want to slash everything. They're pragmatists who budget carefully and hate hidden costs. They see broad tariffs as a regressive tax on working families. They want government to cut corporate welfare and administrative bloat, not school meals and Medicare.

As one participant put it: "Treat the budget like buying a used car. Total cost of ownership matters. You can skip the warranty and 'save today,' then eat a blown transmission tomorrow."

The winning message for these voters isn't "cut spending." It's "cut the right spending, protect working families, and show me the receipts."

Want to test your economic messaging with fiscally-minded voters? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real consumers to share their thoughts. Here's what they told us:

How do you feel about tariffs? Are they a smart economic move or do they contradict conservative free-market principles?

Omar Murphy, 39, Medical Assistant, Broken Arrow OK:

Broad tariffs feel like a tax with a flag on it. If you sell it as tough-on-China or pro-worker, but the bill shows up in my grocery cart and on my OR supply list, that's not fiscal responsibility. That's cost-shifting with a patriotic bow. Blanket tariffs contradict the small-government, free-market vibe. It's price manipulation from the top.

Brett Rush, 46, Linehaul Driver, Port St. Lucie FL:

Tariffs are a tax with different wrapping. If the goal is fiscal responsibility, hiking my checkout total at Tractor Supply and Aldi is a lousy way to do it. I feel tariffs in the cart and in the garage. Harbor Freight sockets, brake pads for the bike, fasteners for the roof, plywood before a storm. It all creeps up. Use tariffs like a torque wrench, not a sledgehammer.

Megan Muniz, 38, Administrative Assistant, Chicago IL:

I don't like broad tariffs. They feel like a tax on my grocery cart with a different label, and they don't square with all the 'free market' talk. They hit consumers first. Prices creep up on basics and school supplies. It's a hidden fee. I hate hidden fees. Tariffs show up in shelf prices, not in some honest line on the receipt.

When Republicans talk about cutting spending, what cuts would you support and what would you protect?

Brandi Castellanos, 45, Stay-at-Home Parent, Springfield MO:

Yes, the talk about cutting waste and shrinking the deficit resonates, because at home we watch the budget like a hawk. But la verdad, I flinch when politicians use scissors and end up chopping the stuff families actually lean on. Cut corporate welfare, slash bloated consulting contracts, trim farm subsidies that mainly pad massive agribusiness. But protect Social Security and Medicare - nonnegotiable. Kids' stuff: CHIP, WIC, school lunches.

Jazmin Gutierrez, 28, Product Manager, Southaven MS:

Not really. When I hear Republicans talk about cuts and deficits, it usually sounds like code for slicing the stuff families actually use while protecting tax breaks and defense fat. If we are cutting, I'd back trimming bloated defense projects, corporate subsidies for oil and mega-farms, federal contractor bloat. I'd protect healthcare help - ACA Marketplace subsidies, Medicaid. Childcare and early education. Public schools and school meals.

Daniel Lopez, 25, Sales Representative, Rural CA:

The budget-hawk talk hits me a little because I live on envelopes and coffee-can savings. But every time I hear 'cut spending,' I picture the clinic that took me on a sliding scale, the 911 crew rolling to a crash, the school lunch that keeps a kid from fainting. I'd cut corporate welfare and sweetheart deals, bloated contracts, consultant theater. I'd protect community clinics, public schools, EITC and Child Tax Credit, SNAP and WIC.

When you see an endorsement from a 'fiscal conservative' organization like Club for Growth, does it make you more or less likely to support that candidate?

Jazmin Gutierrez, 28, Product Manager, Southaven MS:

An endorsement from groups like that makes me less likely to support the candidate. Nine times out of ten it reads as code for tax cuts up top and 'tighten your belt' for everyone else. I'd need to see who funds them, exact policy asks, track record on deficits, worker impact. If they can't answer that straight, I don't trust the endorsement. Cute name, same old cuts.

Brett Rush, 46, Linehaul Driver, Port St. Lucie FL:

An endorsement like that does not sway me. If anything, I get skeptical until I see the receipts. Logos are cheap. Show me the cuts, not the cheerleading. I want to know who funds them, what 'less spending' means in line items, their infrastructure stance, disaster and Florida reality stance. Endorsements are bumper stickers. Show me the math or I'm not buying it.

Megan Muniz, 38, Administrative Assistant, Chicago IL:

Less likely. When I see 'lower taxes and less spending,' I hear cuts to schools, transit, and basics my neighbors use, while the rich get the bigger break. That's a red flag for me. A Club-for-lower-taxes endorsement is a yellow-to-red flag. If your 'small government' plan makes it harder to heat apartments, feed kids, or keep buses running, no gracias.